Credit line software

Streamline your credit line process with Fintech Market's customizable and secure SaaS loan management system.

FTM credit line software

Offering a credit line to your customers is easy with our platform, as we take care of the back-end development for you. Our credit line software helps you serve your customers by designing credit line products exactly according to your business needs.

Customizable product

Create a polished revolving credit-applying experience for your clients with our innovative loan management system, allowing you to tailor and personalize your product to meet the unique needs and preferences of your customers.

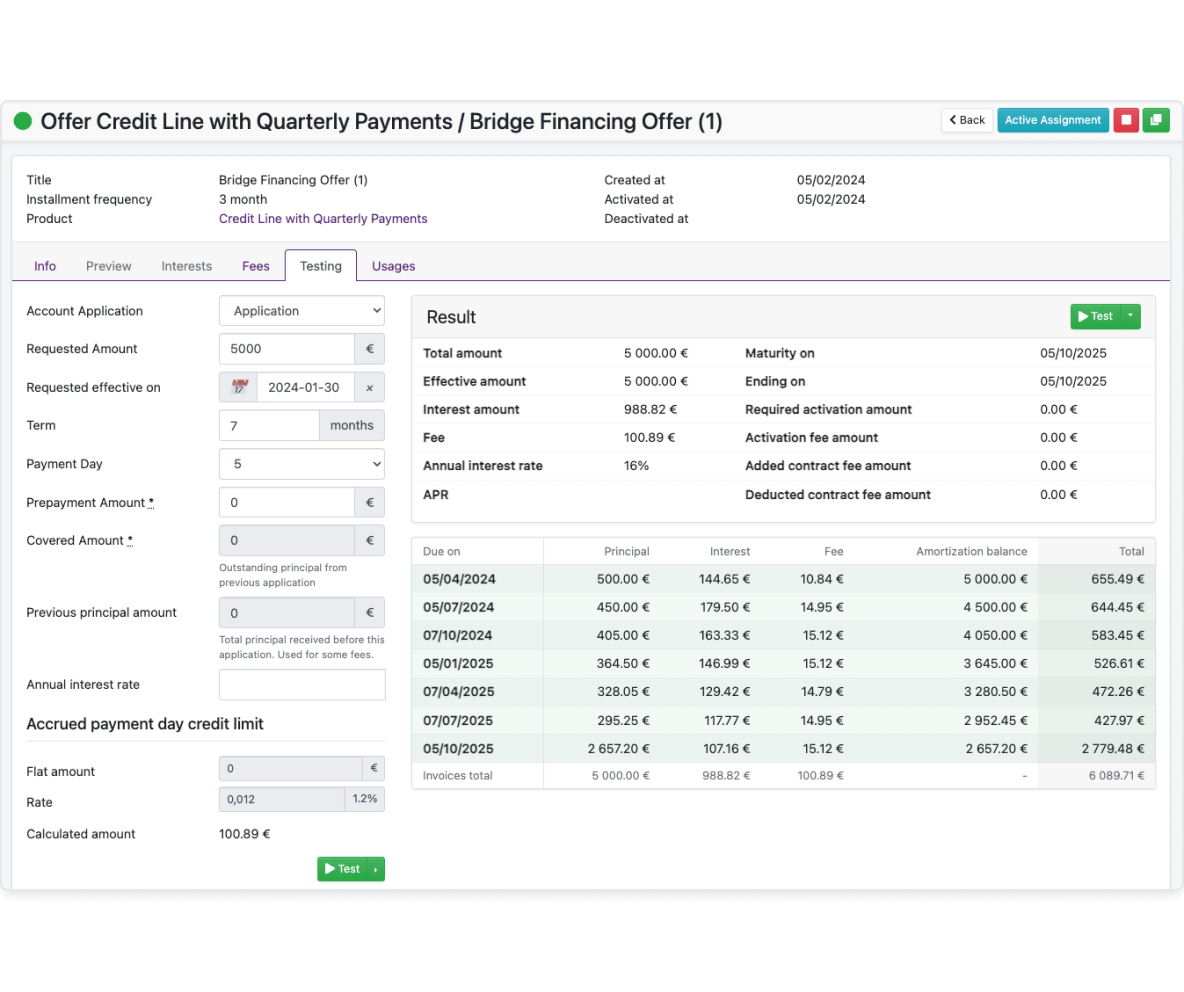

- Flexible product configurations: Set up credit line products with suitable limits and interests, and fix repayment terms and conditions, ensuring an experience that aligns with individual financial needs.

- Versatile amortization options: Choose from a variety of schedule and amortization types, allowing for consistent payment amounts with principal-only, principal and interest, proportional balance-dependent, or single payment options.

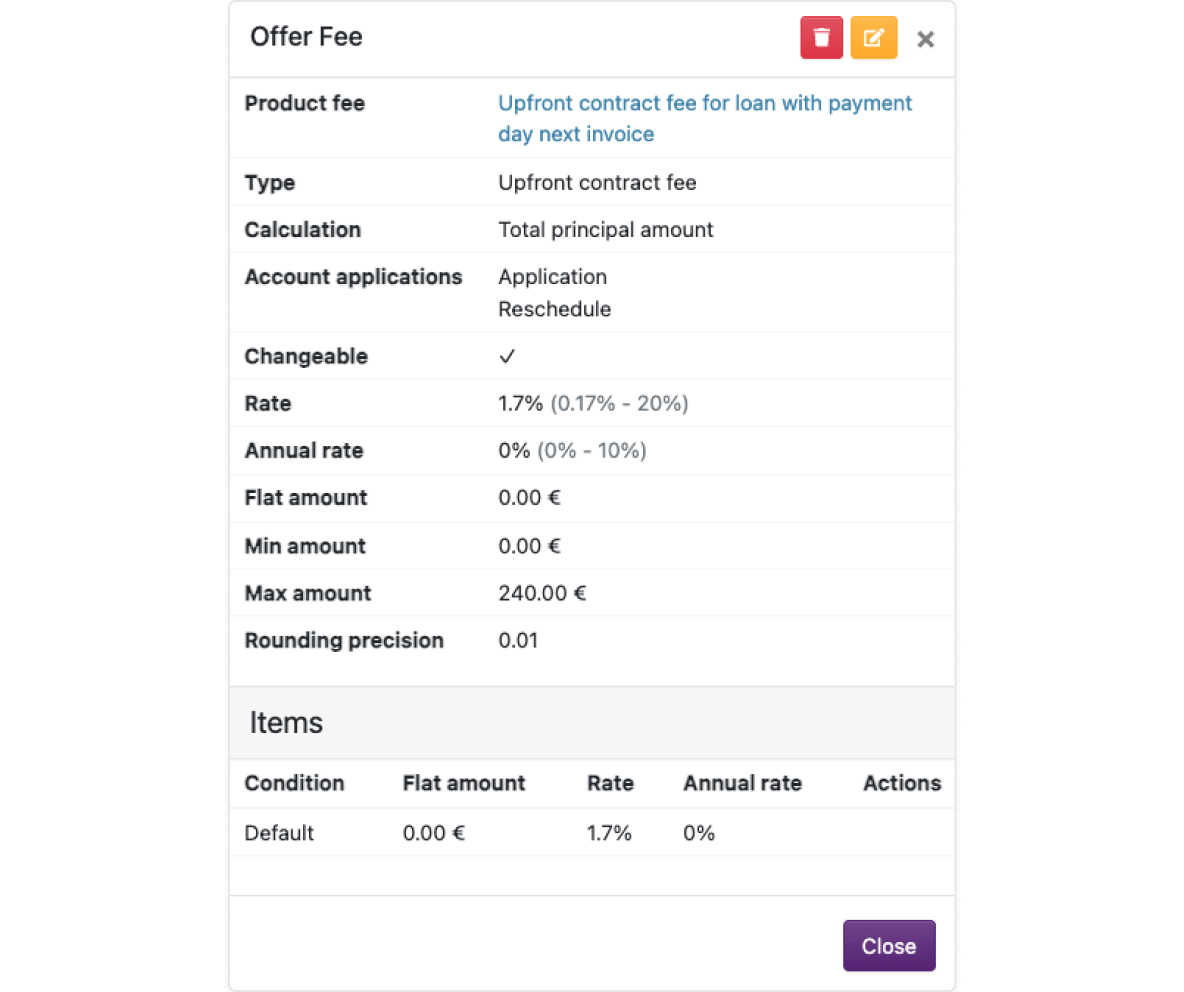

- Transparent fee structure: Implement a clear and fair fee system, allowing customers to understand and differentiate interest and fee rates for different customer groups.

Risk evaluation and mitigation

Mitigate risks effectively with our comprehensive risk evaluation tools, empowering you to assess potential risks, implement proactive measures, and make informed decisions to safeguard your business and maximize success.

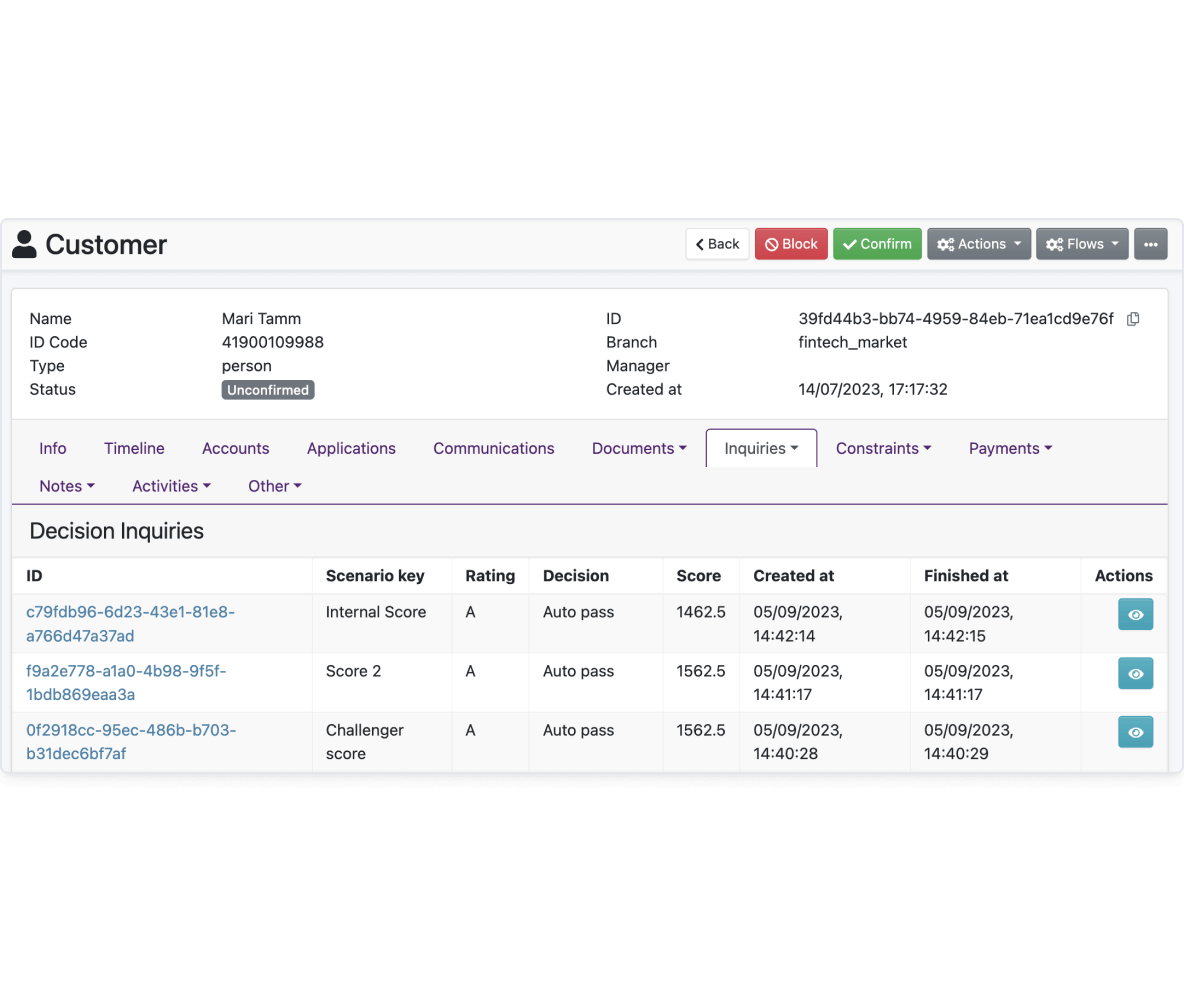

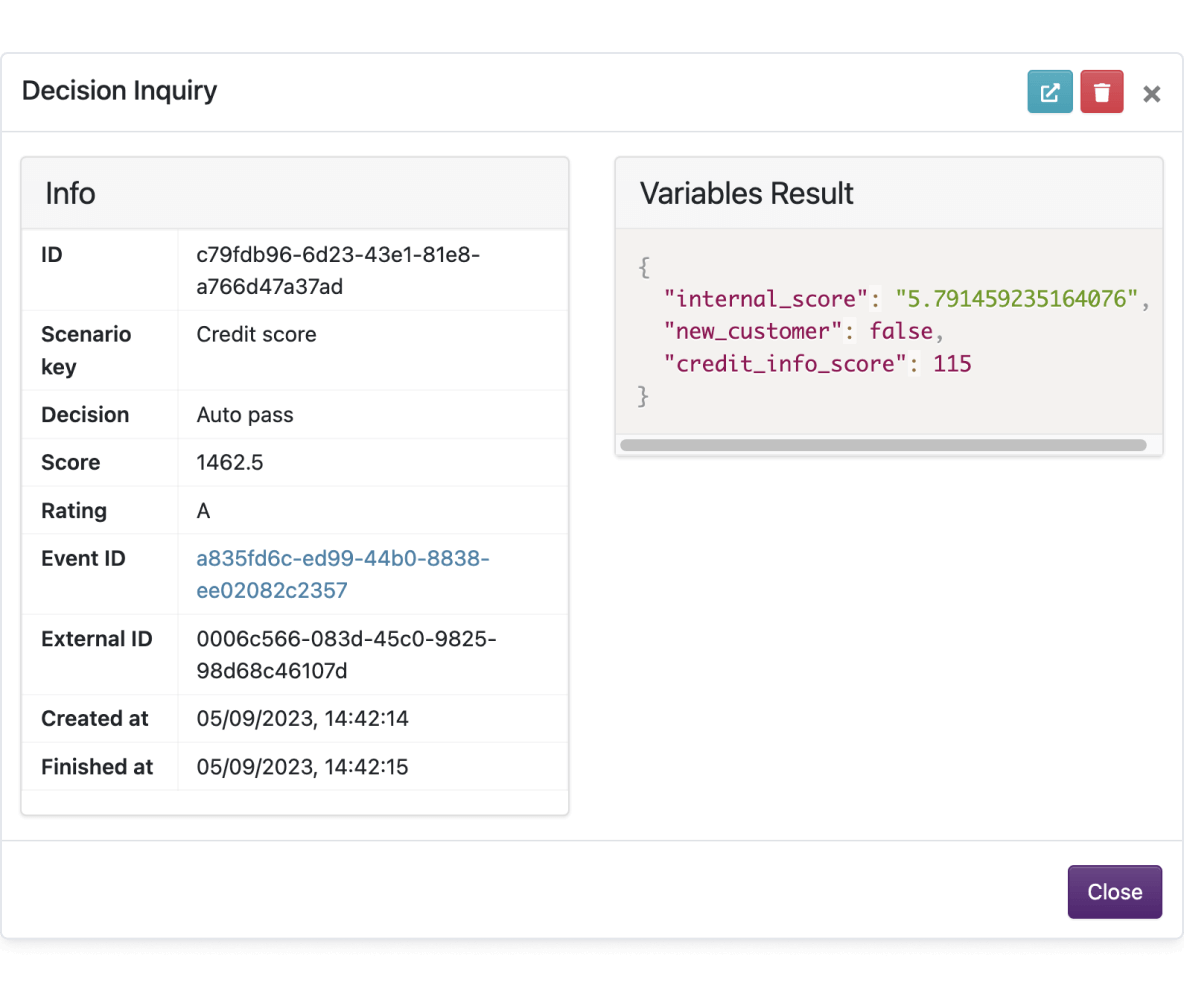

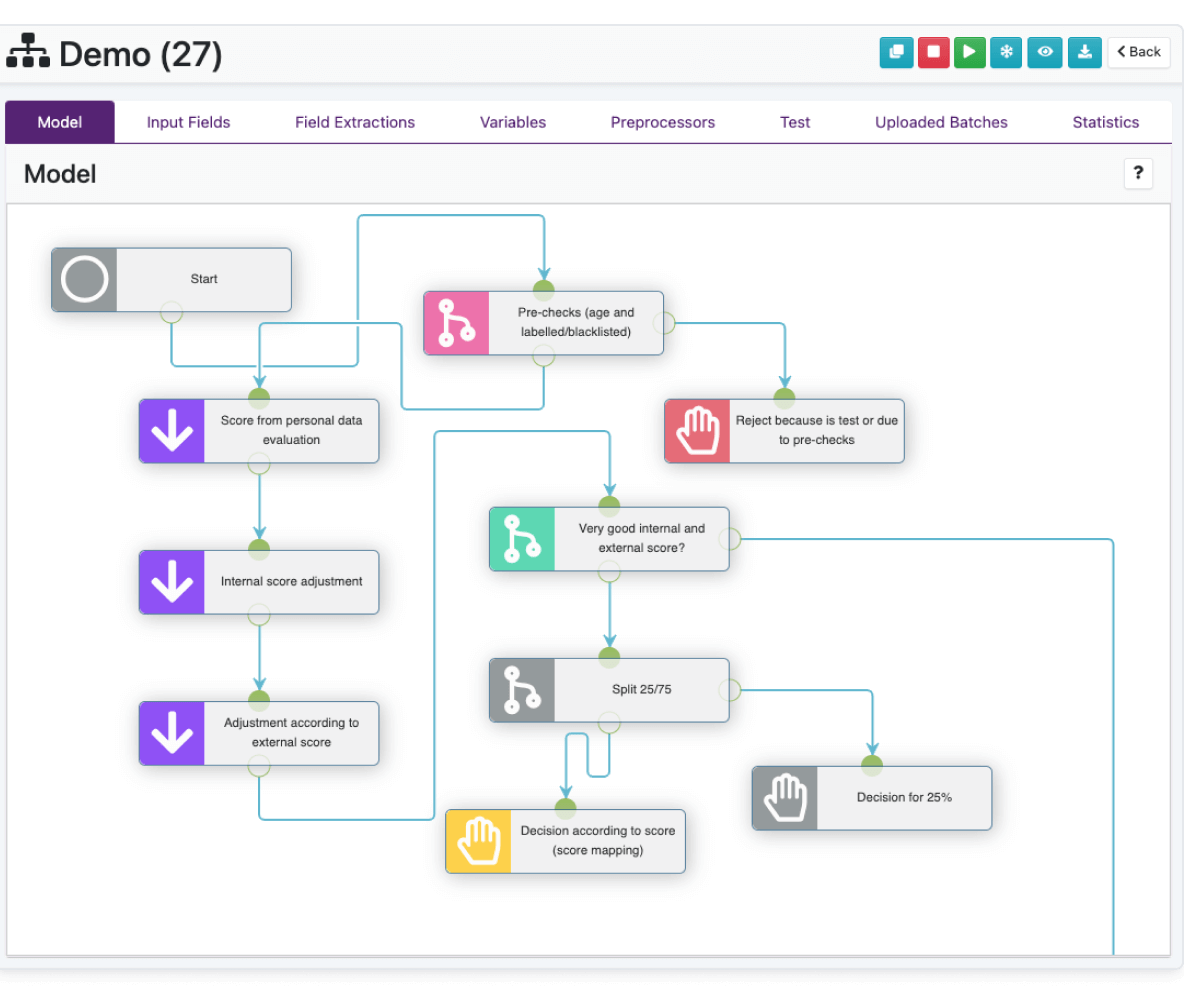

- Tailored risk models: Build customized risk models and scoring calculations using our Decision Engine application, ensuring a personalized approach to credit lines.

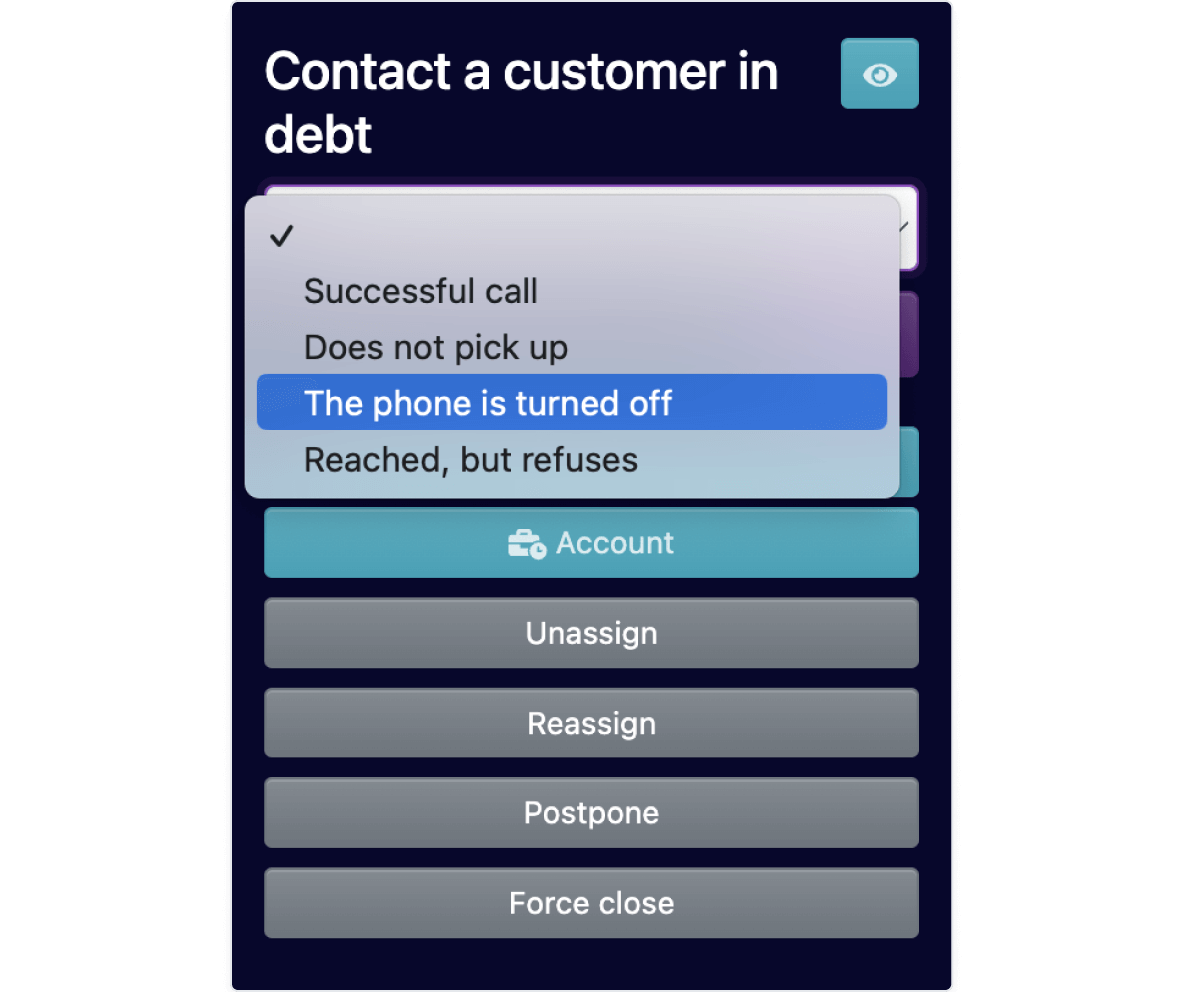

- Efficient debt management: Streamline the process of collecting debts, handling claims, and implementing proactive measures to effectively manage and resolve outstanding debts, ensuring financial stability and customer satisfaction.

- Loan portfolio-based credit limit adjustment: Revolving credit loan credit limits can be adjusted within a product group, allowing for increased or decreased credit limits and the consideration of principal balances for different types of loans.

Payments & Integrations

Maximize the potential of your revolving credit line payment processes with our credit line software, enabling seamless transaction management, automated credit limit utilization, and harnessing the capabilities of multiple payment providers for a convenient and versatile payment experience through our integrated solutions.

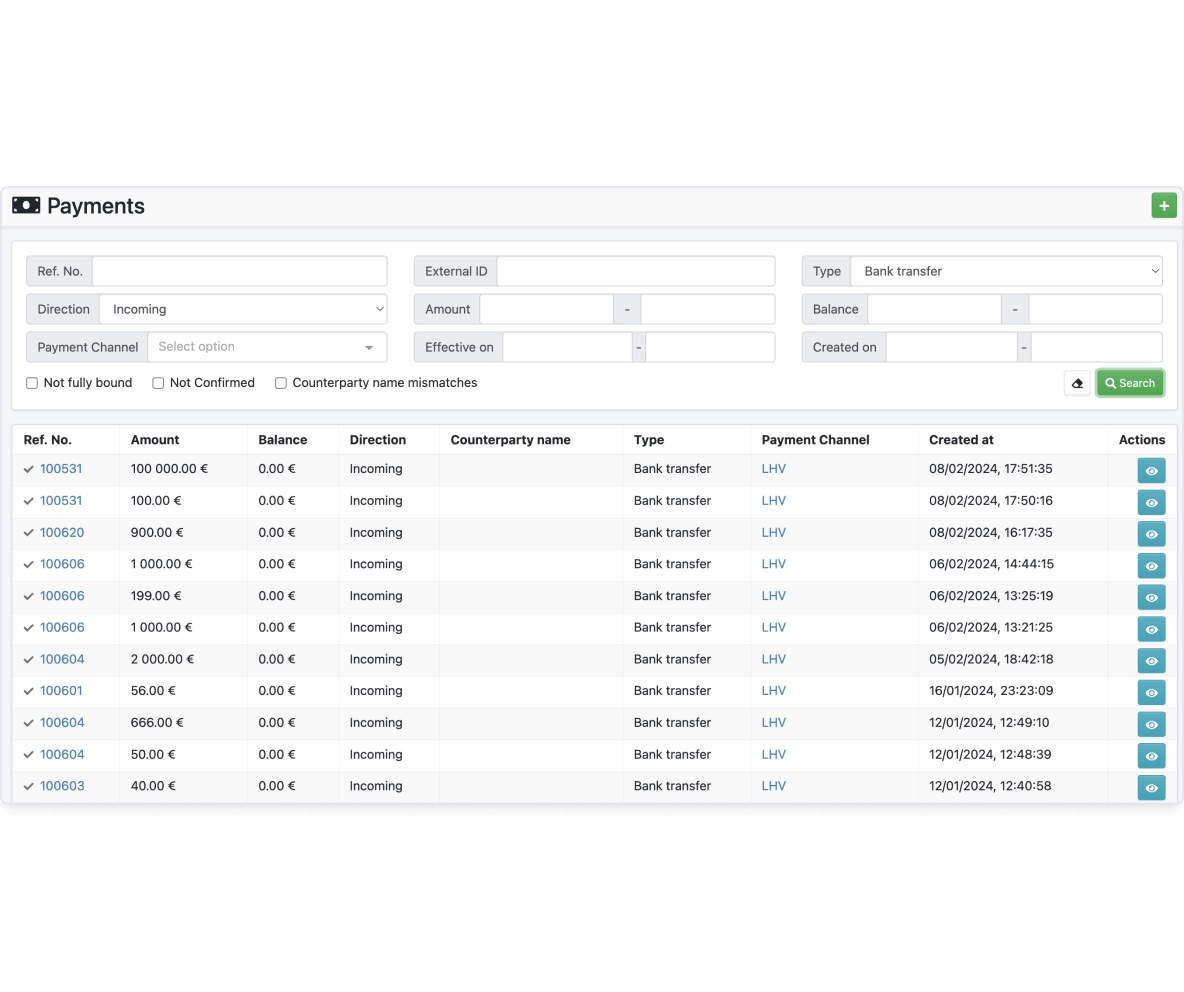

- Diverse payment options: Provide customers with a wide array of choices for incoming, outgoing, and internal payments, including API requests, importing/exporting payment files, and manual creation, while also enabling the creation of authorization hold for outgoing payments.

- Automated credit limit utilization: Create rules to automatically employ unused credit limits or restrict their usage based on specific requirements, ensuring efficient and controlled credit utilization.

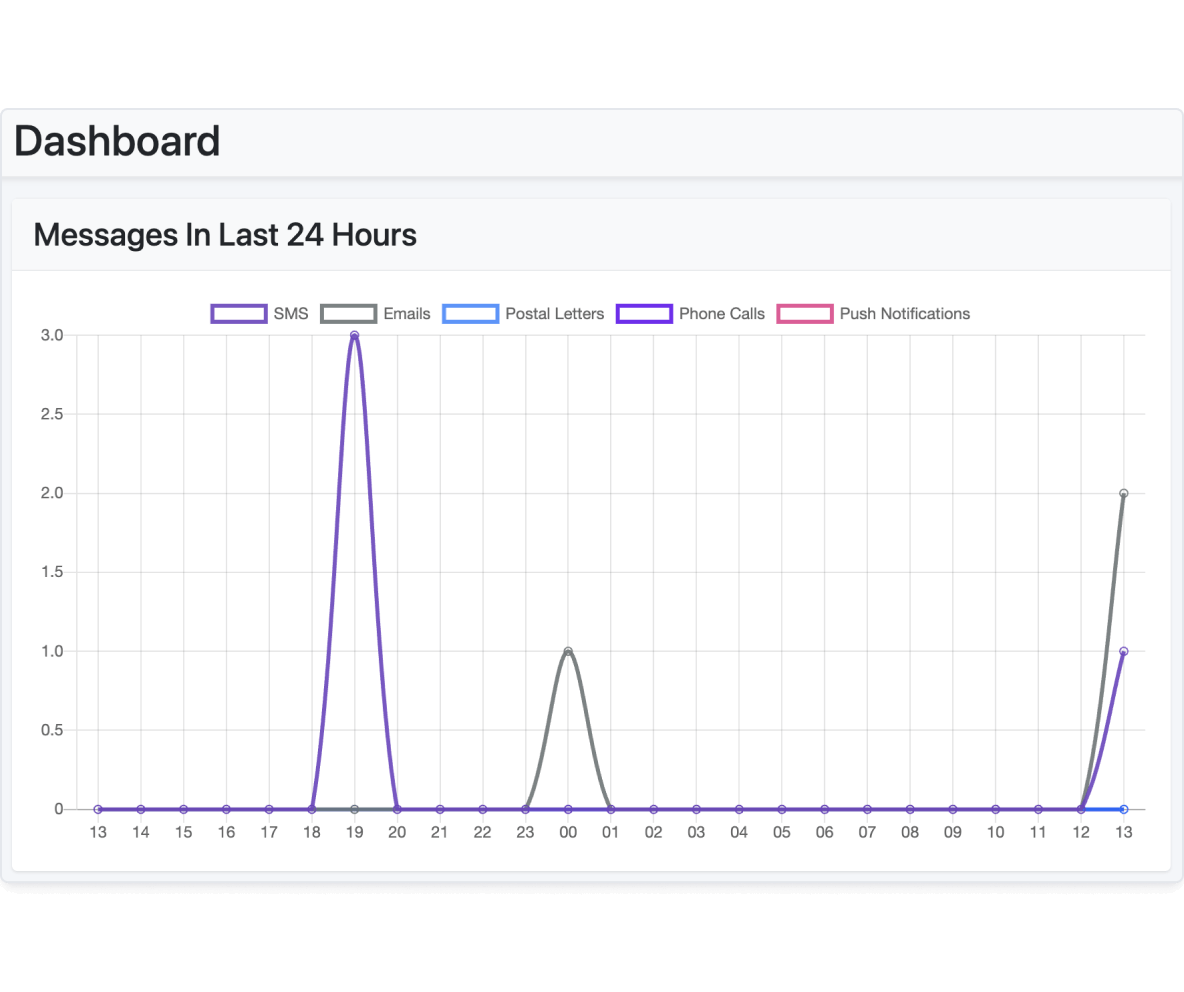

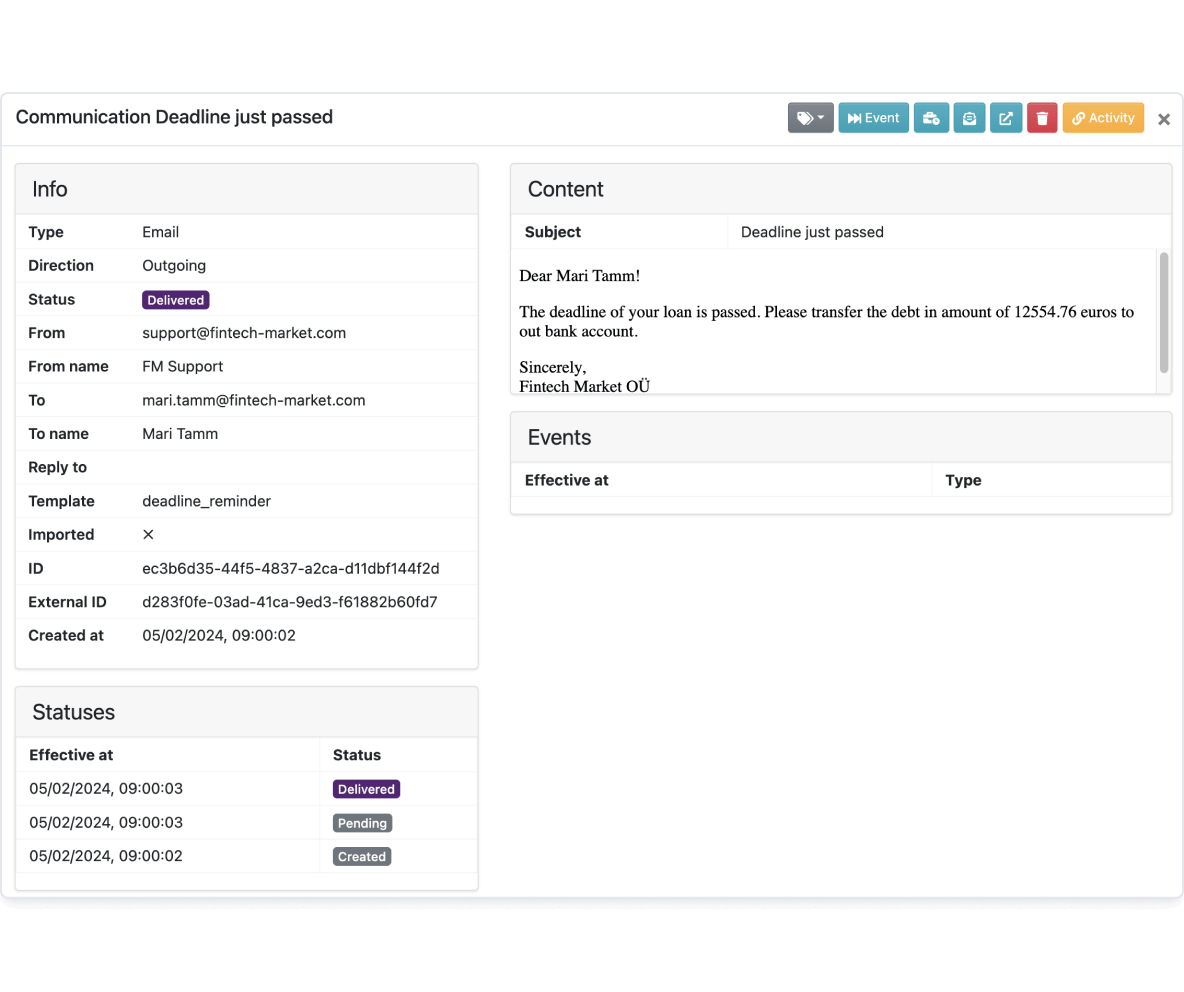

- Comprehensive list of third-party integrations: Leverage third-party services integrated on our loan management system including communications, credit scoring, risk management, KYC verification, and digital signing.

Client journey

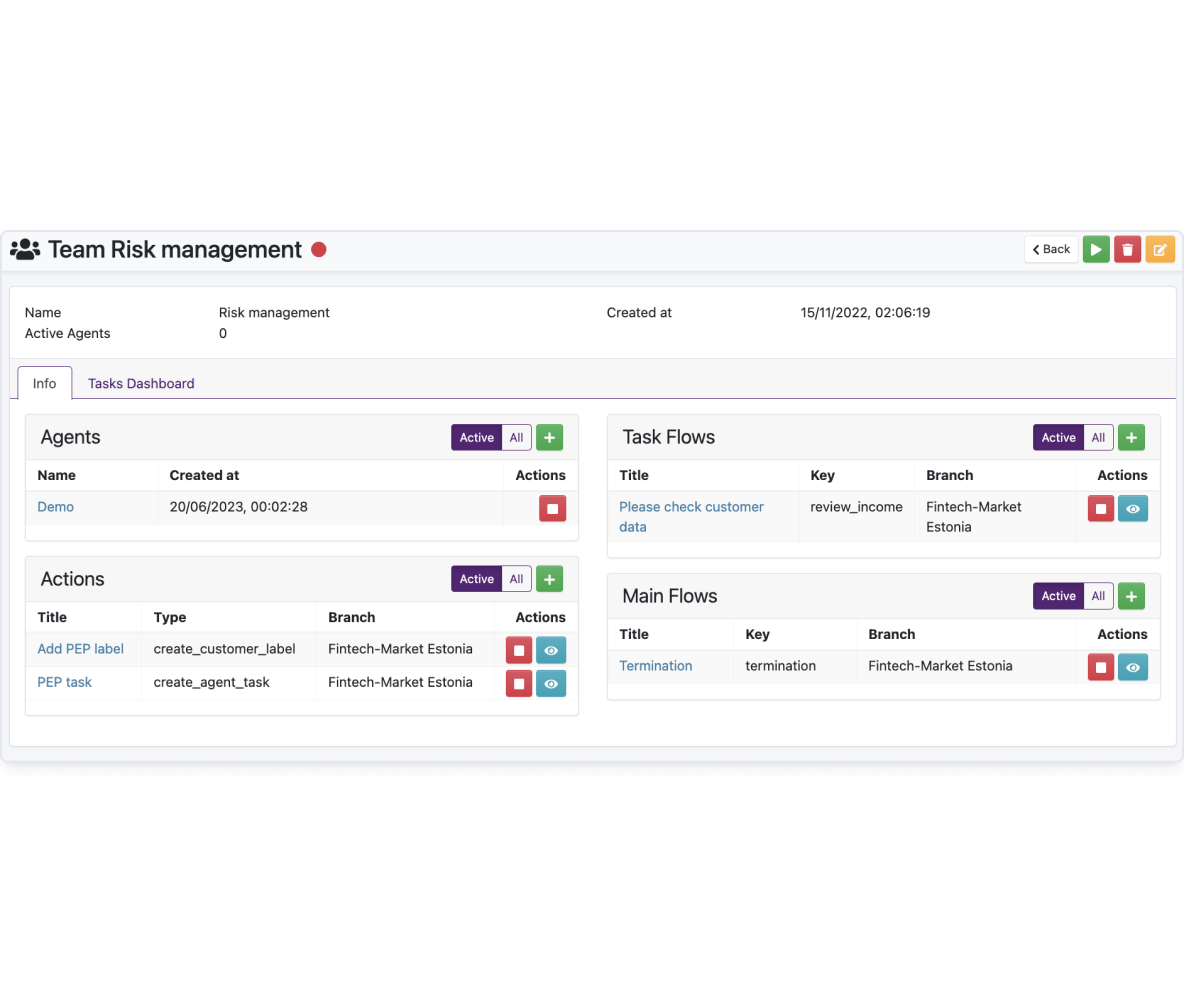

Customize interdependent workflows tailored to the specific needs of your credit line management and client journey, aligning with business requirements and legal obligations.

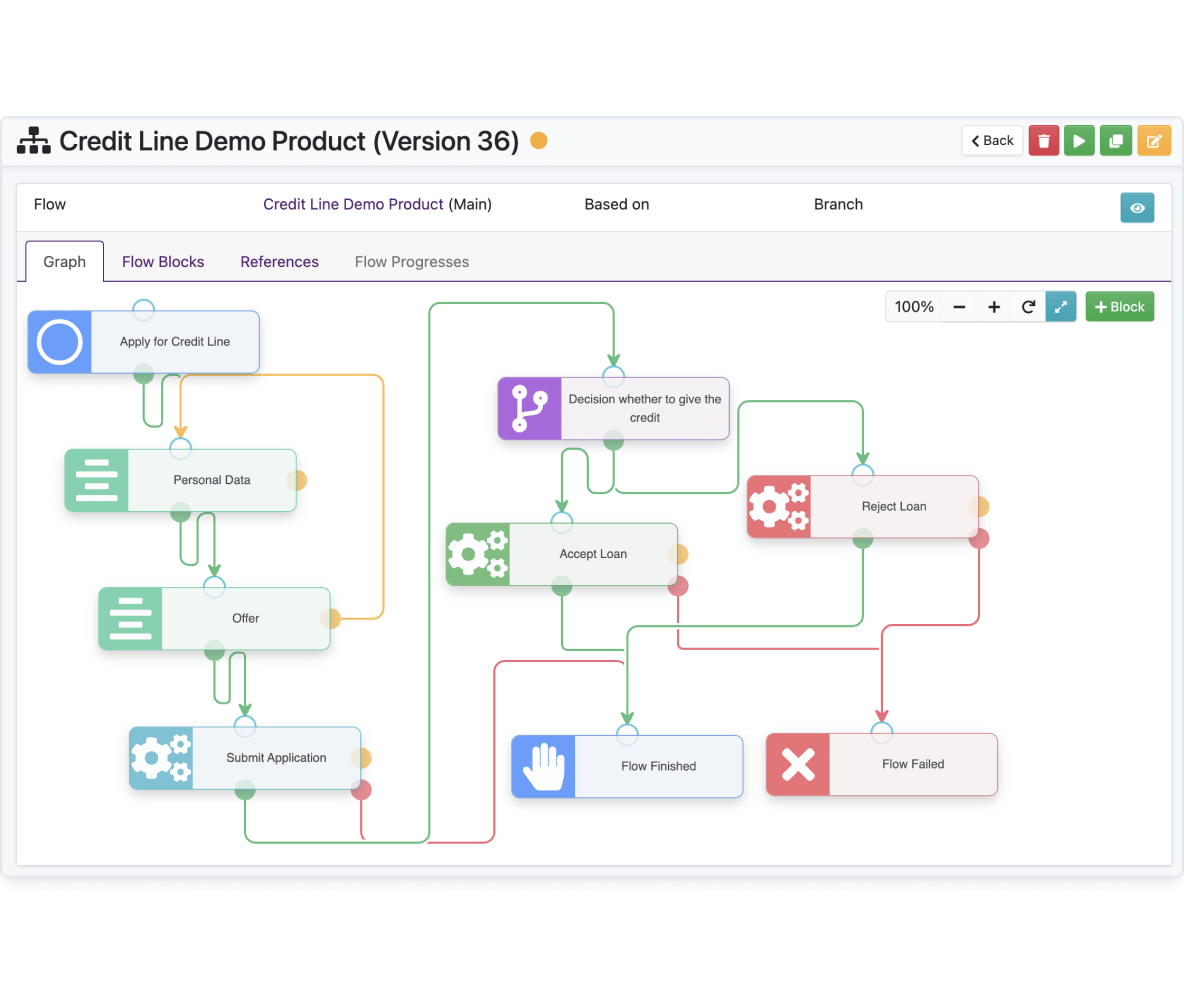

- Agile process customization: Easily adapt to changing regulations or market shifts with customizable workflows for a seamless credit line and client journey management, allowing effortless configuration of diverse business processes such as revolving credit line applications, customer onboarding, contract management, and debt collection, while ensuring authorized access to designated flows, actions, and tasks.

- Tailored workflows: Different types of flow blocks allow for seamlessly creating, connecting, and rearranging elements through user-friendly visual flowcharts and building elements within flows, enabling a wide range of functionalities for data management, such as external interactions with credit bureaus, communication, and calculating the customer score for the credit limit.

- Improved credit limit adjustment: Throughout the client's life cycle, dynamically modify credit limits by increasing the cap for revolving credit products through rescheduling and refinancing. The establishment of a new credit limit encompasses the existing credit amount, providing customers with enhanced flexibility and expanded financial possibilities.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.