Mortgage software

Seize the mortgage loan market with Fintech Market's secure and customizable SaaS platform for seamless efficiency.

FTM Mortgage software

Introducing our mortgage software on the cutting-edge FTM platform, designed to empower financial institutions and mortgage professionals to deliver tailor-made products to their clients. With an unwavering commitment to flexibility, seamless integration, regulatory compliance, and top-notch security, our mortgage loan software empowers clients to fine-tune loan terms, interest rates, and account features, ensuring a perfect fit for their specific needs. Take advantage of our robust reporting and analytics tools to gain valuable insights and monitor performance, equipping you to provide unparalleled and individualized mortgage financing services.

Flexible product tailored for the mortgage industry

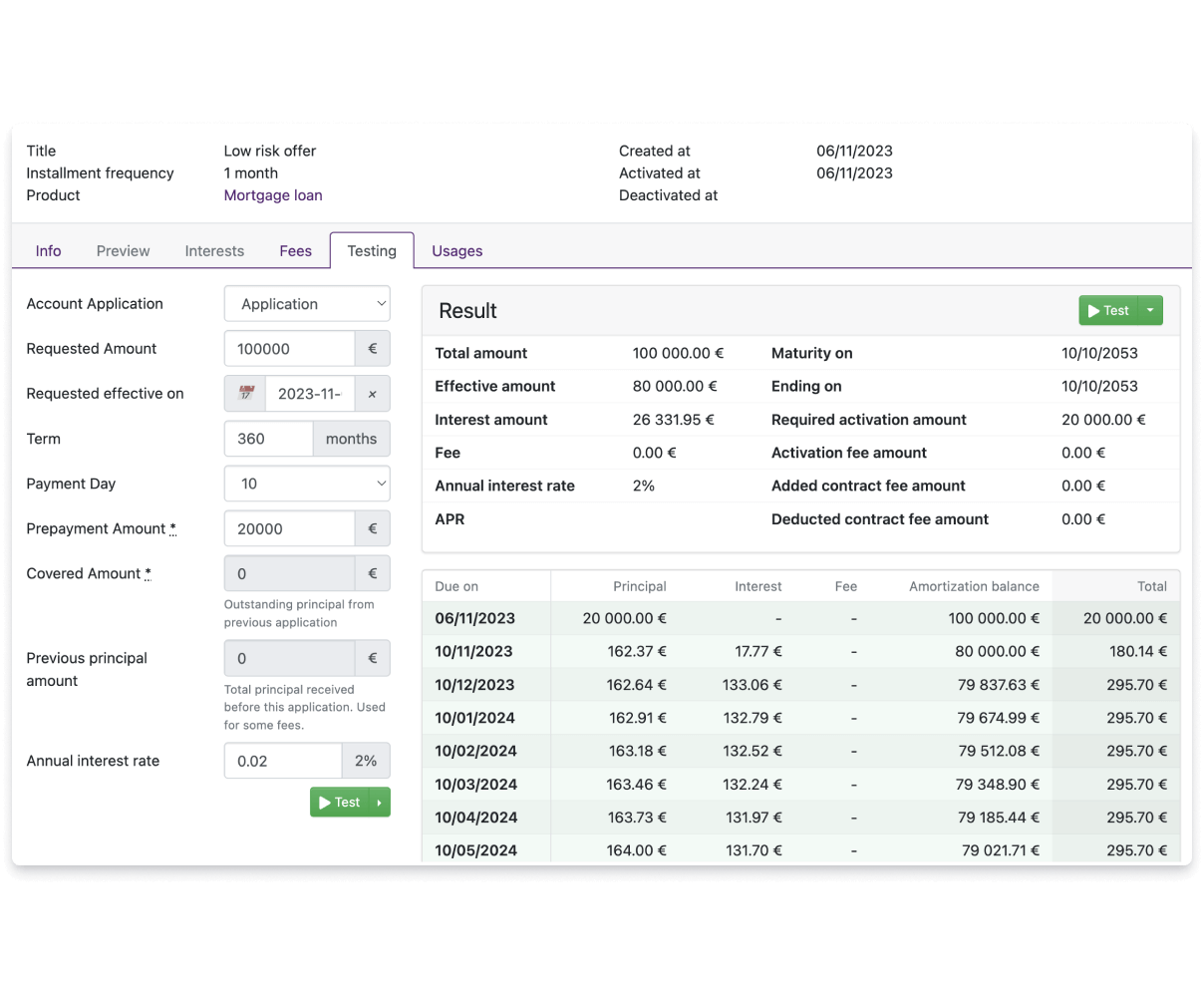

FTM mortgage software includes management tools designed for mortgage and loan agents, featuring account creation, flexible product configuration, and automated interest calculations.

- Adjustable product: Configure with ease the various types of mortgage products you want to offer. Set up the product with fixed or adjustable values for amounts, interest rates, terms and determine how to handle penalties and the grace period and handle interest rate calculations, including how rates are determined (e.g., daily, monthly, or annually), and whether they are variable or fixed.

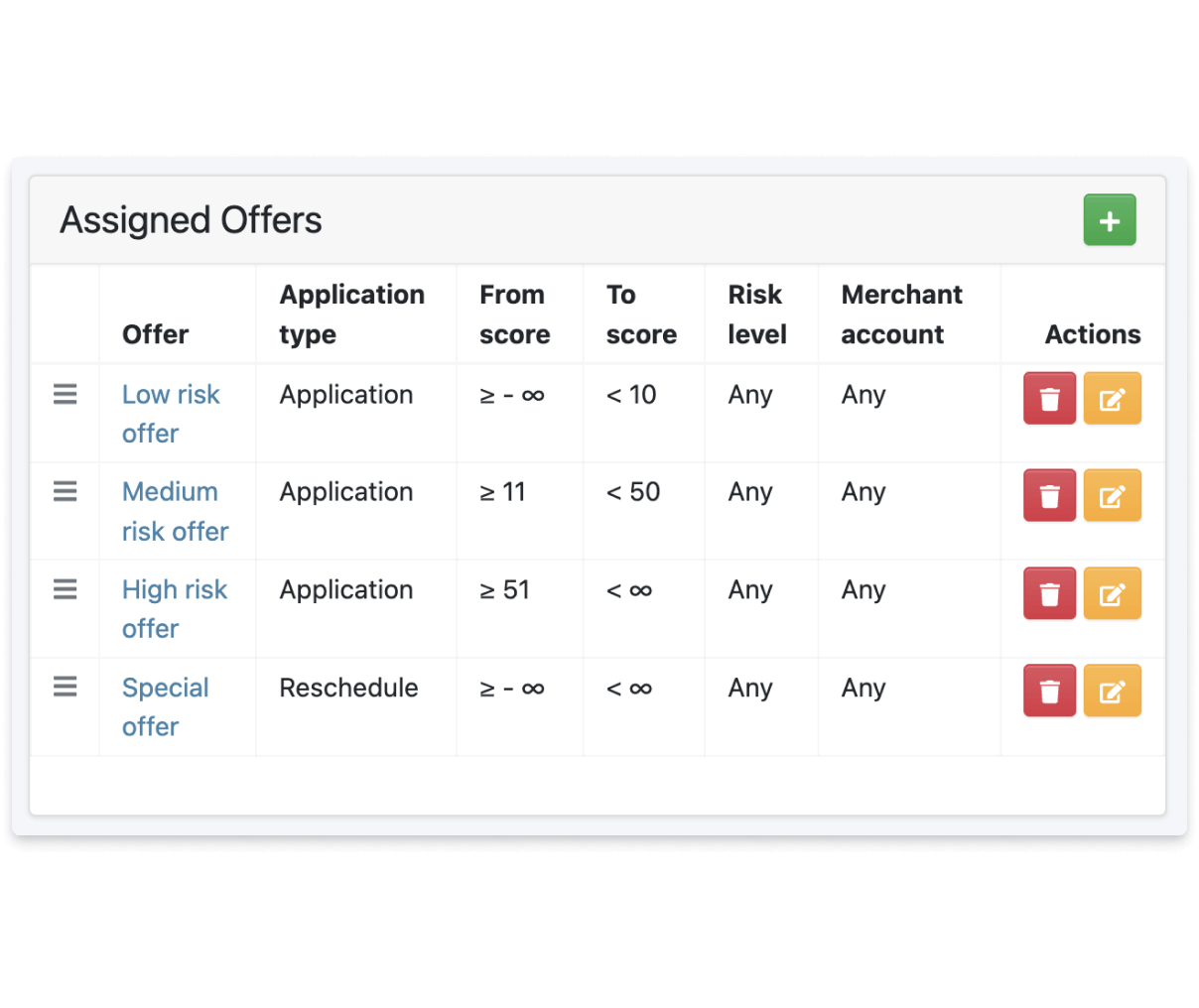

- Personalized offers: Craft offers with flexible or fixed values and allocate them to particular risk levels or credit score ranges for risk-based pricing. You also have the option to specify if the offer is only applicable to one application type, such as rescheduling or refinancing, or if it applies to all application types.

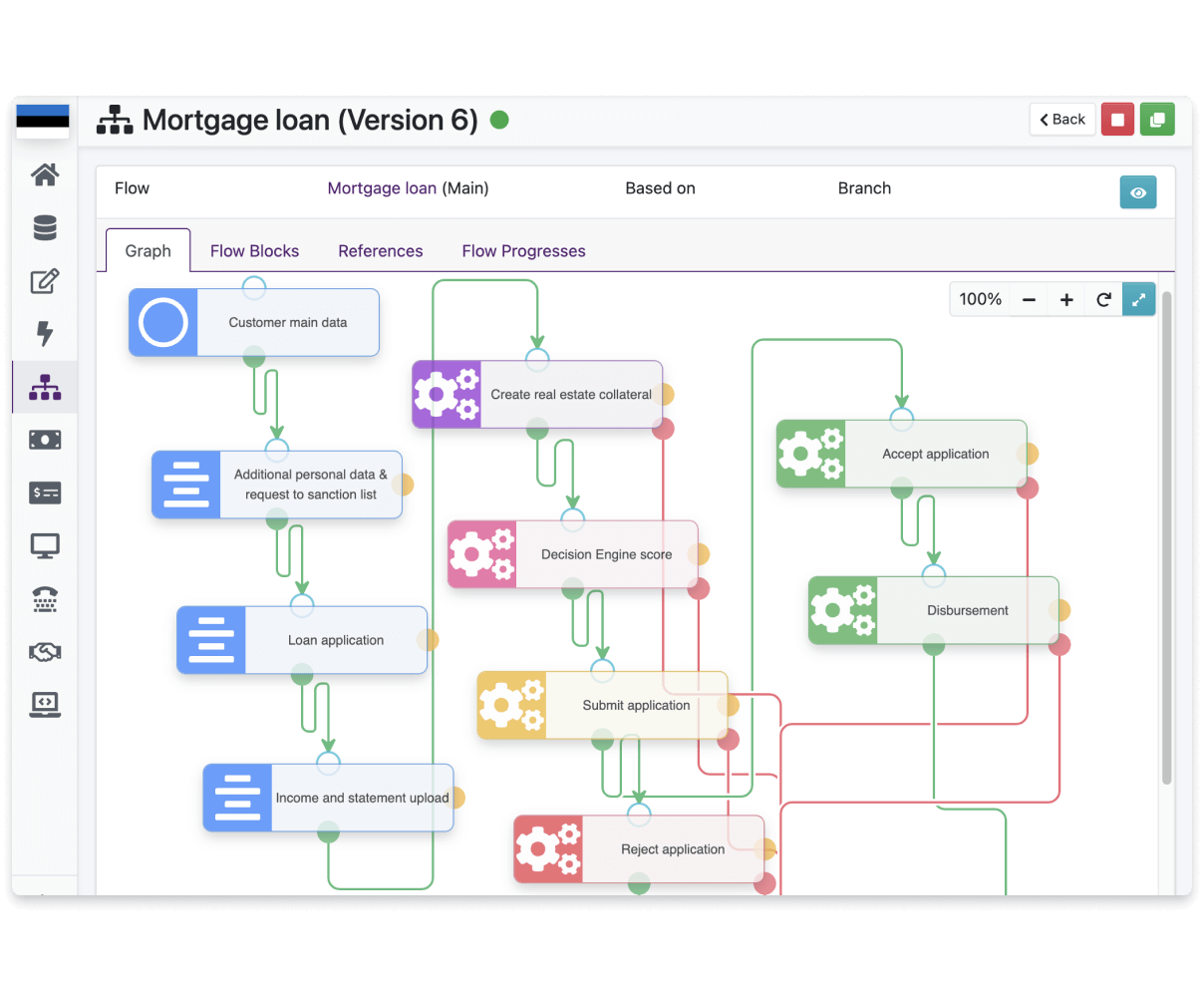

- Loan origination and application process: Easily design and configure the application workflow for collecting and processing applicant data, credit checks, income verification, and other necessary documents with FTM loan origination software for a user-friendly application experience.

Risk management for mortgage lenders

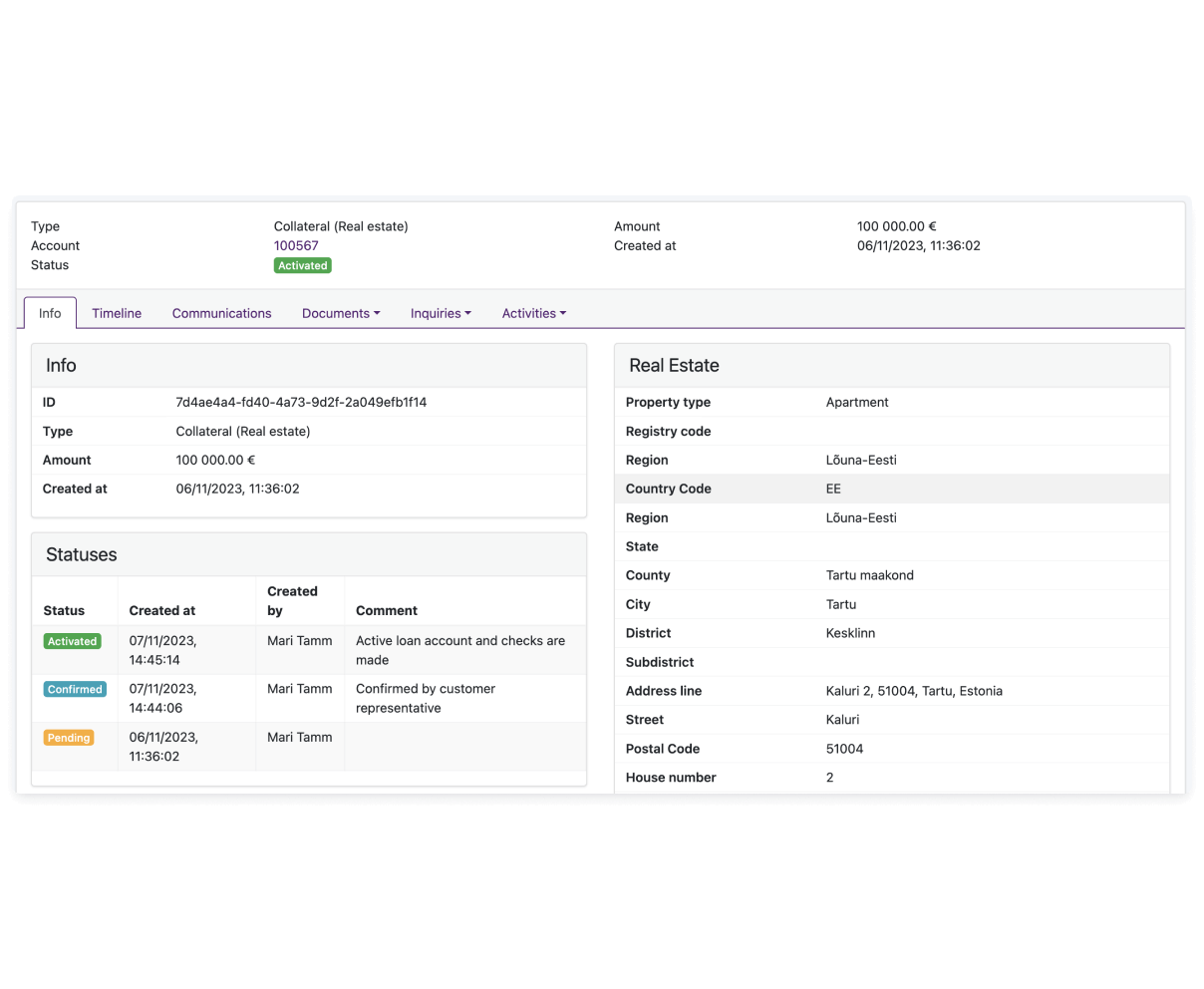

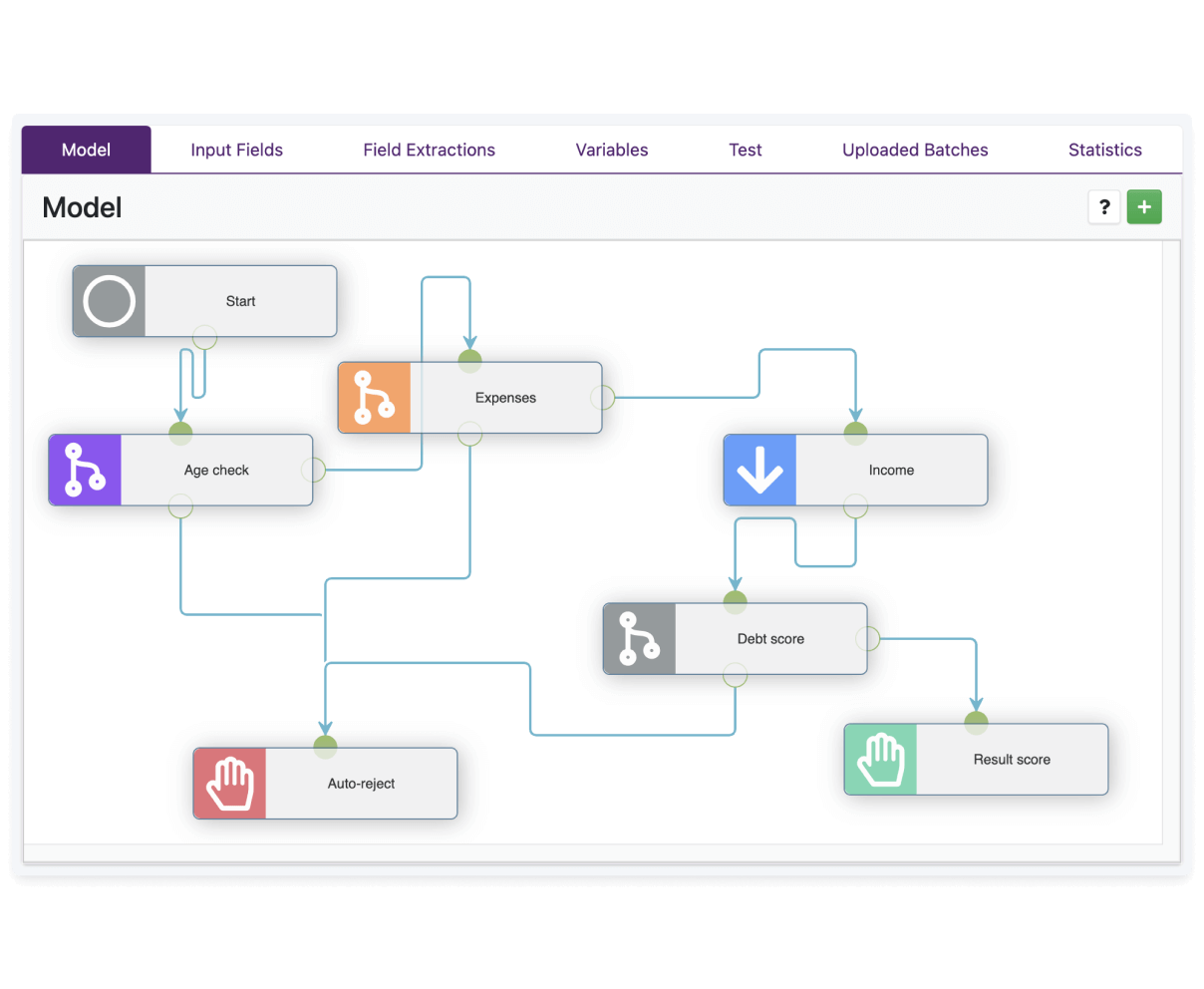

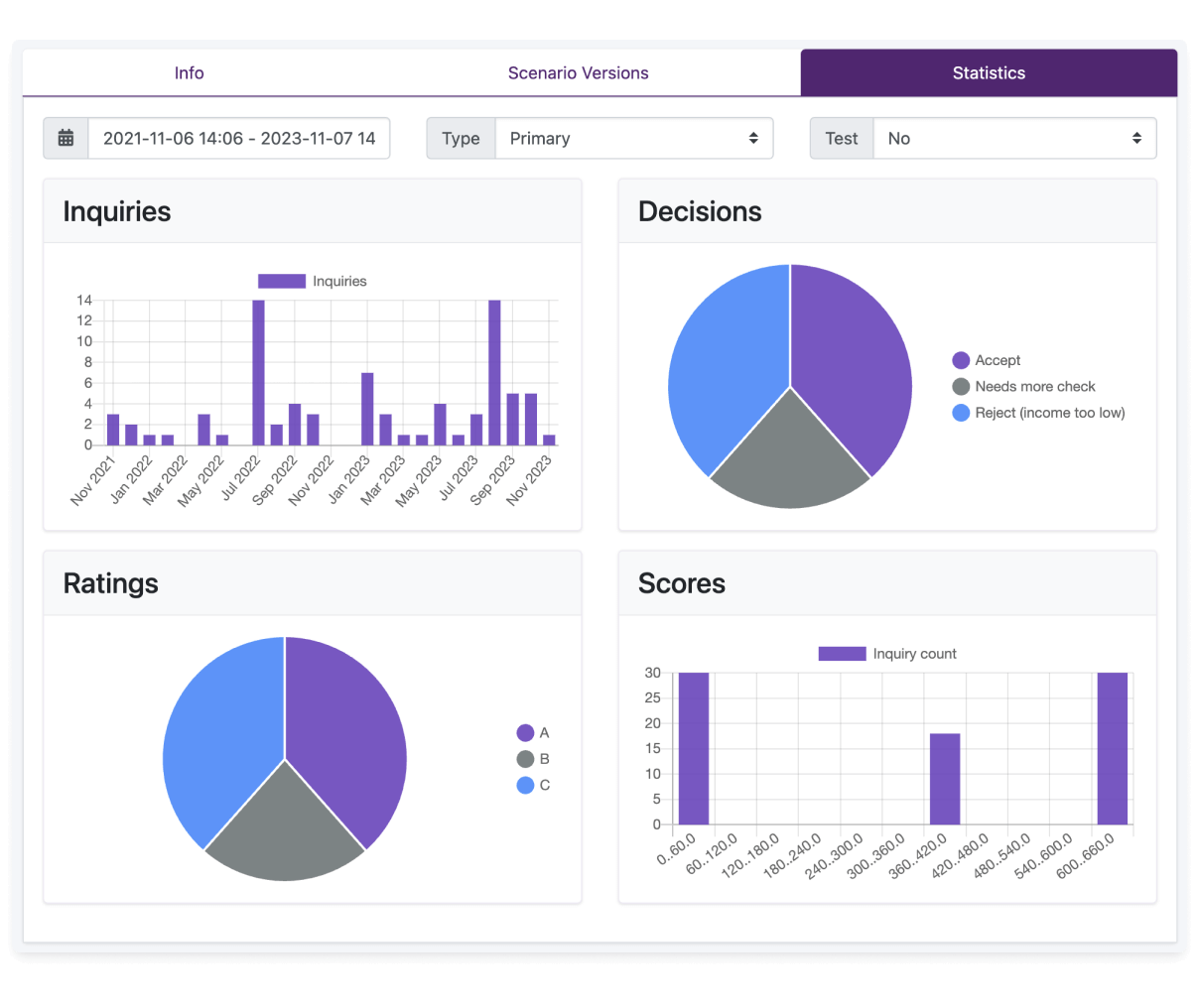

Unlock the full potential of risk management in FTM loan management software with a range of powerful tools, such as risk model building, database inquiries, and streamlined document templating and generation. Our comprehensive risk management tools are designed to enhance the security and efficiency of the entire mortgage process, from initial application to final approval.

- Credit scoring: Integrate your credit scoring models with the tools available in FTM mortgage software to assess the creditworthiness of applicants and make informed lending decisions.

- Automated underwriting: Our FTM loan handling software is at the forefront of automating credit origination, enabling you to seamlessly implement underwriting rules, automate the loan approval process, and ensure decisions align with risk tolerance and regulatory requirements.

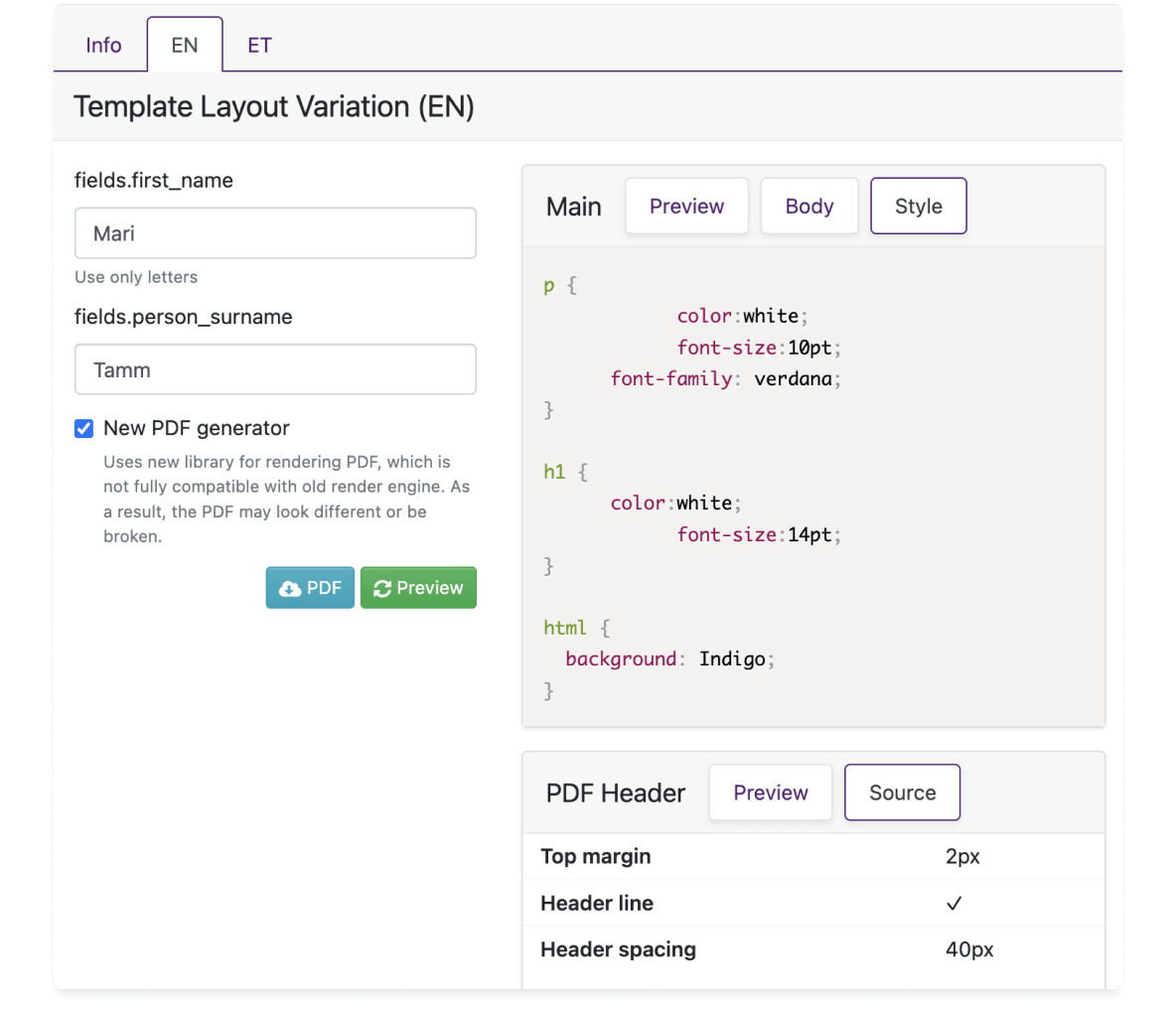

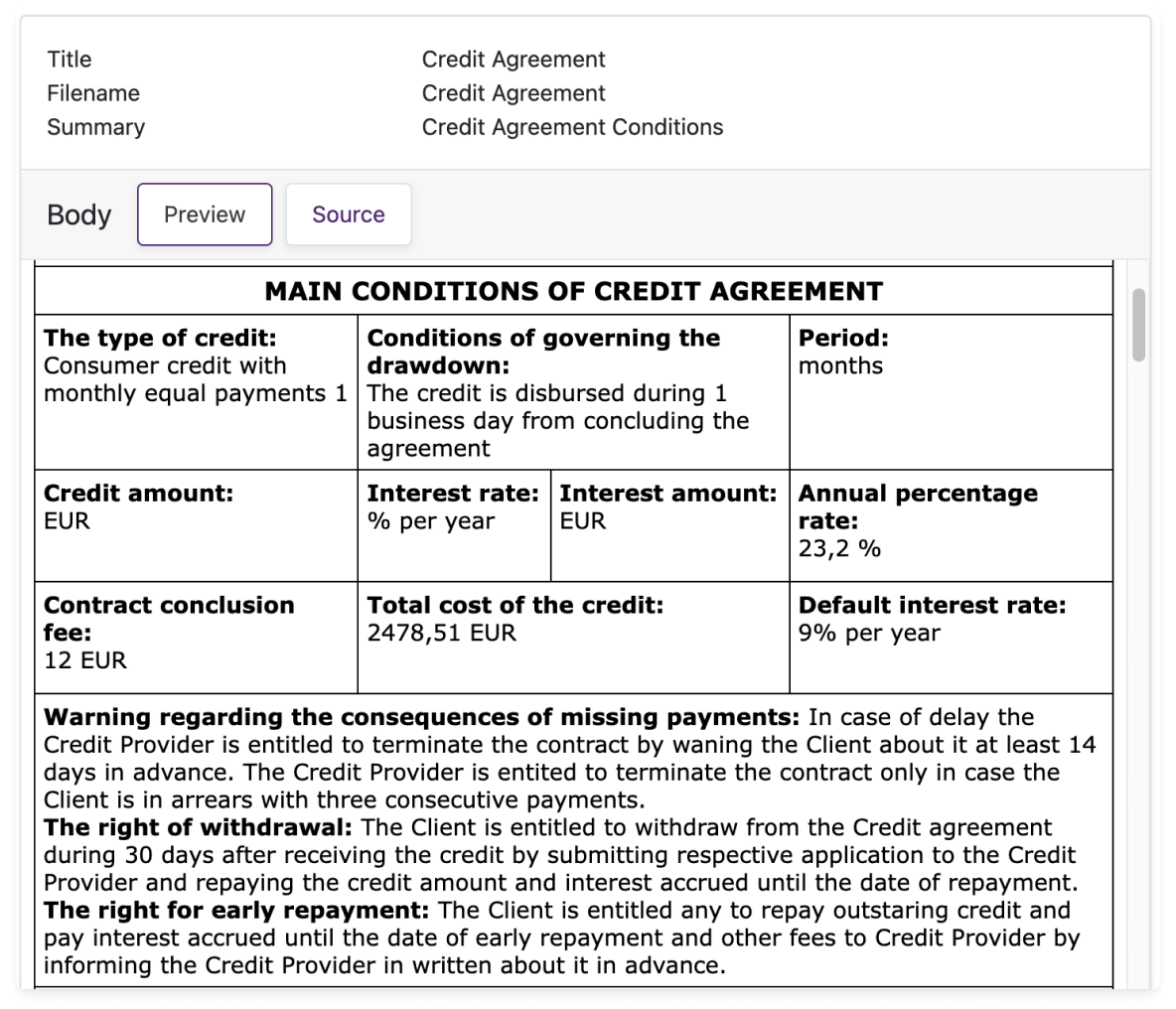

- Collateral document generation: Automate the creation of collateral documents with predefined templates to ensure that all of the necessary legal and property-related documentation is accurate, complete, and compliant with regulatory requirements.

Uplifting borrower experience

Fintech Market's mortgage software prioritizes the seamless management of borrower interactions and accurate financial computations, ensuring a superior customer experience and precise financial clarity.

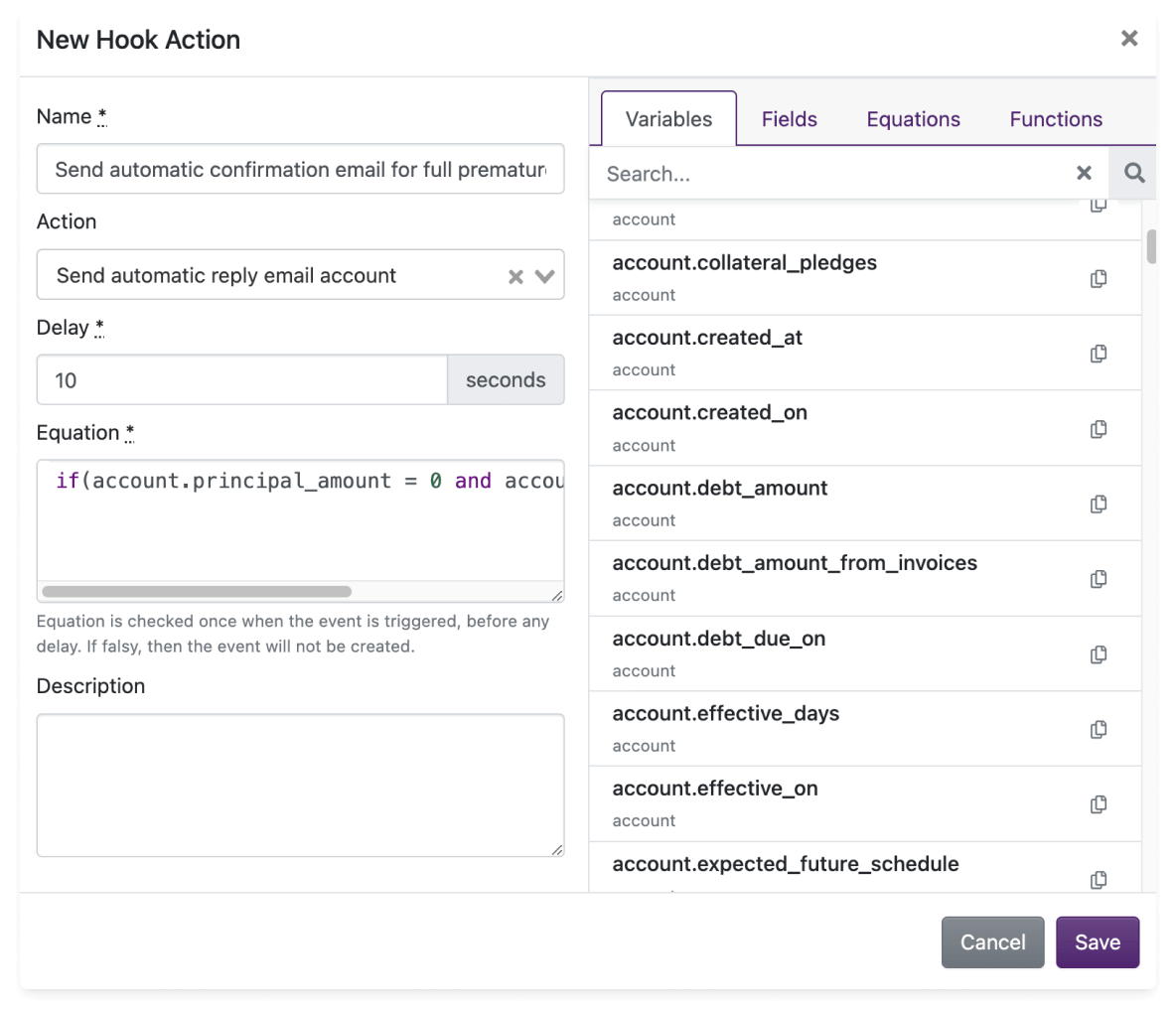

- Mortgage CRM: The CRM module within FTM mortgage loan software allows you to efficiently track borrower interactions, maintain transparency in loan status tracking, and provide personalized customer service, fostering trust and confidence among borrowers. Set up automatic workflows for all activities throughout the loan life cycle, including rescheduling and refinancing processes, streamlining operations, and enhancing borrower convenience.

- Automated messaging: Deliver timely notifications and enhance communication efficiency through automated messages sent via SMS, push notifications, or emails. This enhances borrower engagement, and boosts operational efficiency through event-driven responses.

- Third-party integrations: A list of trustworthy third-party integrations is available on the platform, encompassing communication tools, payment services, and digital signing solutions. We are continually expanding the list to provide an ever-growing suite of options designed to enhance your mortgage lending processes.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.