SME lending software

FTM platform is a modern tool for managing and giving out loans for Small and Medium Enterprises (SMEs).

FTM SME lending software

Our loan management software enables offering SME loans to make processes more efficient and smooth for companies who want to access credit. It enables financial institutions and private lenders to provide a reliable service while facilitating the process by making it easier than in a traditional bank. Our end-to-end loan lending platform helps with processing loan applications and loan origination, servicing, payment collection and reporting.

Customization capabilities

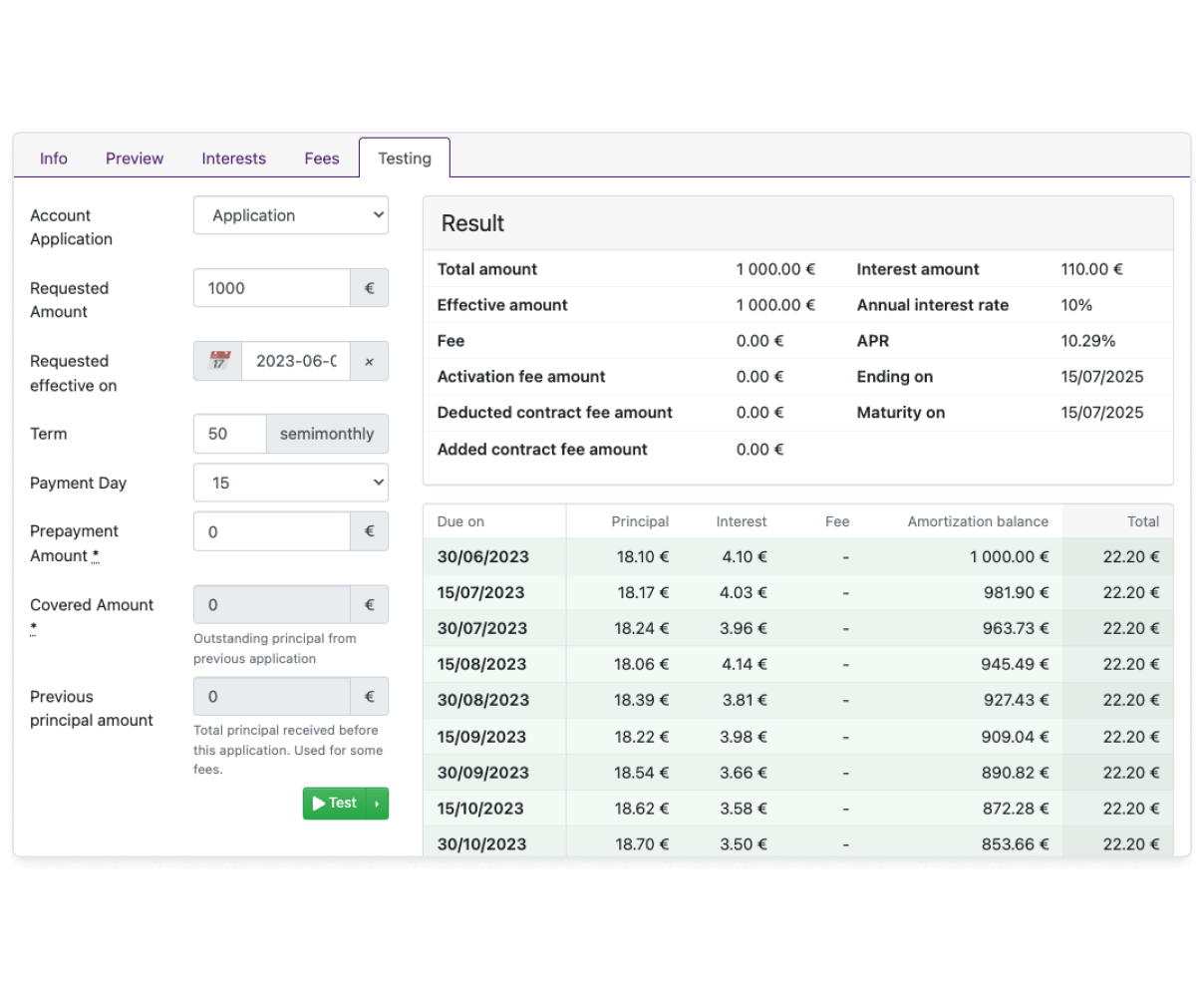

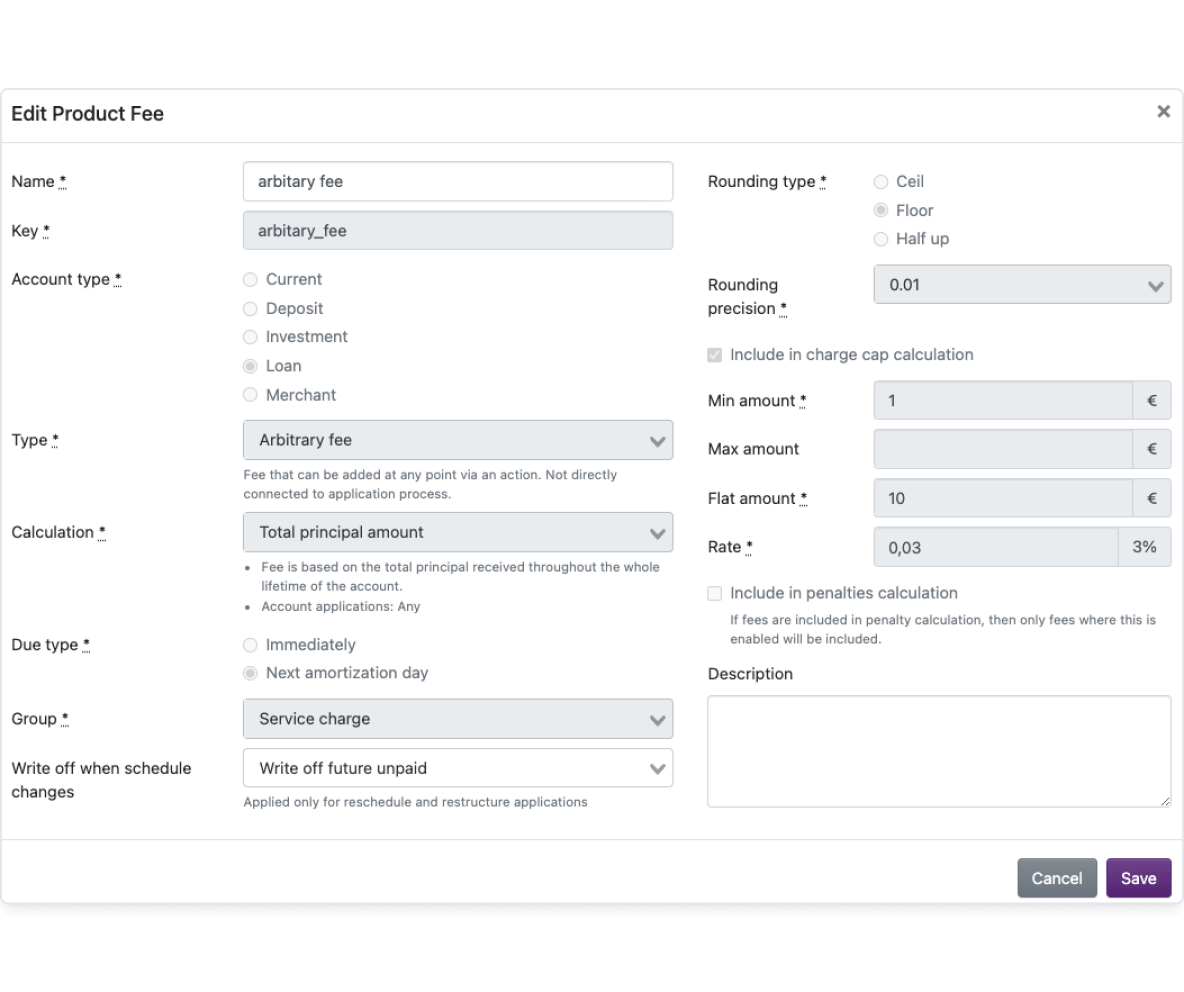

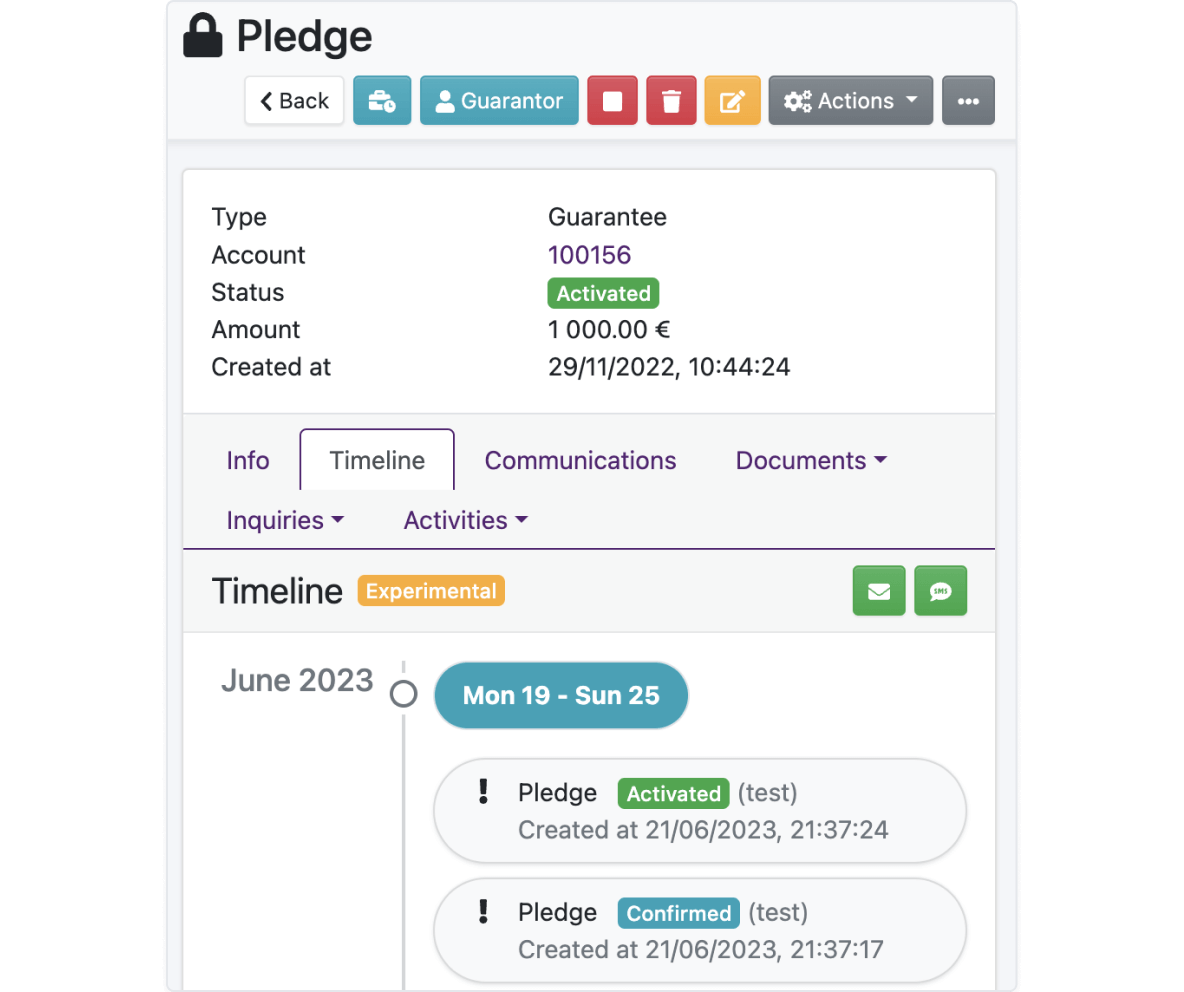

With our SME loan solution platform, we provide extensive adjustment capabilities, allowing financial service providers to tailor loan products to meet the unique needs of small and medium-sized enterprises (SMEs). From interest rates to repayment schedules and collateral options, lenders can configure loan parameters using customizable features, ensuring personalized solutions for SME borrowers.

- Custom-fit loan parameters: Empower your lending operations with the ability to configure loan products and adapt parameters such as fixed or principal-based interest rates, amount, term and interest constraints, a wide range of repayment schedules, and collateral options.

- Flexible loan eligibility criteria: Set specific requirements for SME borrowers, such as credit scores, business performance metrics, and industry-specific factors, ensuring flexibility in assessing loan eligibility with functionalities that enable you to create your assessment logic.

- Personalized loan packages: Our commercial loan origination software allows you to create tailored loan packages that address the unique funding needs of different types of SME borrowers, delivering individualized and flexible loan servicing options for their specific requirements. Rather than offering a one-size-fits-all approach, our platform allows customization of the loans based on various factors such as the borrower's industry, business size, revenue, credit history, and specific financing requirements.

Comprehensive risk assessment tools

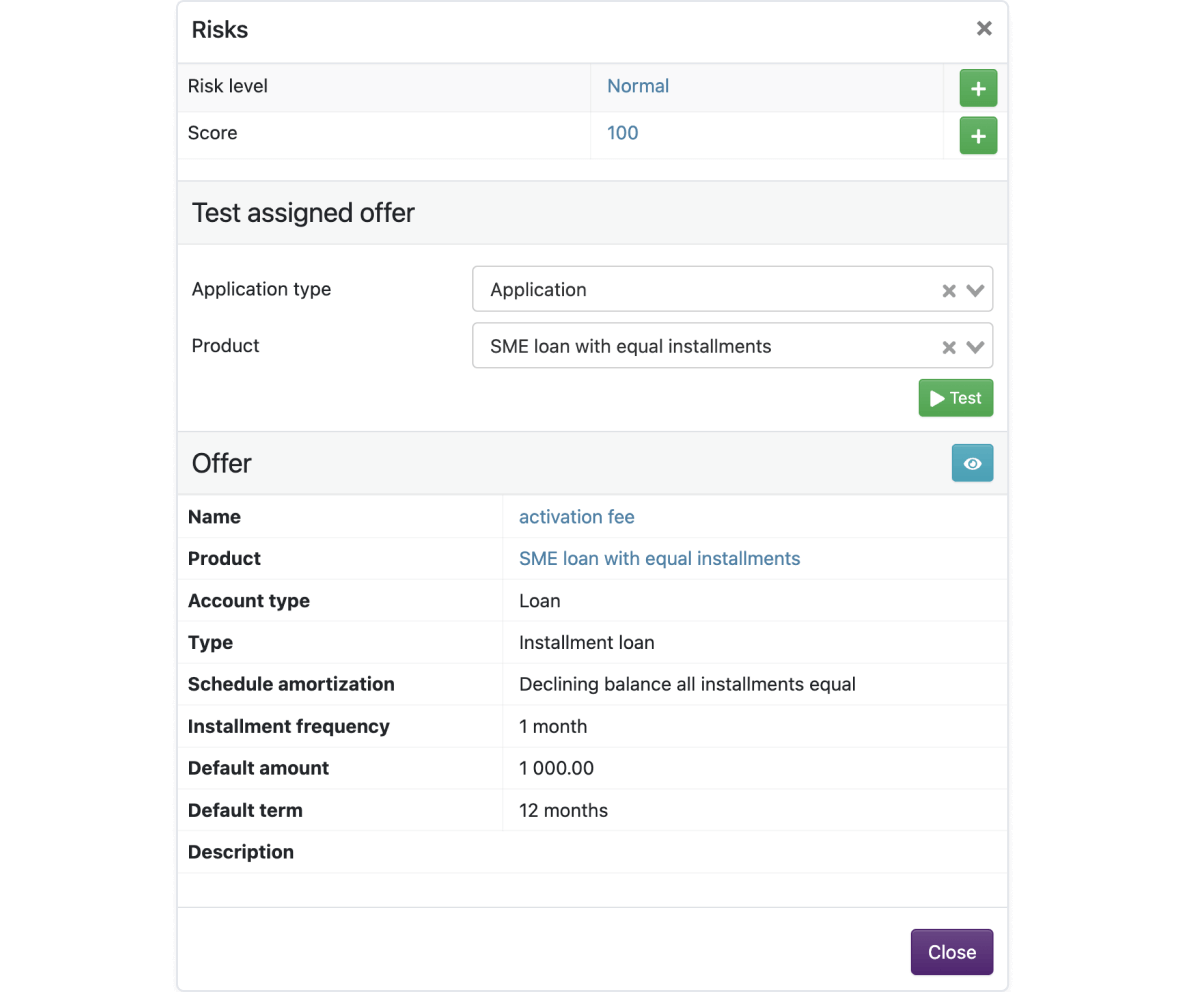

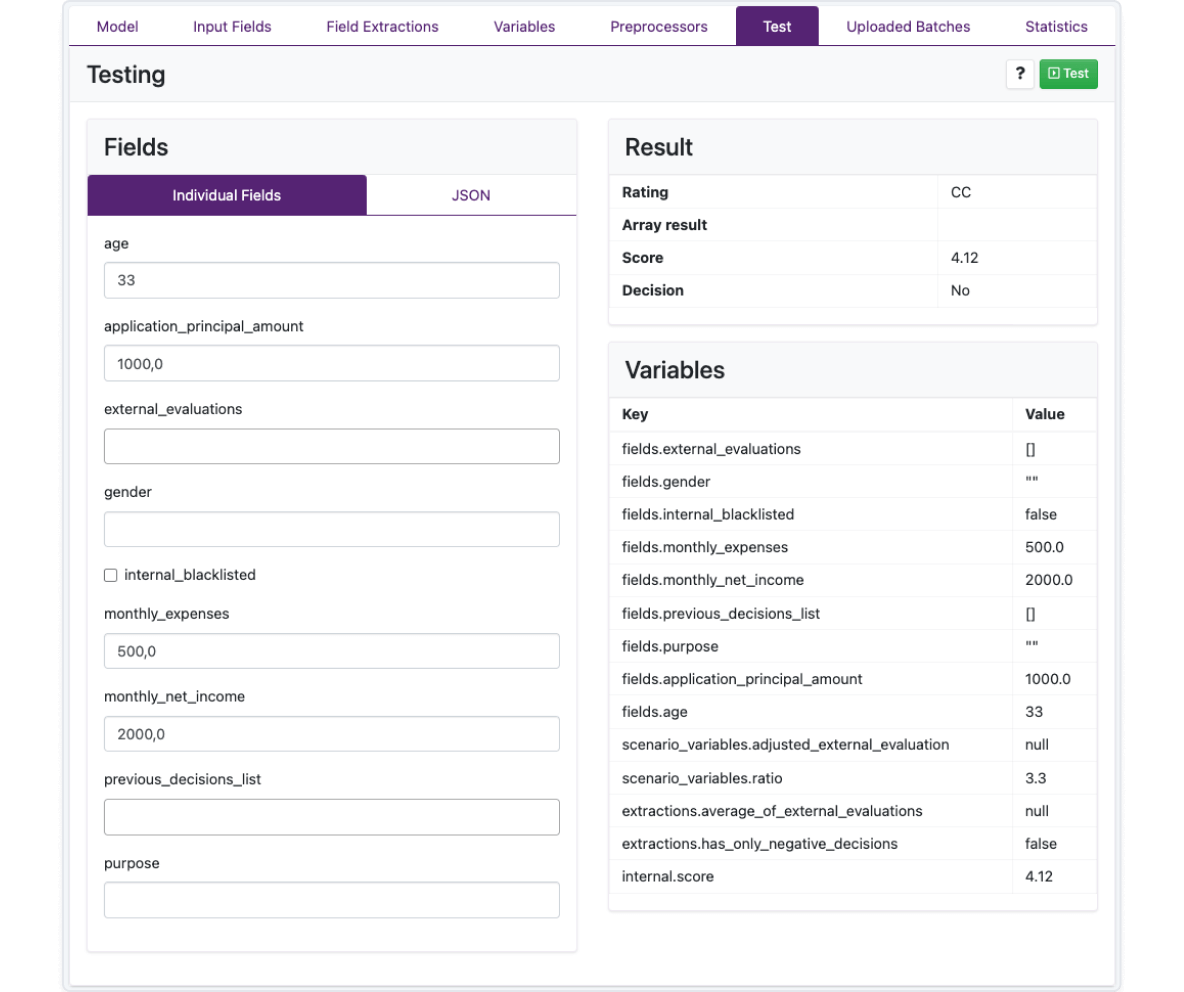

Our commercial loan underwriting software prioritizes comprehensive risk assessment to support informed lending decisions. By integrating credit scoring models and financial analysis tools, lenders can accurately evaluate the creditworthiness of SME borrowers. Access to external data sources further enhances risk assessment, allowing lenders to proactively manage loan portfolio health and mitigate potential risks effectively.

- Accurate creditworthiness evaluation: Integrate credit scoring models and financial analysis tools to appraise the creditworthiness of SME borrowers through our supportive applications. By utilizing these tools, you can take into consideration factors such as credit history, financial statements, and business performance. This comprehensive appraisal helps you make well-informed lending decisions.

- Data-driven risk assessment: Access external data sources, such as credit bureaus and financial statements, to gather comprehensive information for robust risk assessment with the possibility to create lists of individuals or entities to whom heightened scrutiny may apply.

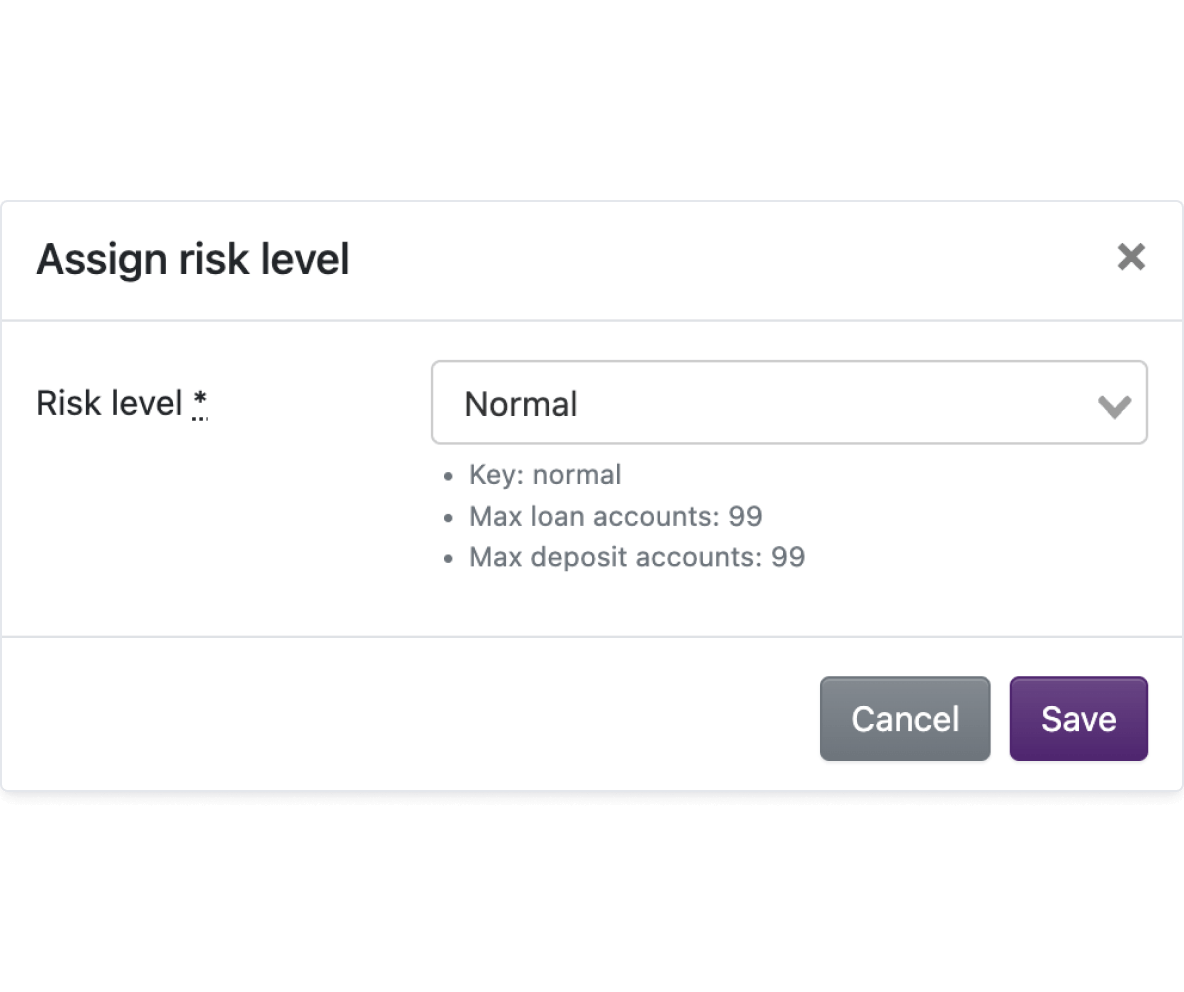

- Proactive risk management: Enhance your risk management strategy by leveraging advanced features, such as early warning systems and portfolio stress testing. Our SME loan software empowers you to identify potential risks and proactively safeguard the health of your loan portfolio. With the option to test each individual's risk level, you can make informed decisions to optimize risk mitigation and ensure the long-term stability of your lending operations.

Seamless application and approval process

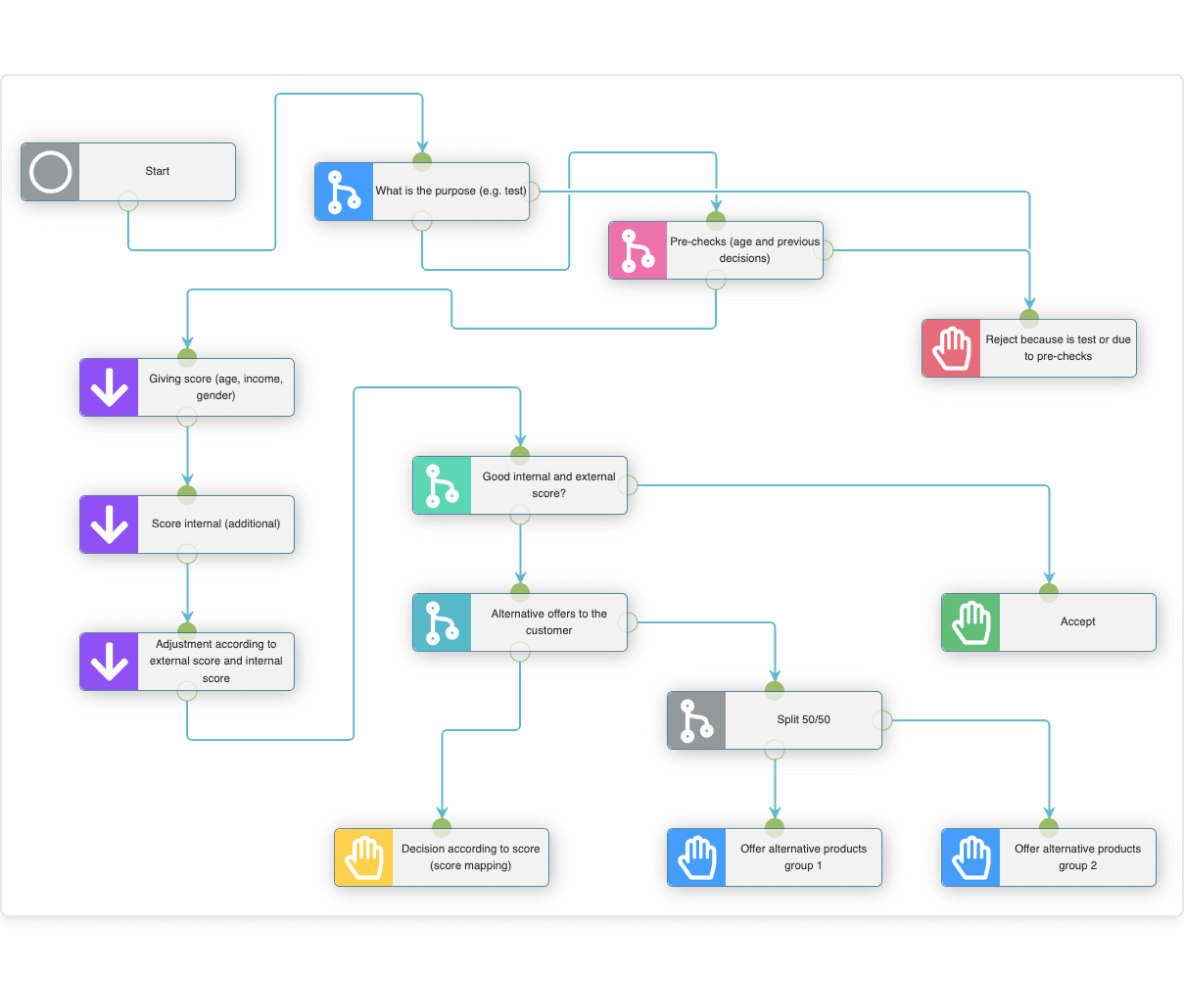

Simplify the borrower journey with our user-friendly interface. Seamlessly collect information and receive documents, transforming the application and approval process into a smooth experience. Leverage automation and advanced credit assessment tools to expedite approvals, providing prompt responses to SME loan applicants. Enhance transparency and communication to keep borrowers informed throughout the lending process.

- User-friendly loan application process: Simplify the borrower's journey with our agile process customization tools. Streamline the application process through visual flowcharts and building elements, enabling easy submission of information and documents, and other helpful functionalities like digital signing and various payment options. We offer end-to-end automation of the entire loan origination process.

- Automated credit assessment: Expedite the approval process with automated credit evaluation and decision-making capabilities providing quick responses to SME loan applicants.

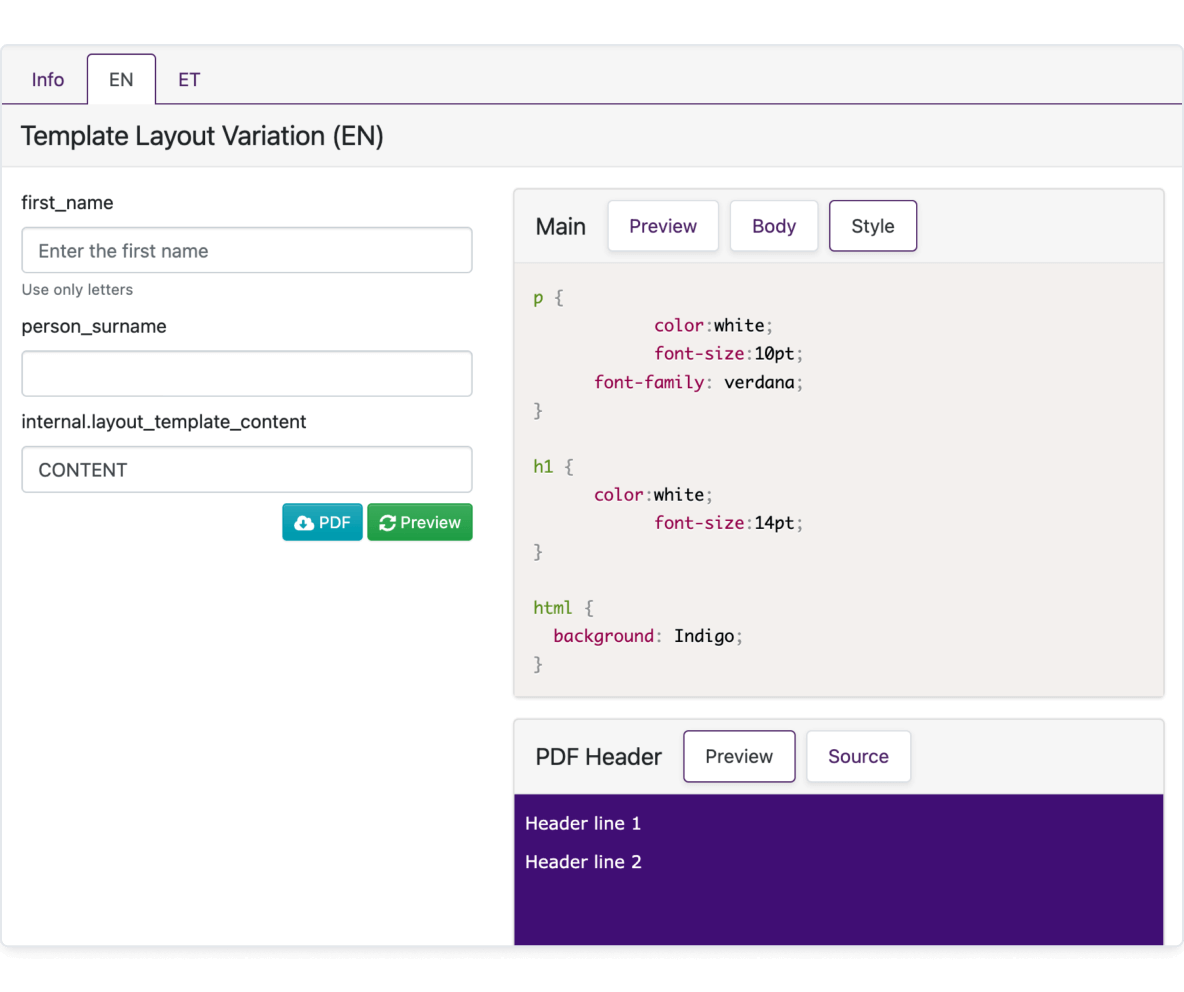

- Transparent loan communication: Facilitate smooth and transparent communication with borrowers through our platform's integrated third-party providers. Utilize SMS, emails, phone calls, push notifications, and letters to keep borrowers informed about their loan application status and any additional requirements, ensuring a streamlined and engaging lending experience.

Loan portfolio management

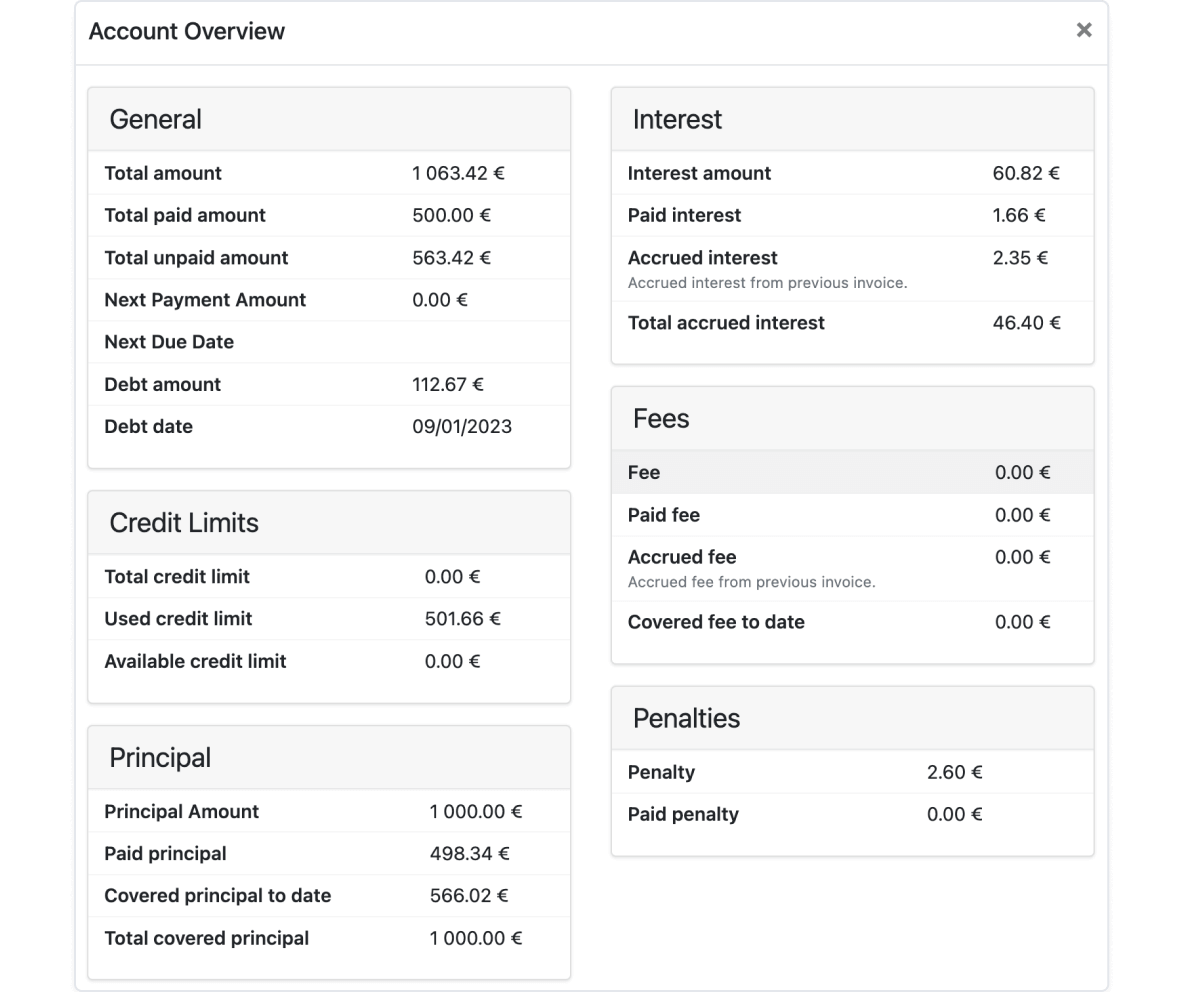

Simplify the management of your loan portfolio with our loan management system in real-time. Detect delinquencies, and identify defaults promptly to maintain portfolio health. Leverage reporting and analytics features to gain valuable insights for data-driven decision-making. Maximize portfolio performance while minimizing default risks with optimized lending operations.

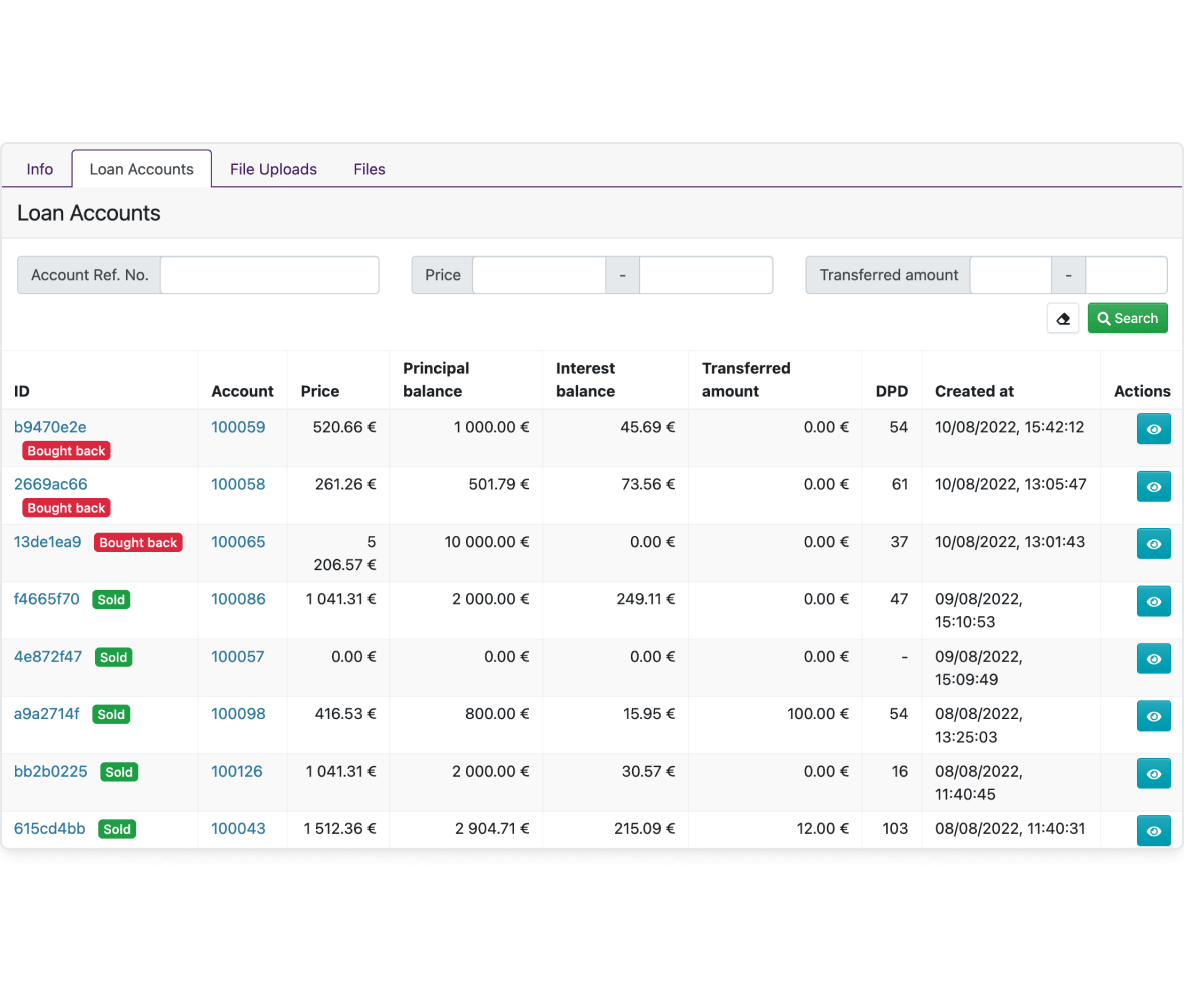

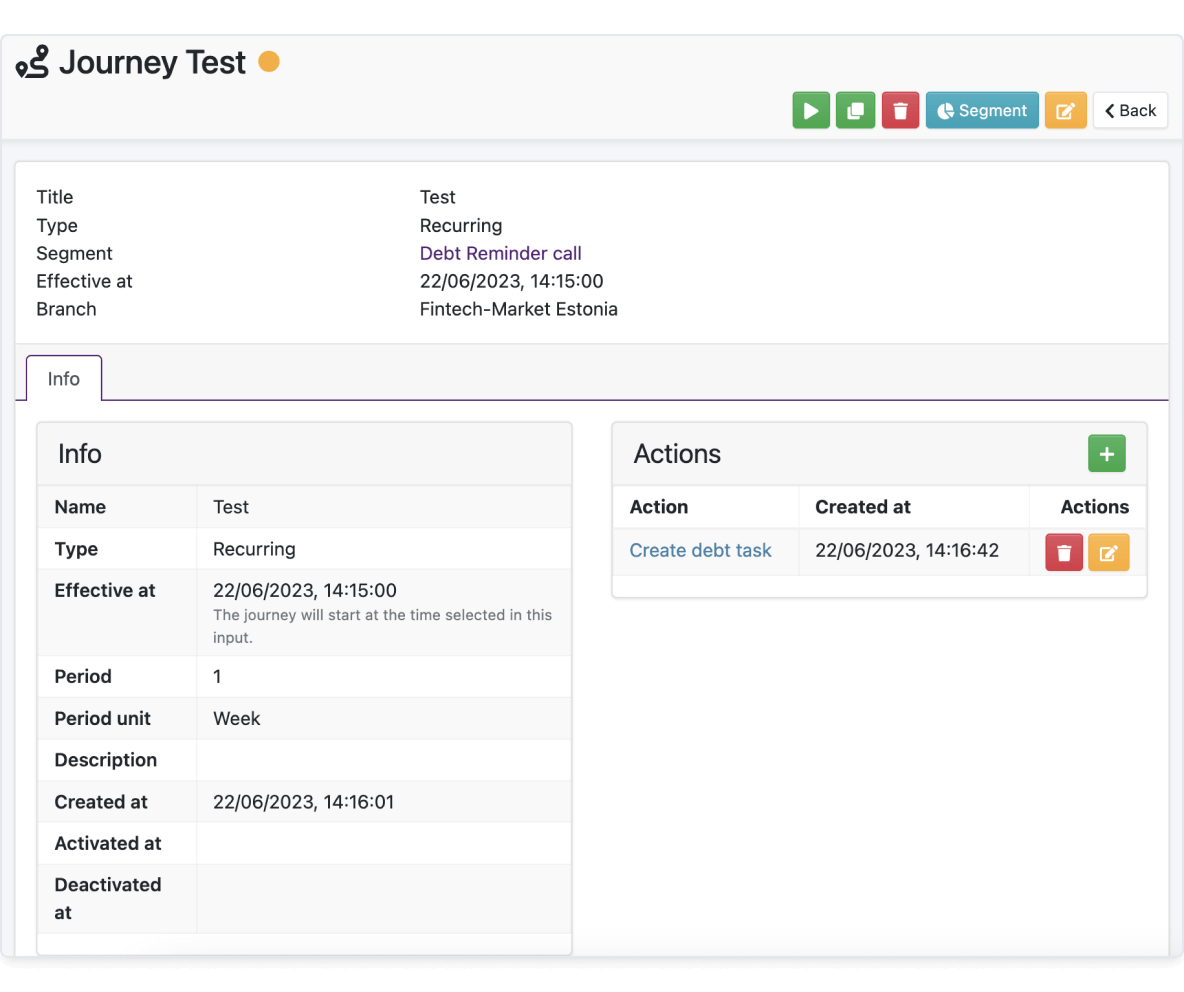

- Real-time loan performance monitoring: Gain real-time insights into loan performance, enabling you to track repayments, delinquencies, and defaults for proactive loan portfolio management. Our platform offers advanced functionalities that include status updates, labeling, and automated reactions triggered by specific events.

- Loan portfolio analytics: Our SME lending solution can generate comprehensive reports on loan portfolio health, performance trends, and key metrics, enabling informed decision-making through insightful and advanced analytics.

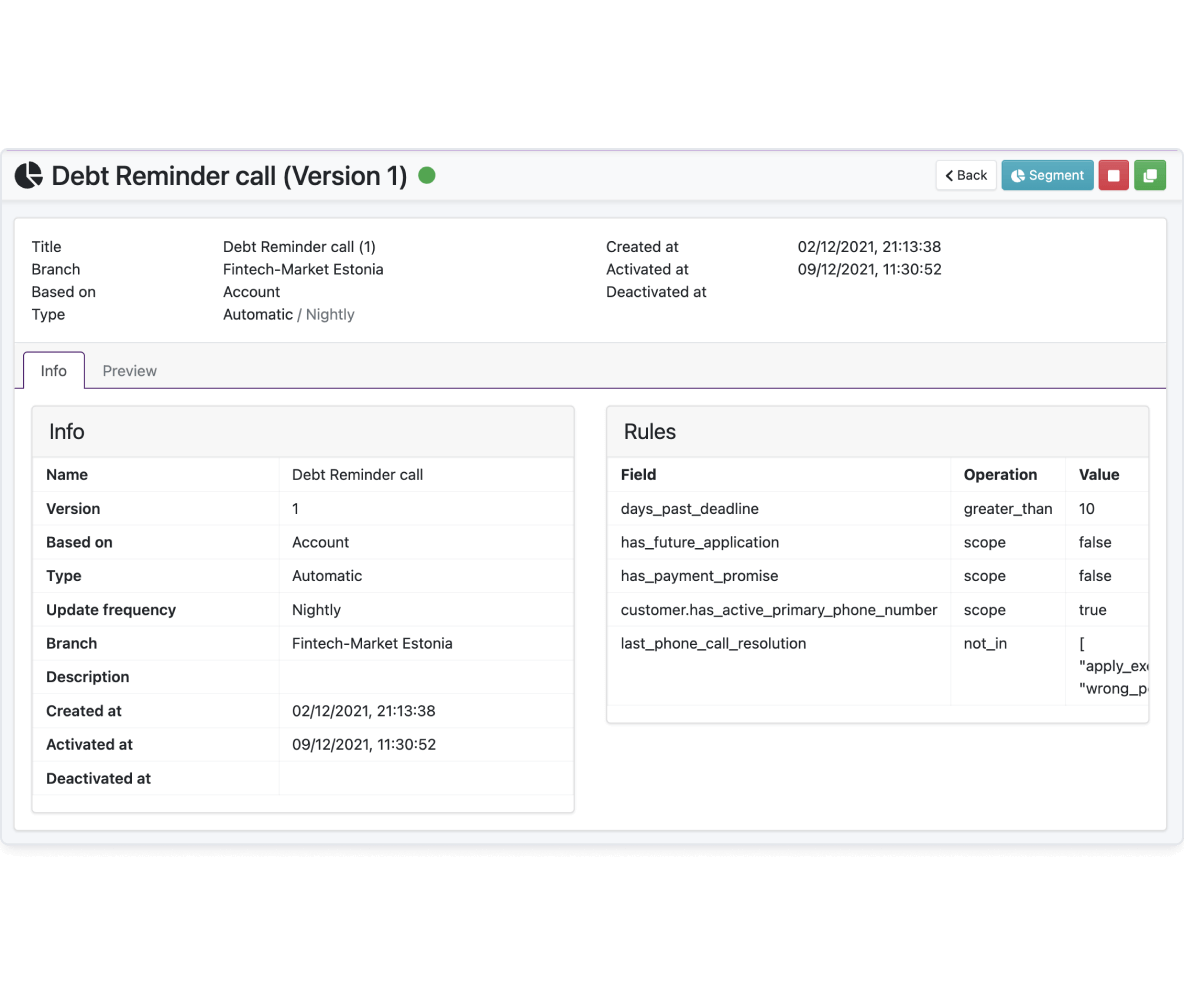

- Loan portfolio optimization: Utilize tools for portfolio segmentation, risk categorization, and automated collection processes to optimize loan portfolio management and minimize default risks.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.