Factoring Software

Offer factoring solutions to your clients using Fintech Market's secure and customizable SaaS platform.

FTM factoring software

Factoring software on the FTM loan management platform gives financial institutions options to service their clients with personalized products and offers to provide them with immediate cash flow, allowing them to access funds that would otherwise be tied up in unpaid invoices. Prioritizing customizability, swift integration, compliance, and security, our factoring software empowers clients to fine-tune terms, discount rates, and account features to align with their specific factoring requirements.

Invoices and documents

FTM factoring software includes management tools such as account creation, flexible fee configuration, automated document generating, and swift invoice uploading options.

- Invoice overview and management: FTM factoring system has overview pages for accounts, customers, and applications with all the data linked. Uploading invoices to the system is swift and all invoices can be viewed on a single page, with statuses and filtering options.

- Documents: Our factoring solution provides functionalities for creating, delivering, and storing documents needed for the factoring process at each stage. Configure the document templates and link them to the data within the system, enabling automated generation of essential documents like agreements with pre filled data fields. Upload signed contracts and associated documents directly into the system.

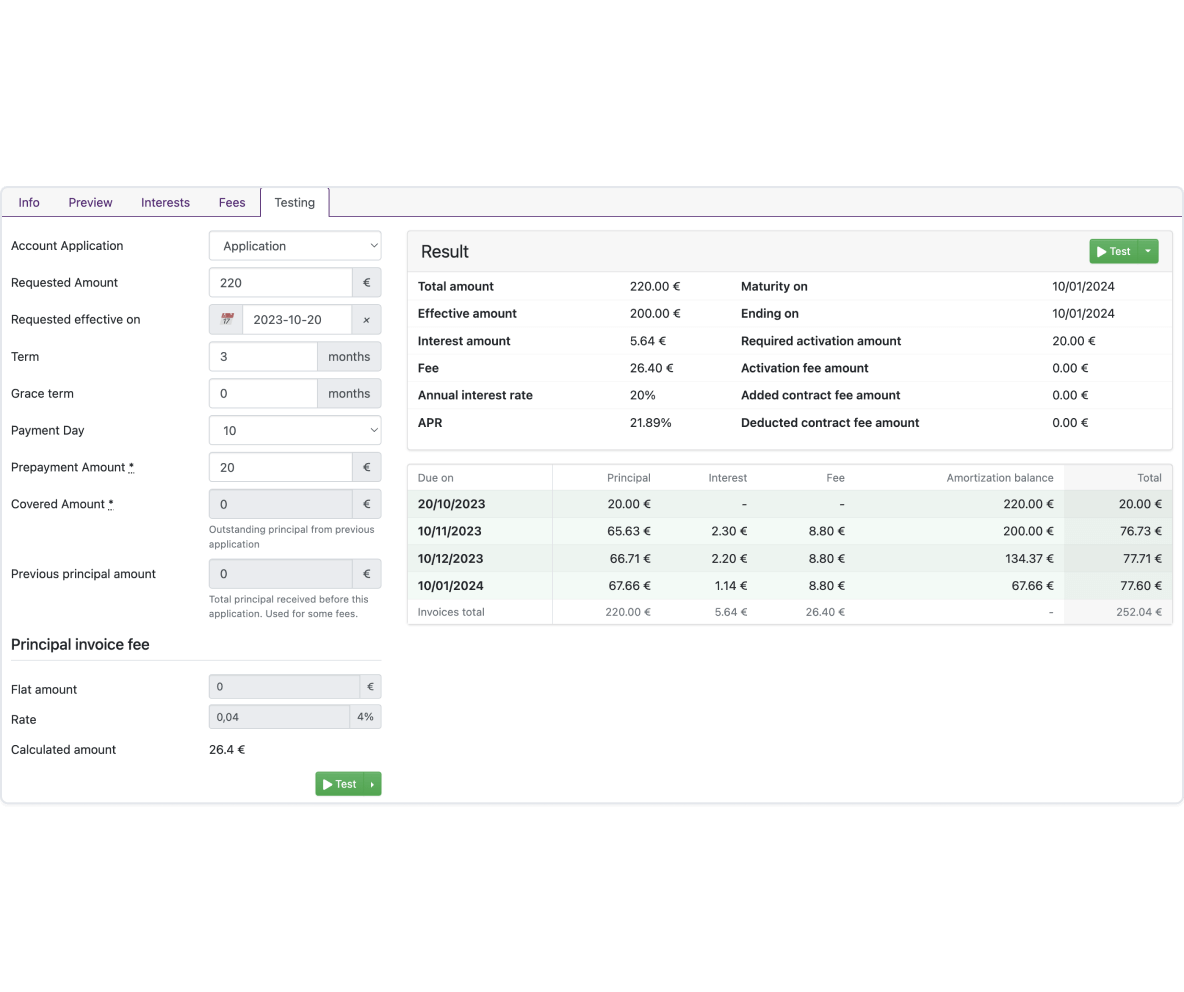

- Rates and fees: FTM factoring product management system streamlines offering standardized terms for all clients, or creating customized terms for specific individuals. Configure advance rates, service fees, and adjust conditions to optimize fund utilization. Customize fee rules for various scenarios, like partial payments, or premium fees, ensuring a dynamic and cost-effective invoice factoring experience.

Risk assessment and debt managing

Fintech Market factoring software helps to assess and manage the risk associated with the factored invoices, including monitoring the creditworthiness of the business and its customers.

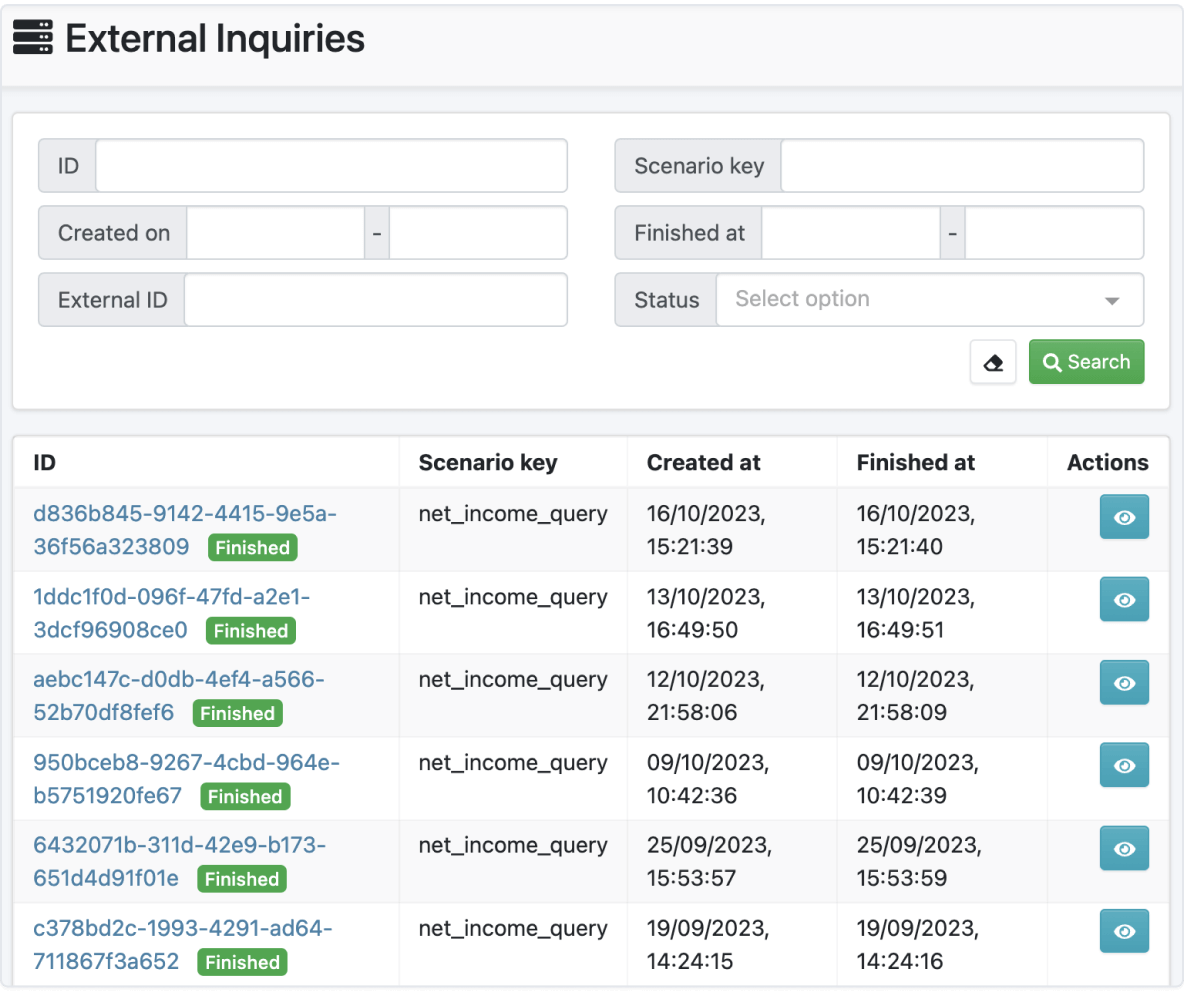

- Requests to third-party integrations: Make requests to get credit reports and other financial data to ensure the invoices are valid and eligible for factoring or conduct searches to identify any outstanding debts, liens, or legal issues that could affect risk assessment. This helps reduce the risk of fraudulent or duplicate invoices being factored, and appraise the potential risk.

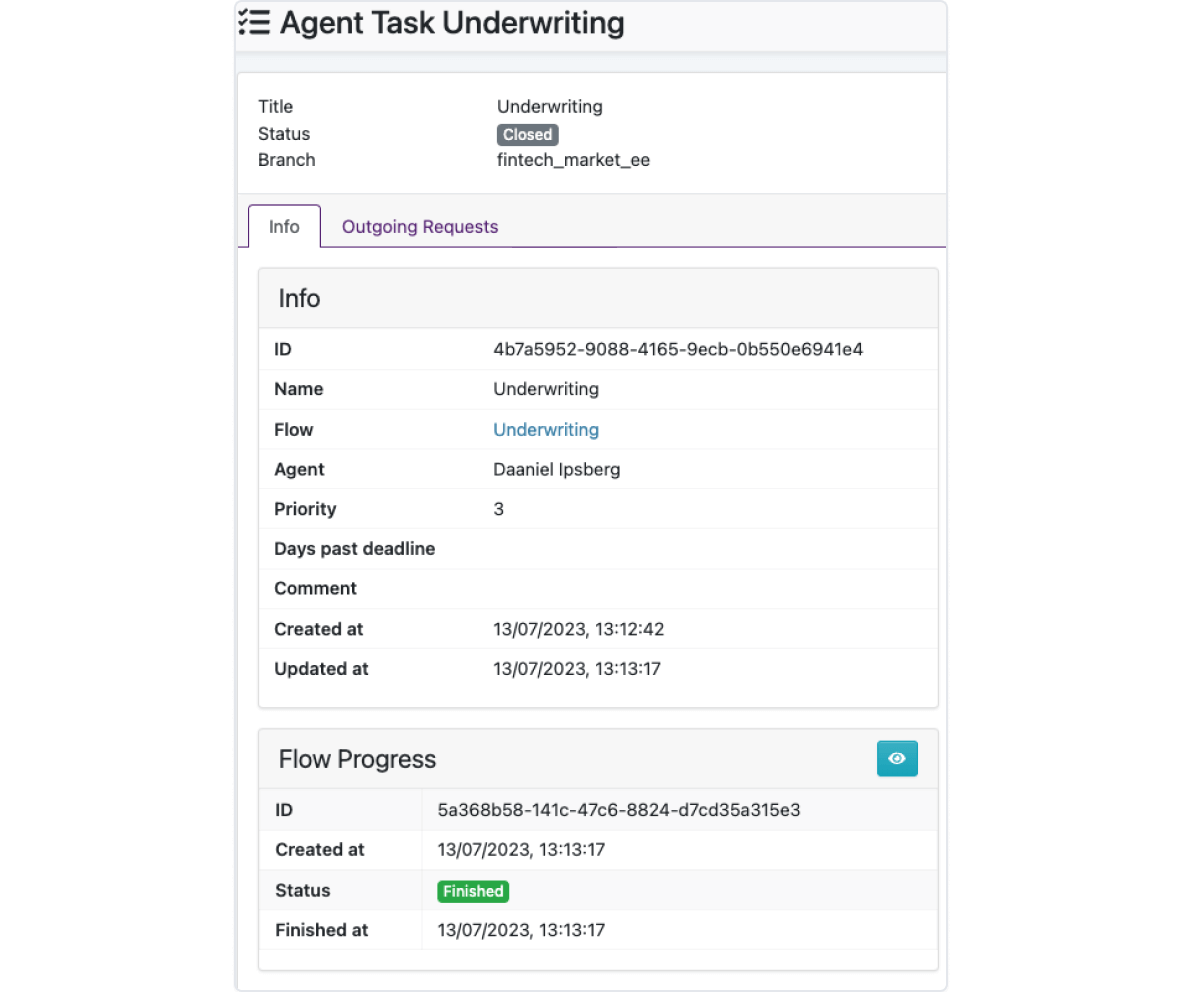

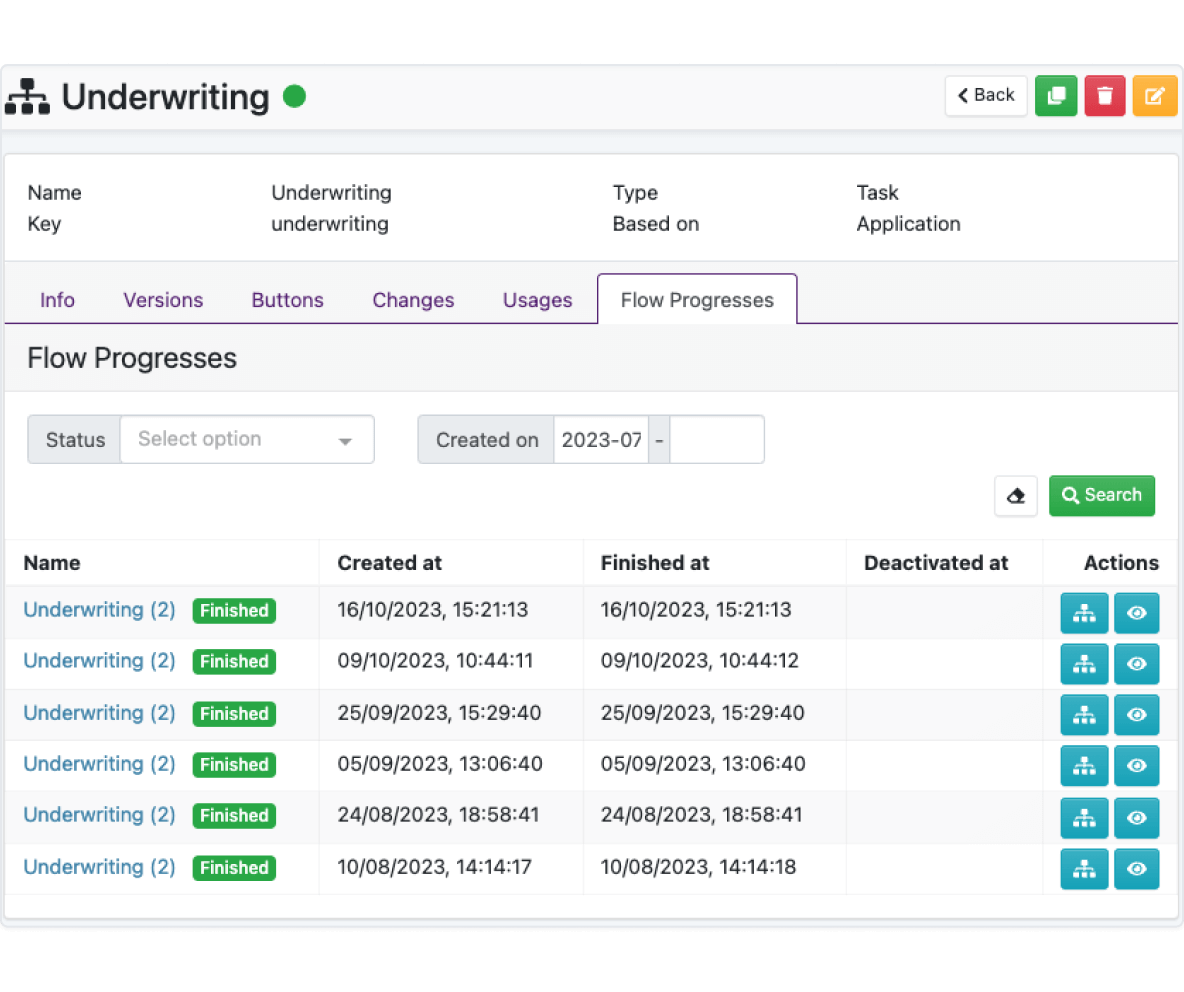

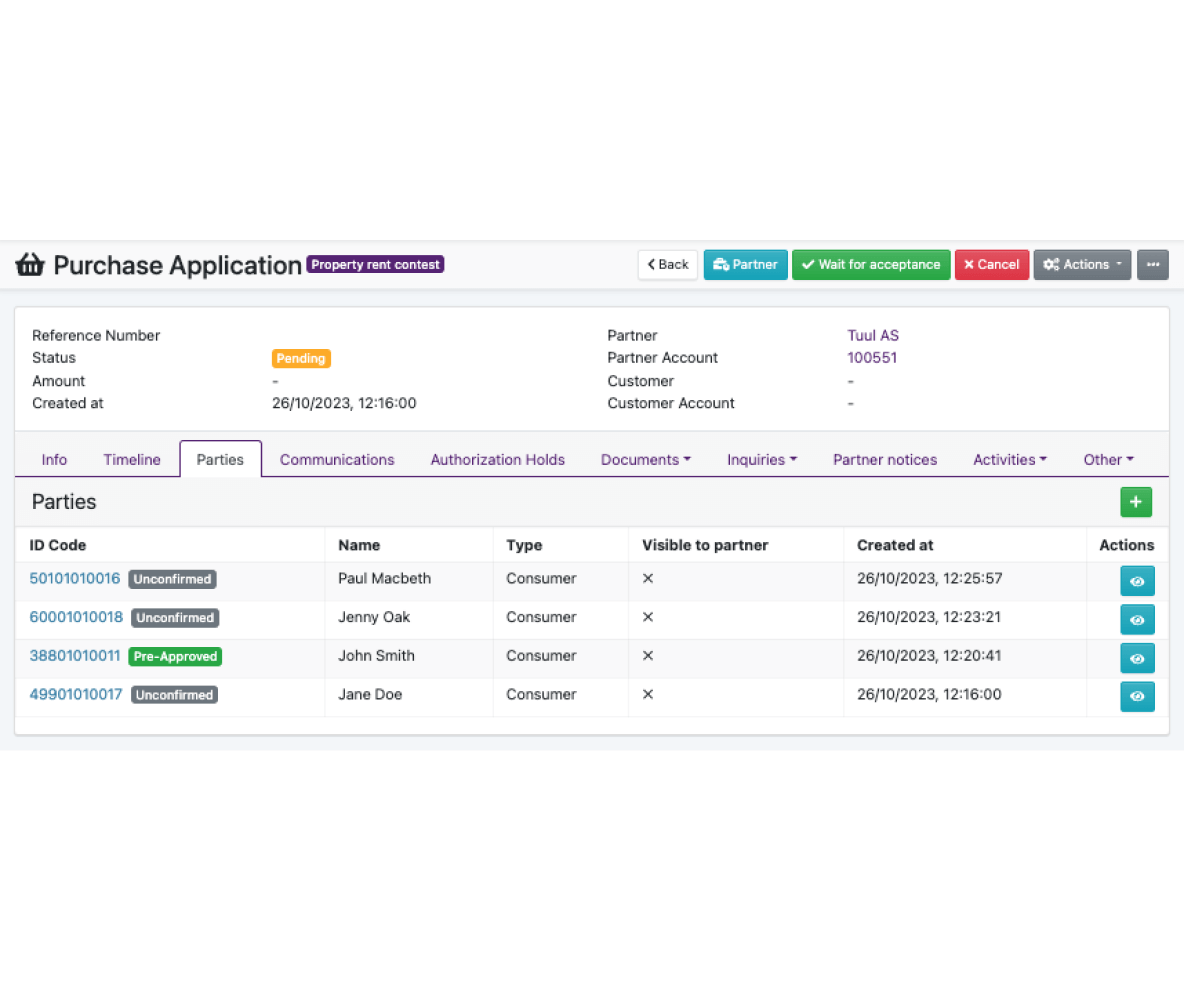

- Invoice factoring underwriting: Allow users to perform underwriting easily by setting specific risk thresholds and defining actions that should be taken when invoices or customers exceed these thresholds. Create approval workflows for underwriting decisions, allowing multiple levels of authorization based on the assessed risk and the specific rules in place.

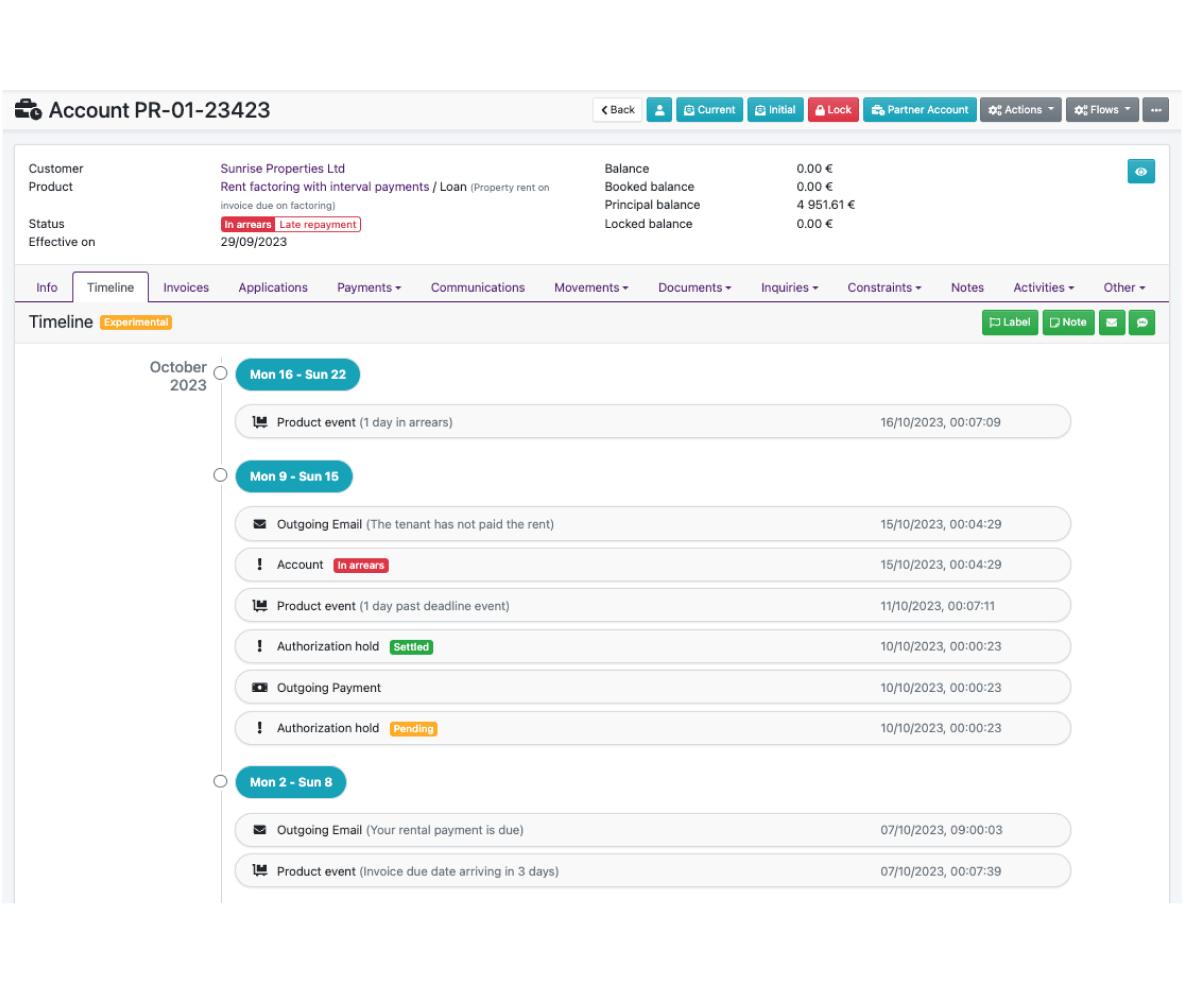

- Debt collection: Track and filter out overdue accounts, to take necessary actions, and record them in the system. Record payment promises and assign follow up actions. You can assign customer service teams or agents to manage specific accounts.

Payments, reports, and communications

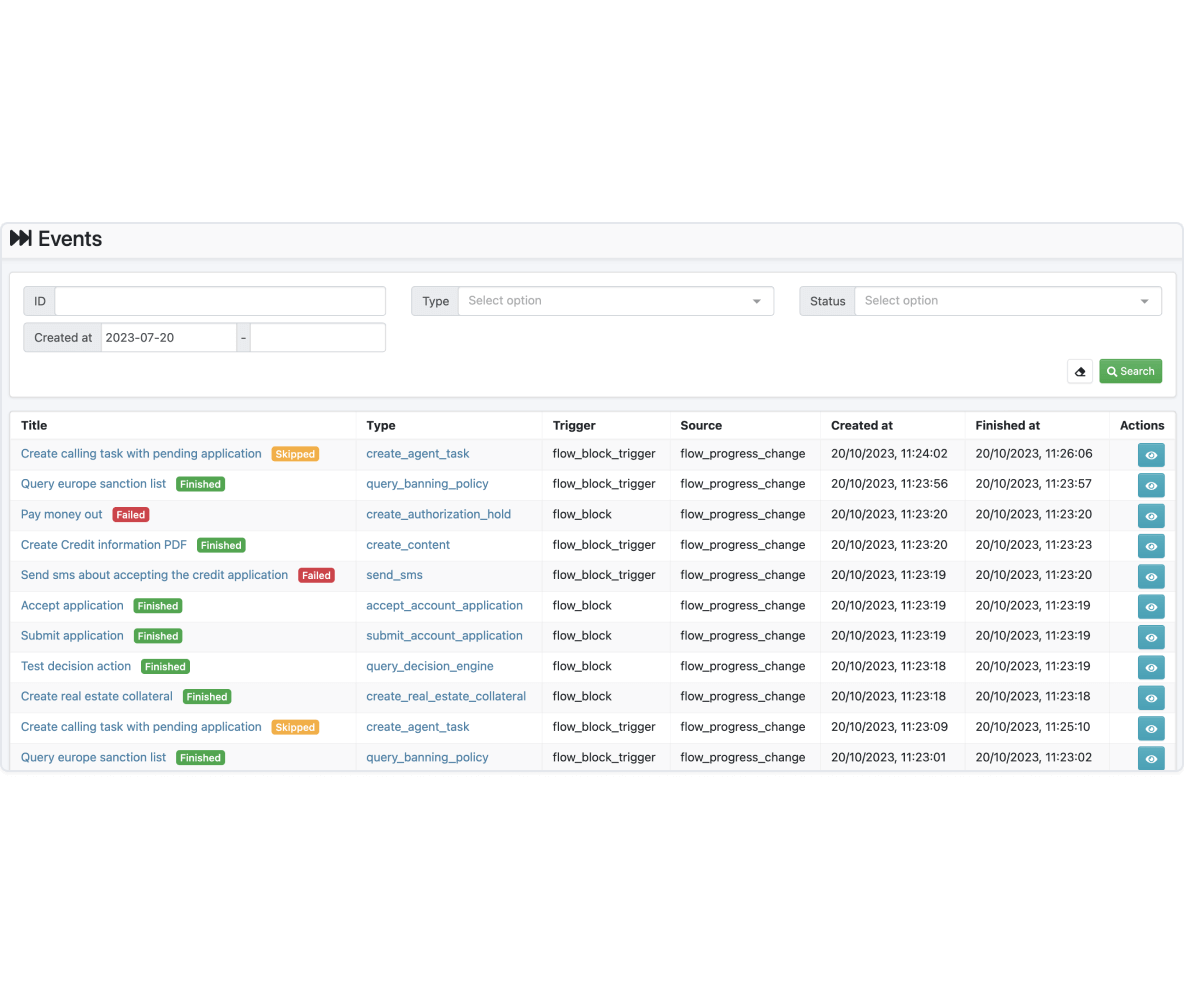

FTM's loan management software allows secure digital payments with flexible payment options in various currencies, real-time reporting with convenient data exporting options, and automated communications through SMS, email, Slack, WhatsApp, and more.

- Flexible payment options: Digital payments can be made with options like mobile money transfers and online payment gateways to streamline the factoring process, reduce administrative burden, and enhance customer satisfaction through secure and efficient payment methods.

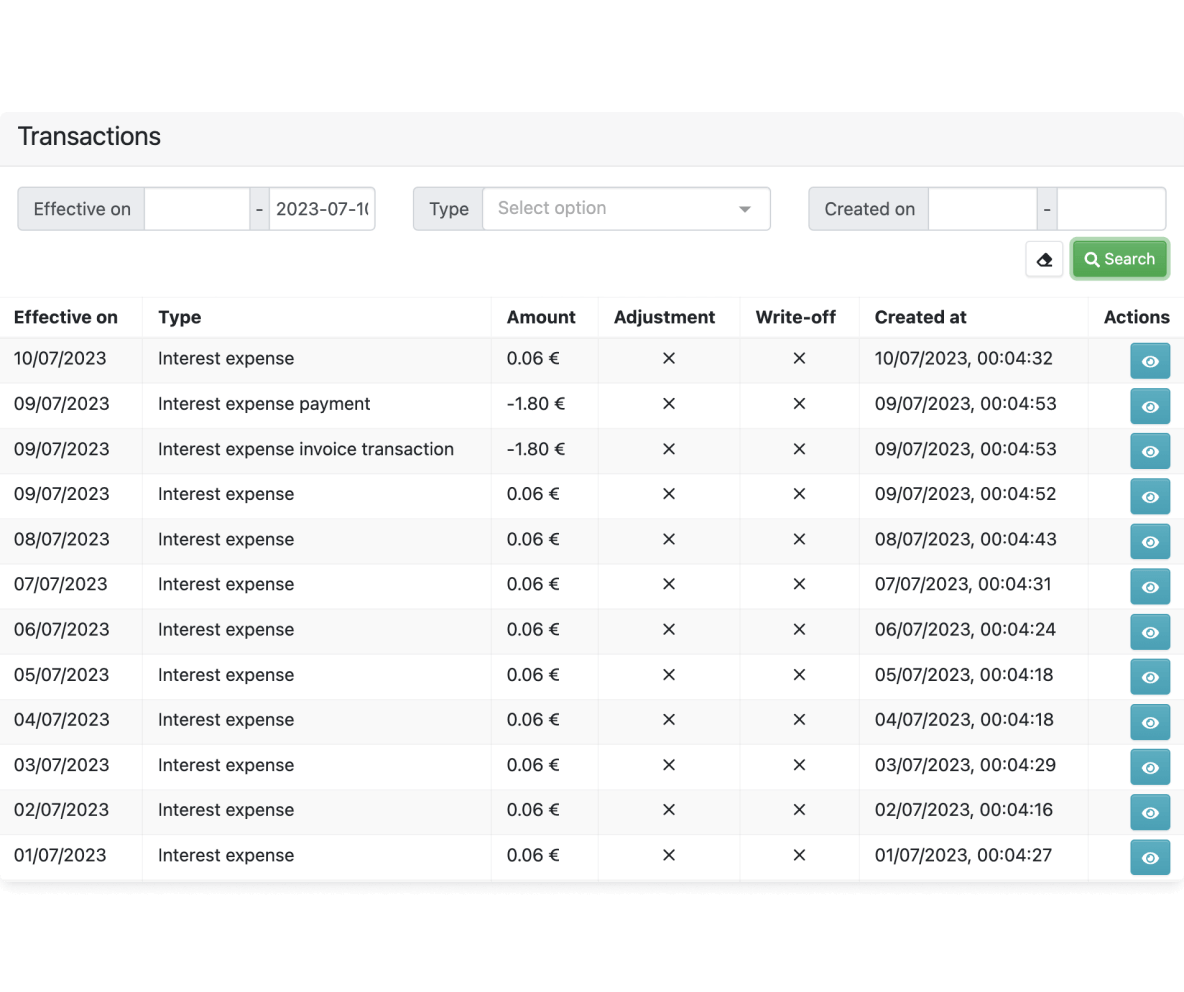

- Real-time reporting: Generate reports and statements, all designed to be easily exportable and print-friendly, including transaction reports for analysis and record-keeping of account activity, customer statements, and regulatory compliance reports that showcase adherence to industry standards. The status of the factored invoices, as well as the fees and charges associated with the factoring arrangement are also provided.

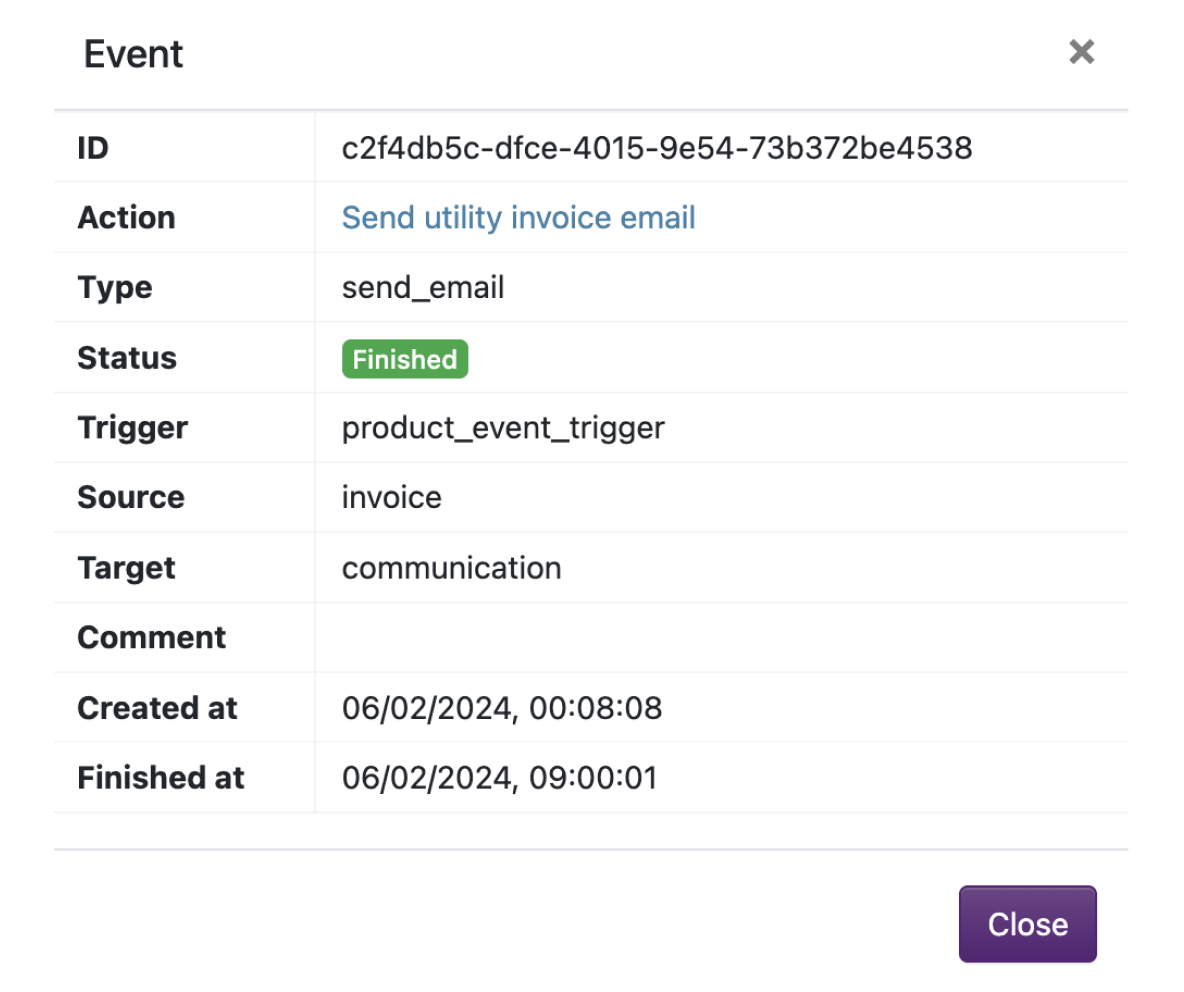

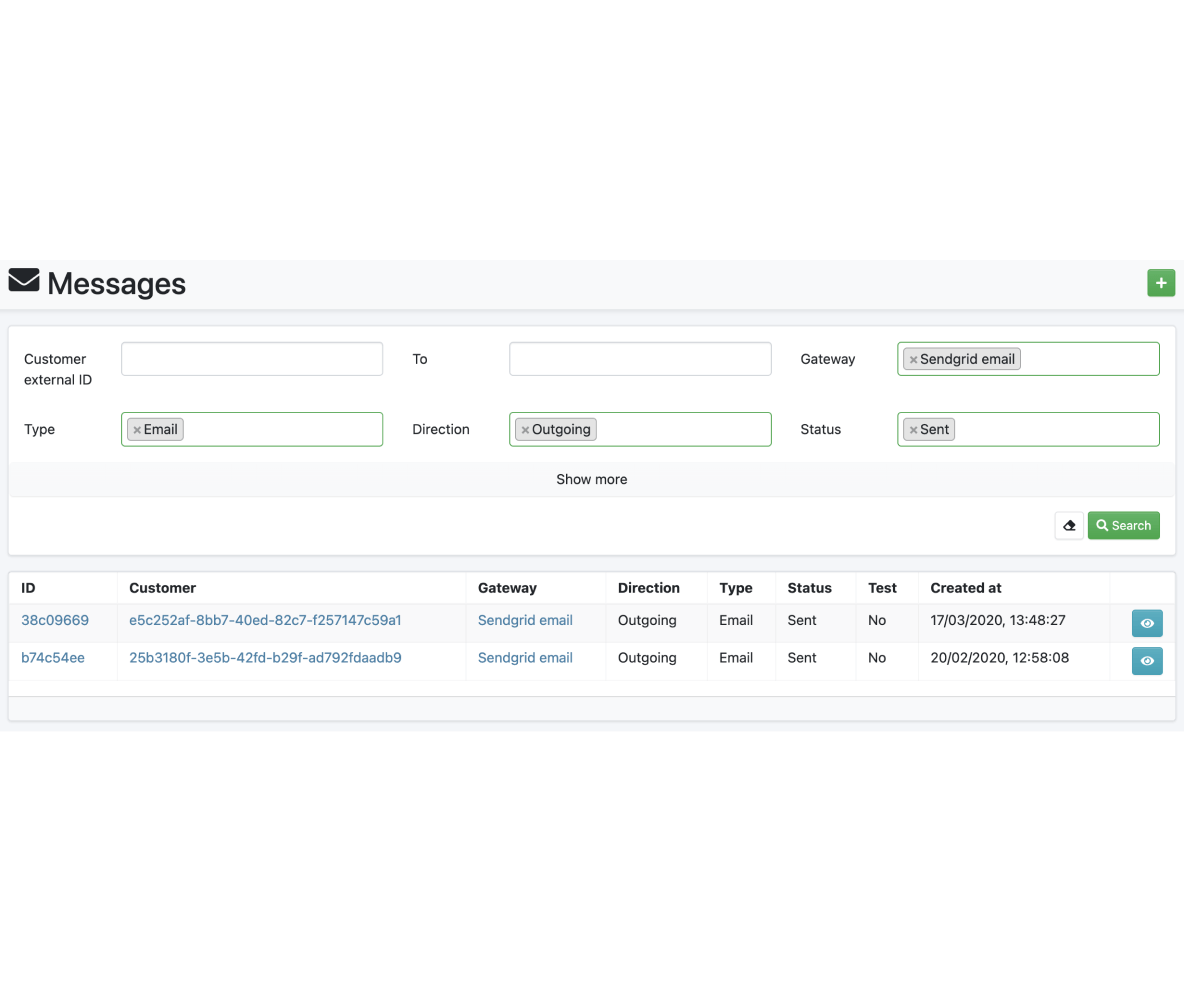

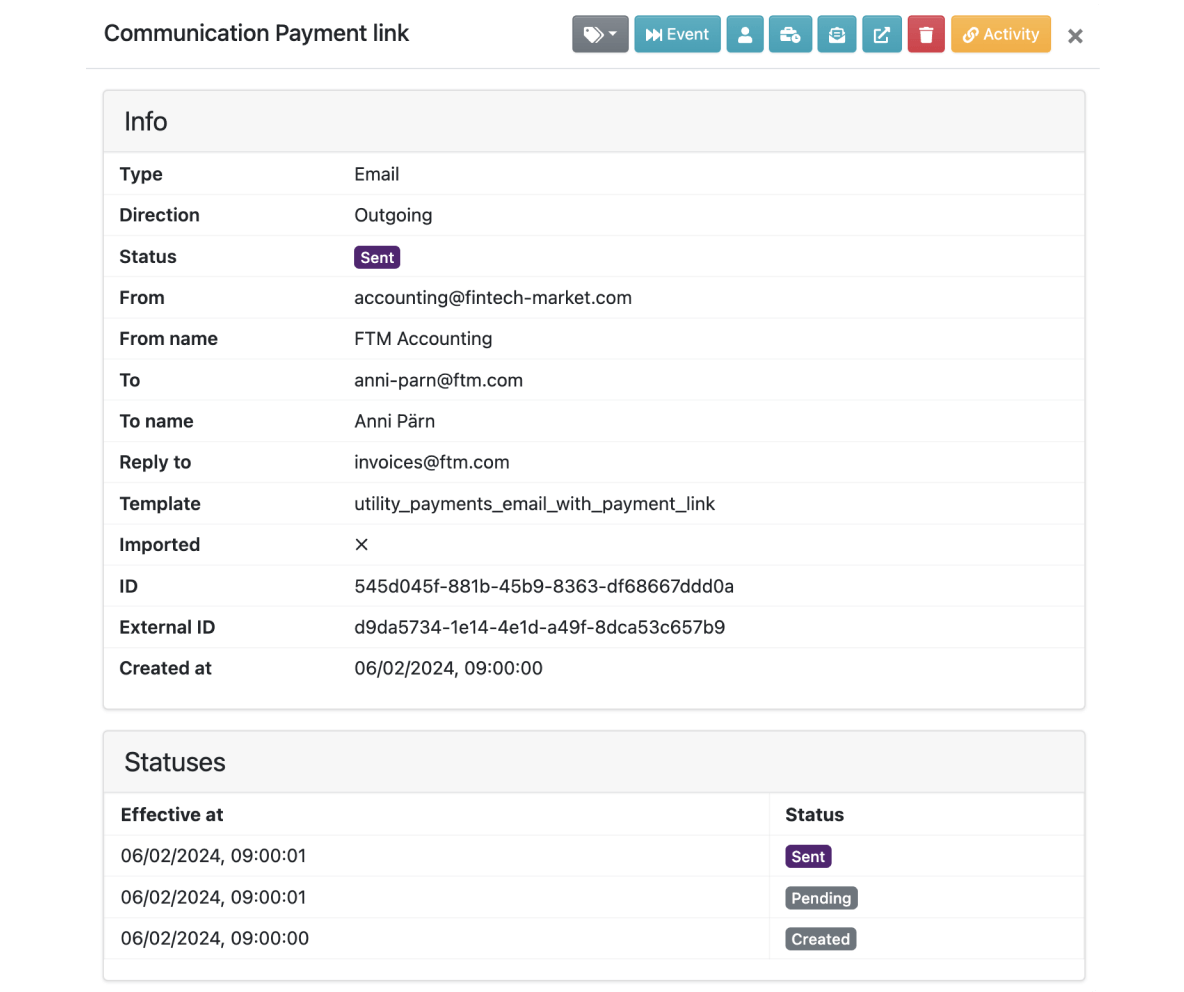

- Automated communications: Set preferences and create customer-oriented templates to automated messages, which can include SMS-s, email notifications, in-platform alerts, or integration with popular communication channels like Slack or WhatsApp, ensuring timely notifications and enhancing customer engagement.

Property rent factoring software

FTM property rent factoring software adapts to your unique business needs, offering diverse rent product customization, efficient property and tenant management, and automating the rent collection.

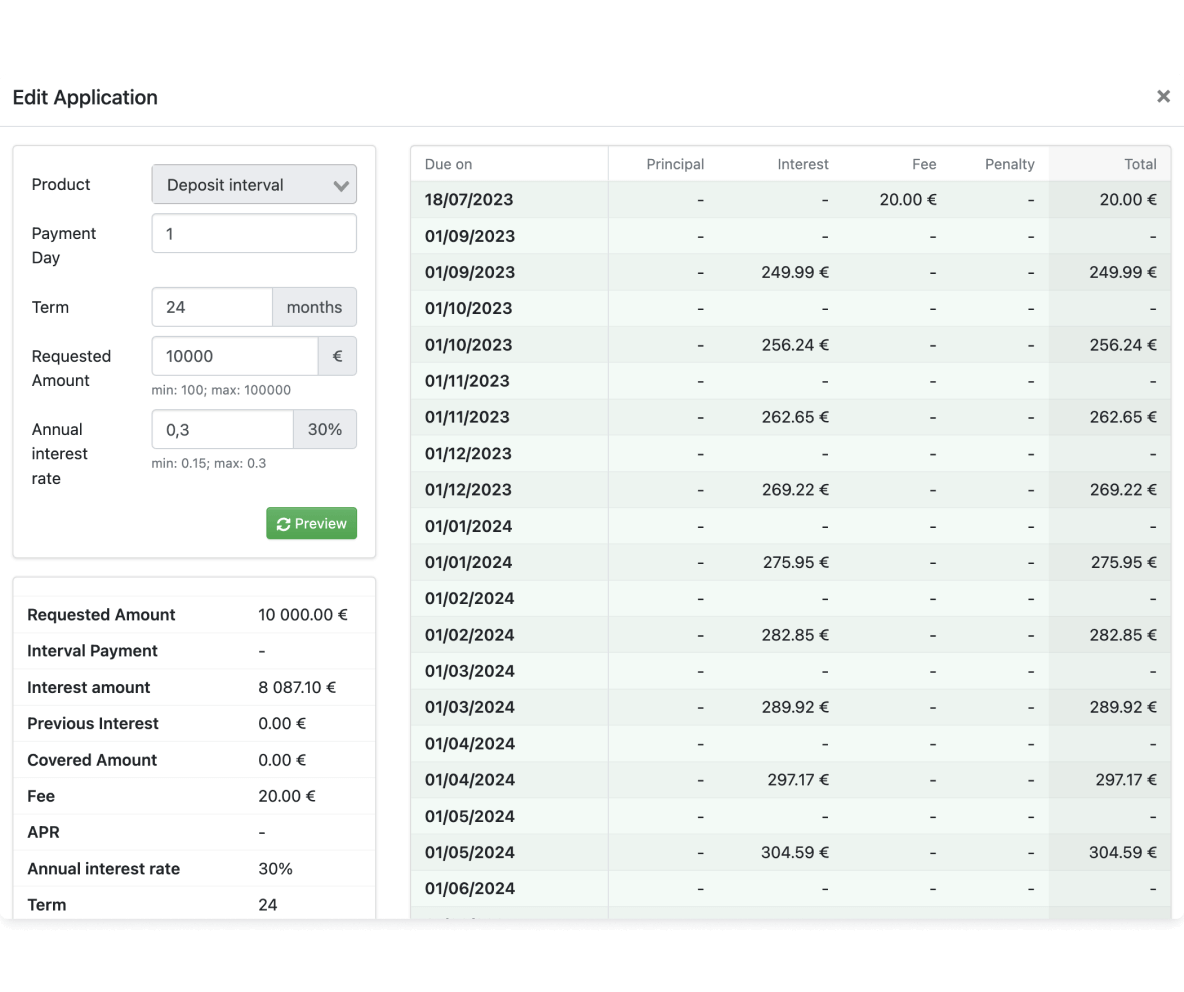

- Factoring product customization: FTM factoring product management simplifies defining and adjusting terms, rates, fees, and specific rent parameters to cater to diverse client requirements.

- Property management tools: Facilitate the upload of property related documents and provide an organized platform for managing both properties and tenants. Our automated system ensures efficiency and accuracy, saving you time and resources.

- Rent financing & collection: Integrate rent financing options and ensure efficient automated rent collection processes. With FTM factoring software you can offer landlords to receive rental income either upfront or on the invoice due date.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.