E-wallet software

Offer an e-wallet product that supports multicurrency management, and flexible payment settings, with efficient customer management features.

FTM e-wallet software

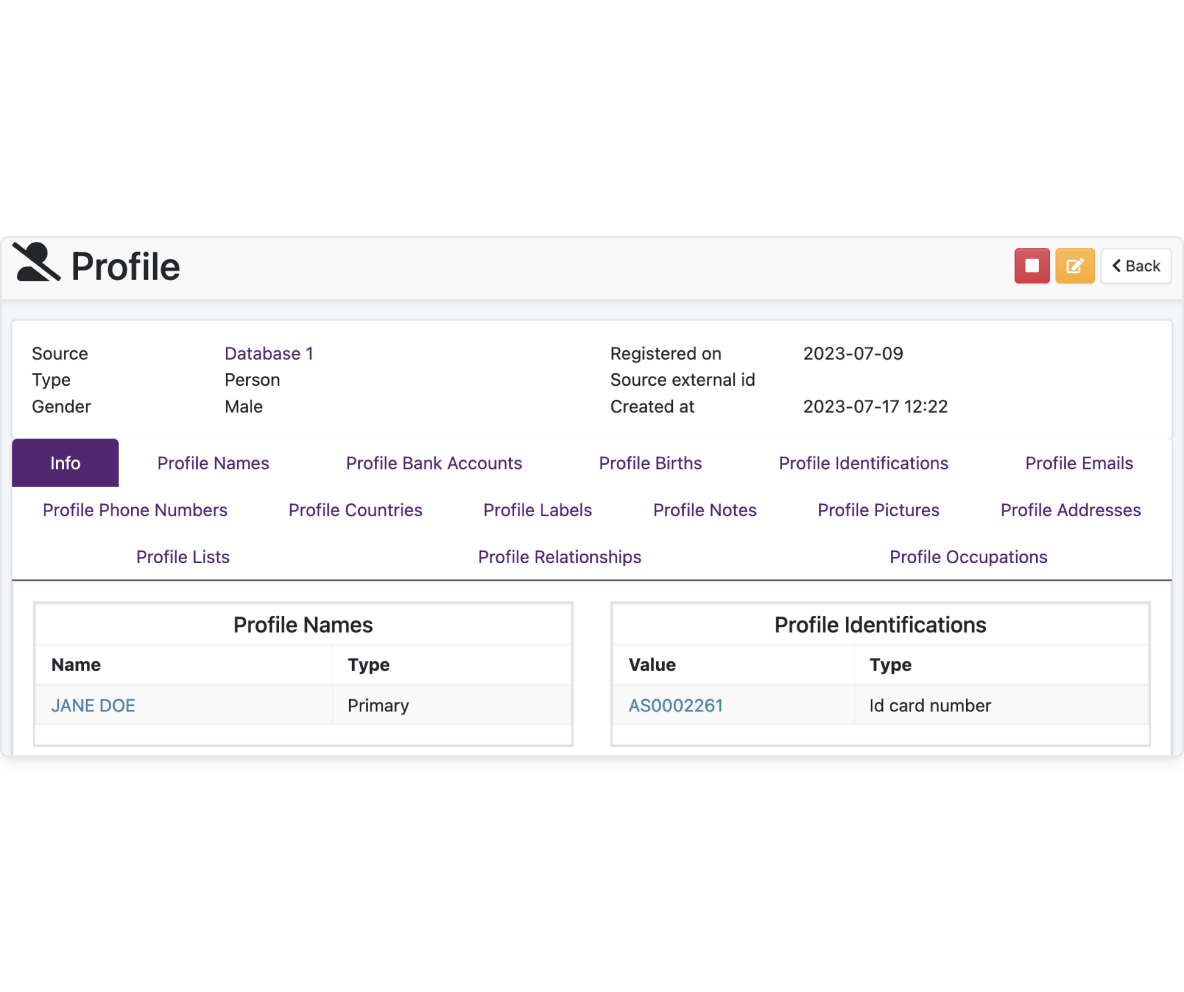

Fintech Market’s e-wallet software provides financial institutions with a secure and customizable platform. With our solution, businesses can optimize their operations, ensure compliance, and provide a seamless experience for customers. With customizable options and dedicated customer support, we help financial institutions drive growth and enhance customer satisfaction in today's evolving financial landscape.

Payment and transaction management

Discover FTM software for payment management for digital wallets, supporting a wide range of payment methods and currencies.

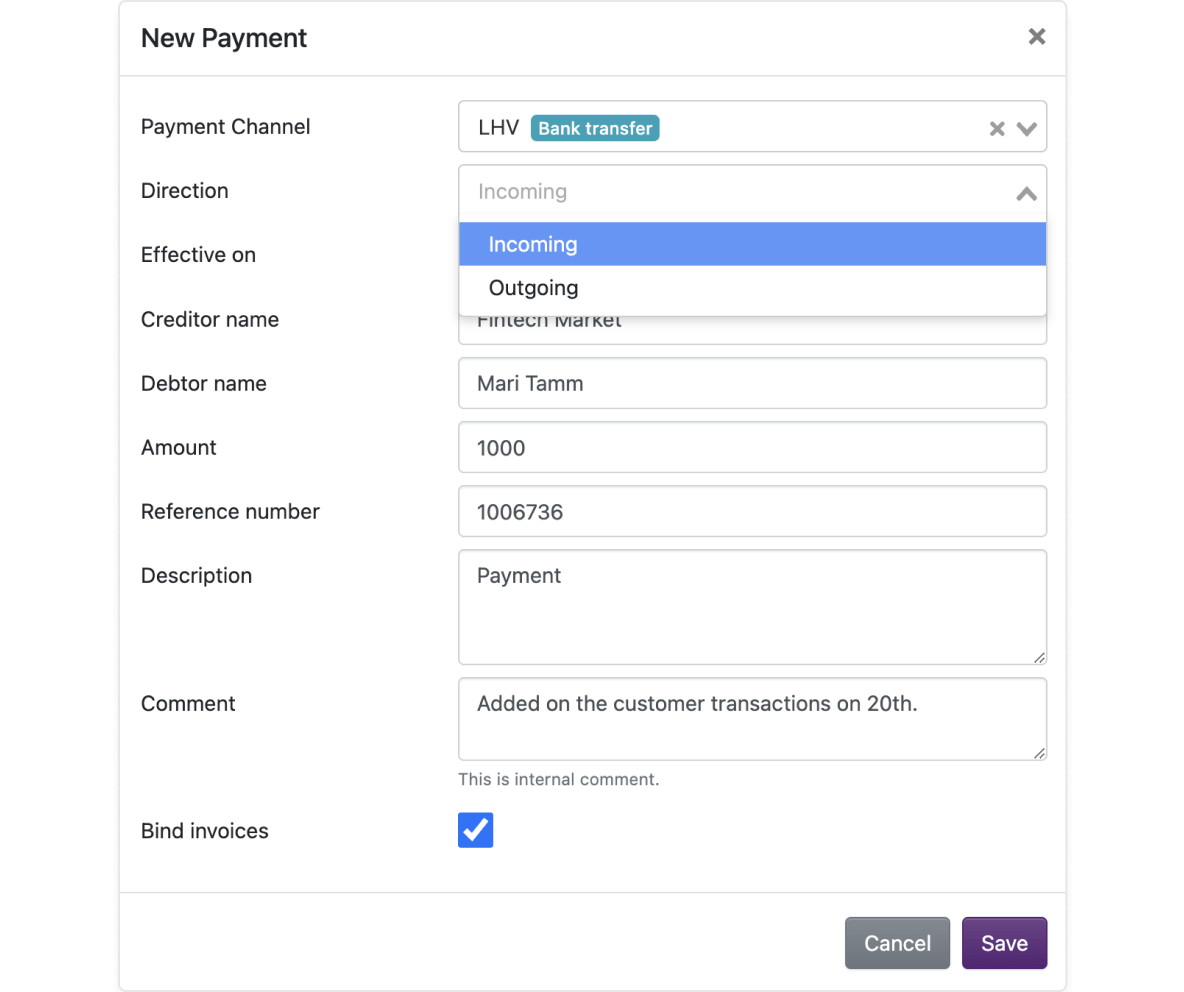

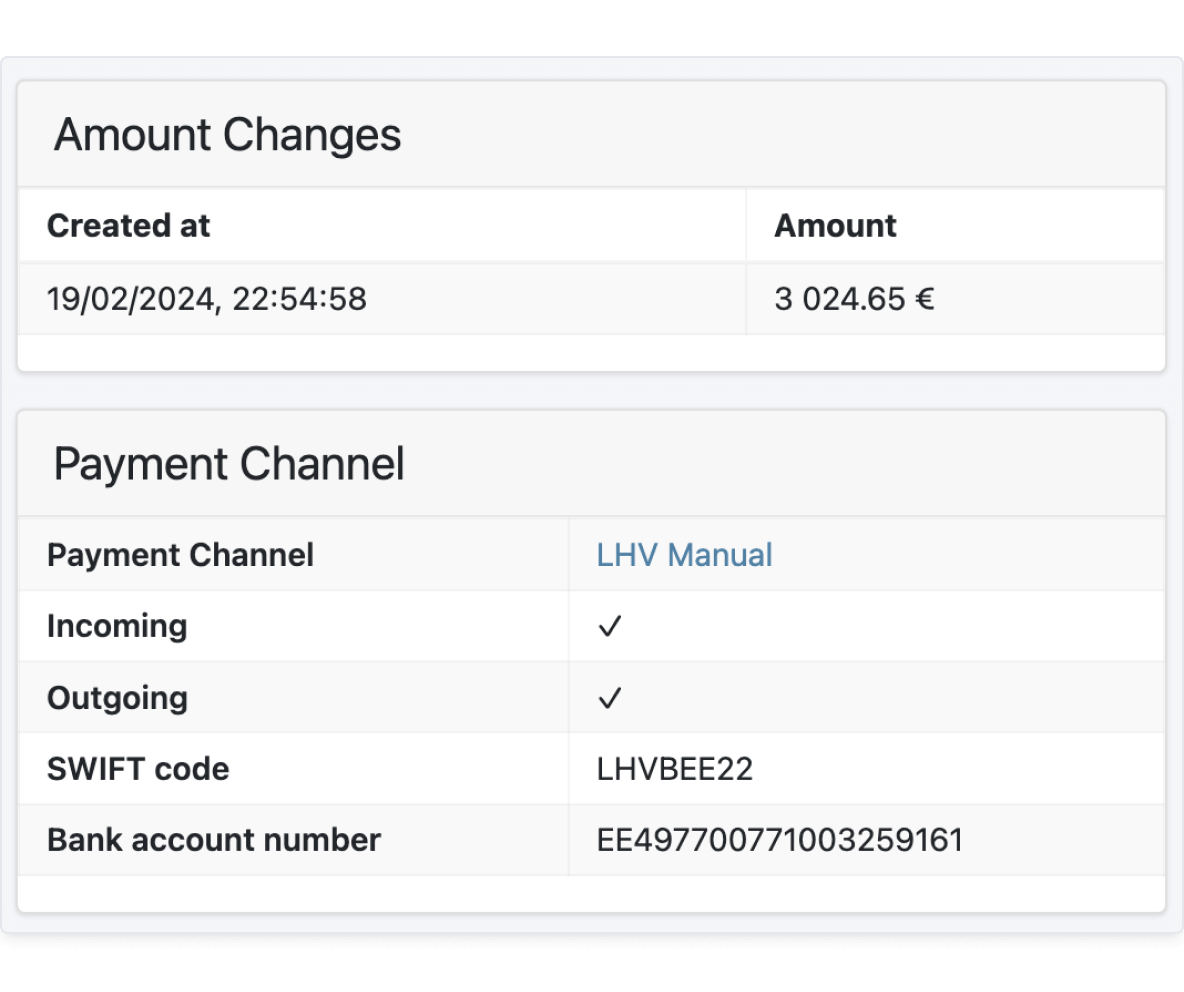

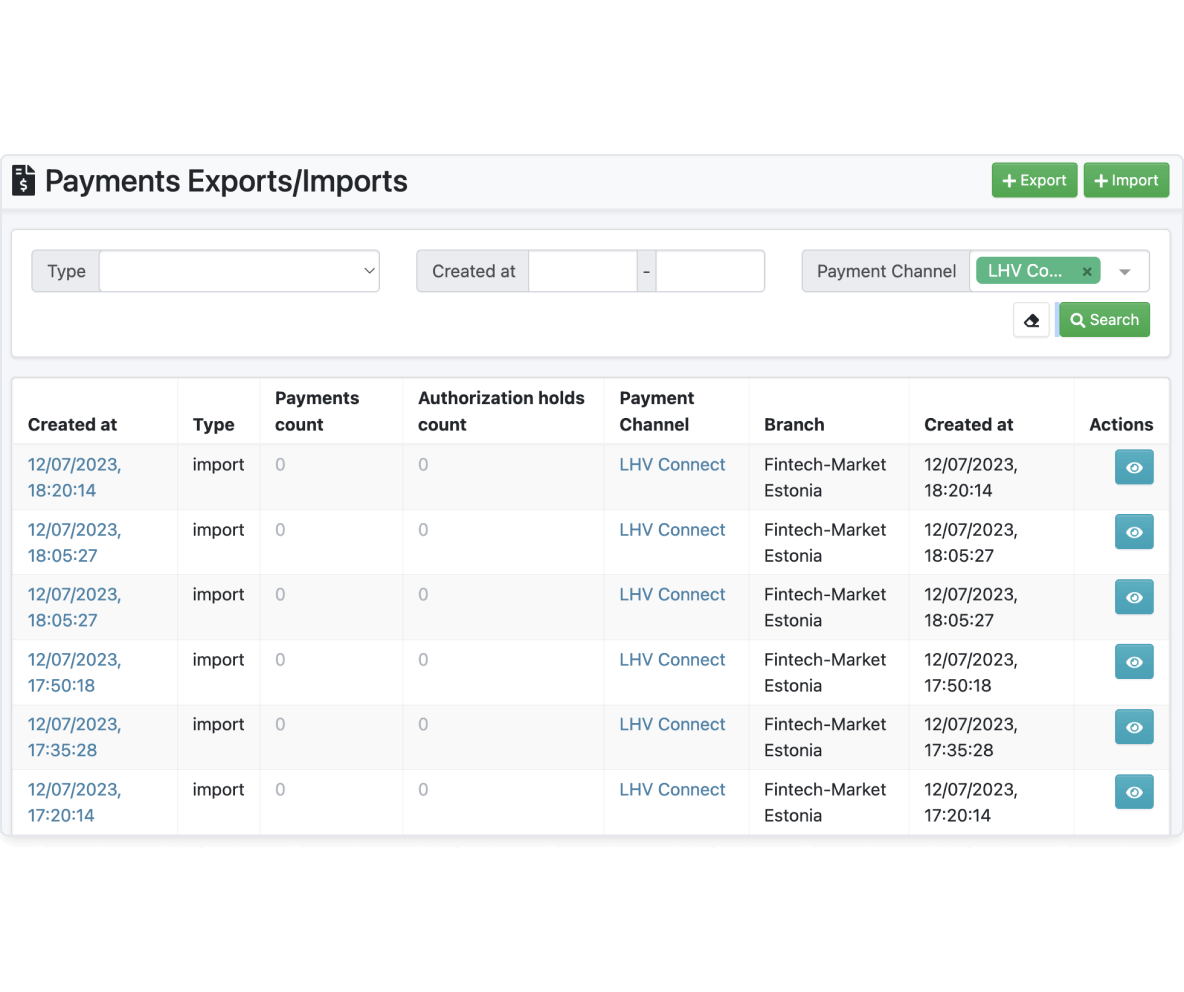

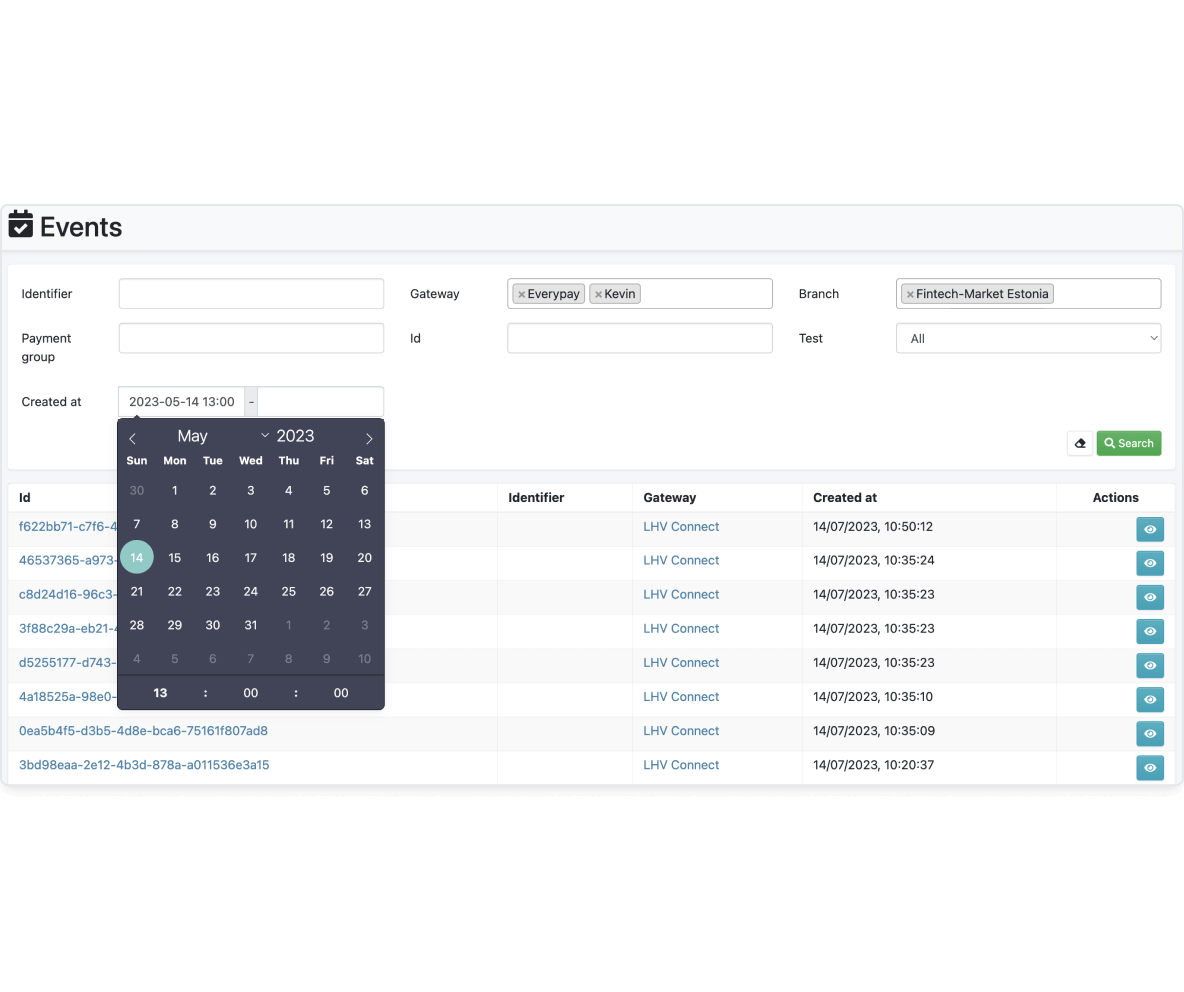

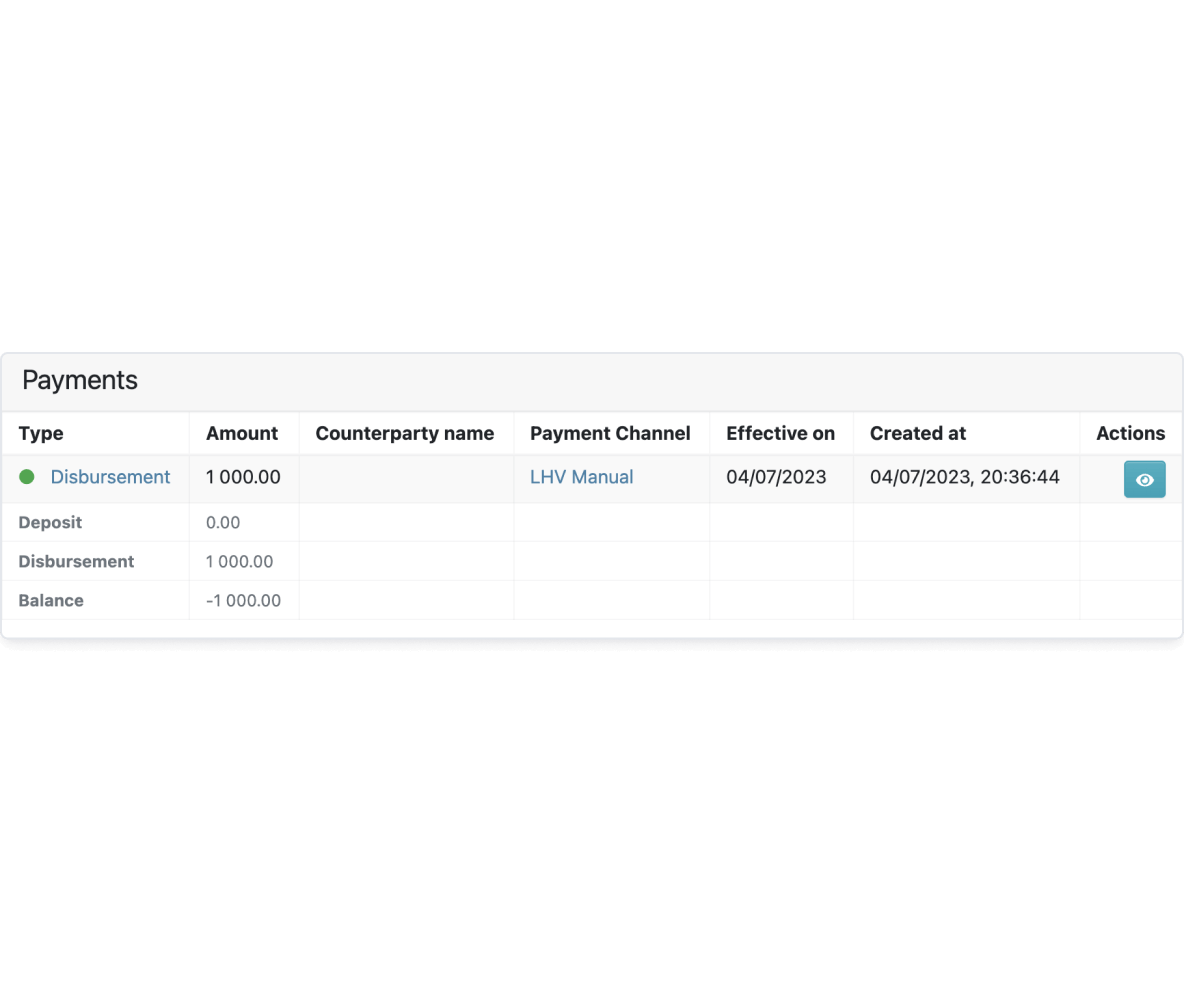

- Payment methods: Enable a variety of payment methods for incoming, outgoing, and internal transactions. FTM loan management software supports API requests, importing/exporting payment files, payment links, and manual payment creation, providing flexibility and convenience for your users.

- Multicurrency support: Fintech Market e-wallet software facilitates transactions in multiple currencies, allowing for seamless conversion and management of funds across borders. Expand your global reach and cater to diverse customer needs.

- Transaction management: Manage transactions within the FTM e-wallet platform with functionalities like real-time transaction tracking, reconciliation, and reporting features, ensuring transparency and simplifying financial oversight.

Security and compliance

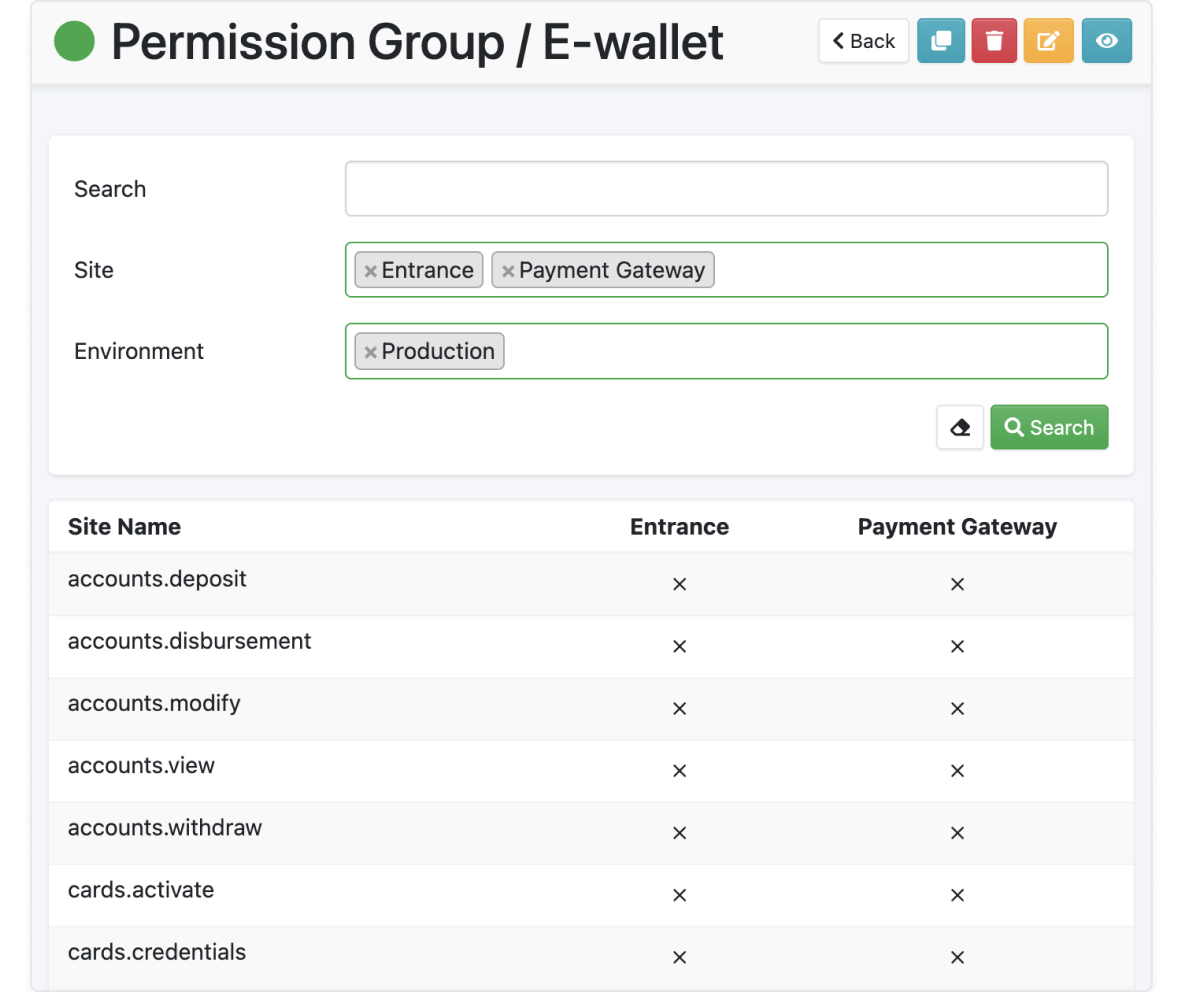

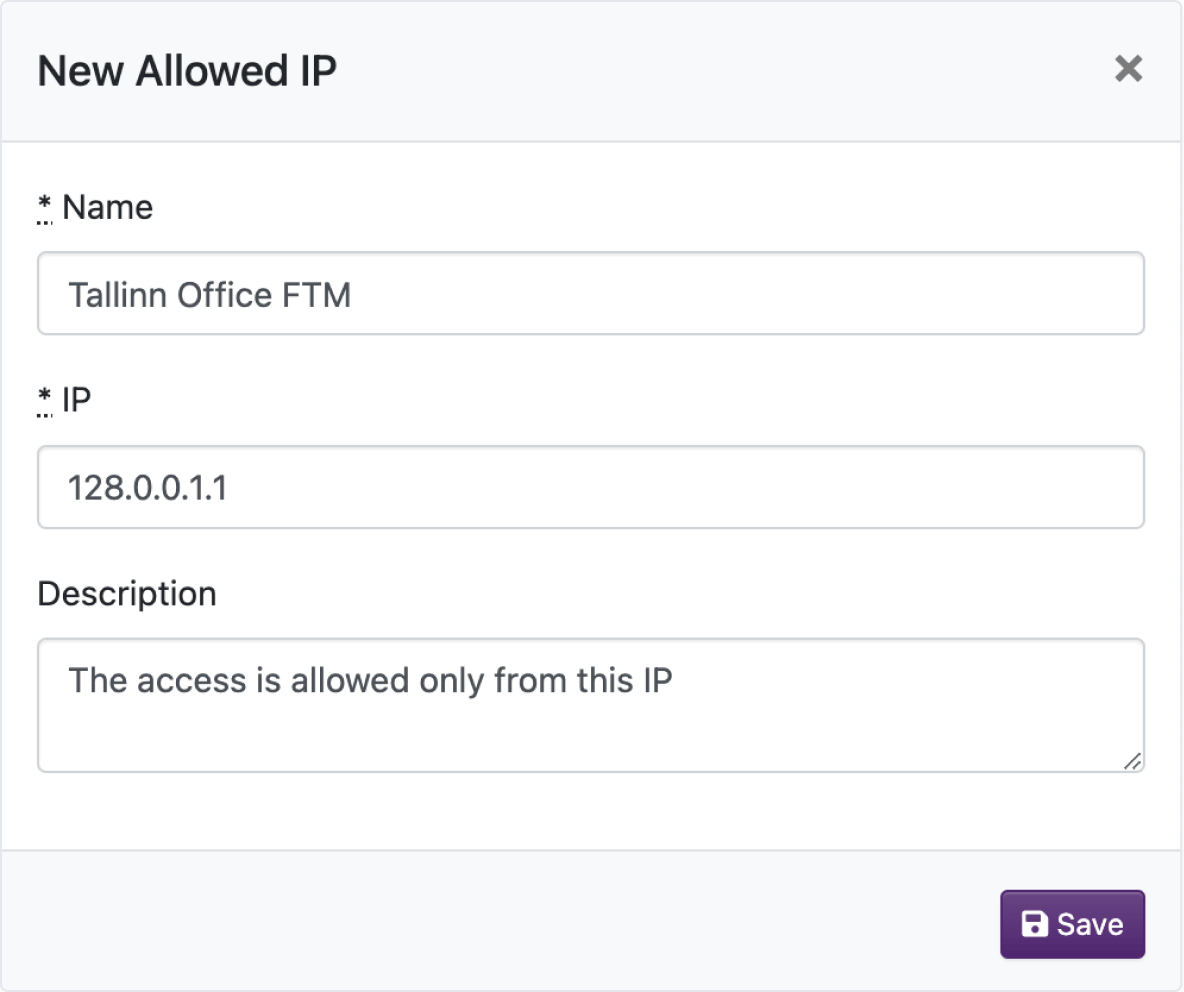

Ensure the security and compliance of your financial institution's e-wallet platform through encryption, secure data storage, authentication, and adherence to industry regulations and standards.

- Multi-factor authentication: Strengthen security with multi-factor authentication, ensuring authorized access to the e-wallet platform.

- Encryption and secure data storage: Protect sensitive customer data through encryption protocols and fortified data storage, preventing unauthorized access and breaches.

- KYC integrations: Integrate with trusted providers for digital signing, payment gateways, and fraud detection systems, streamlining document workflows and enhancing security.

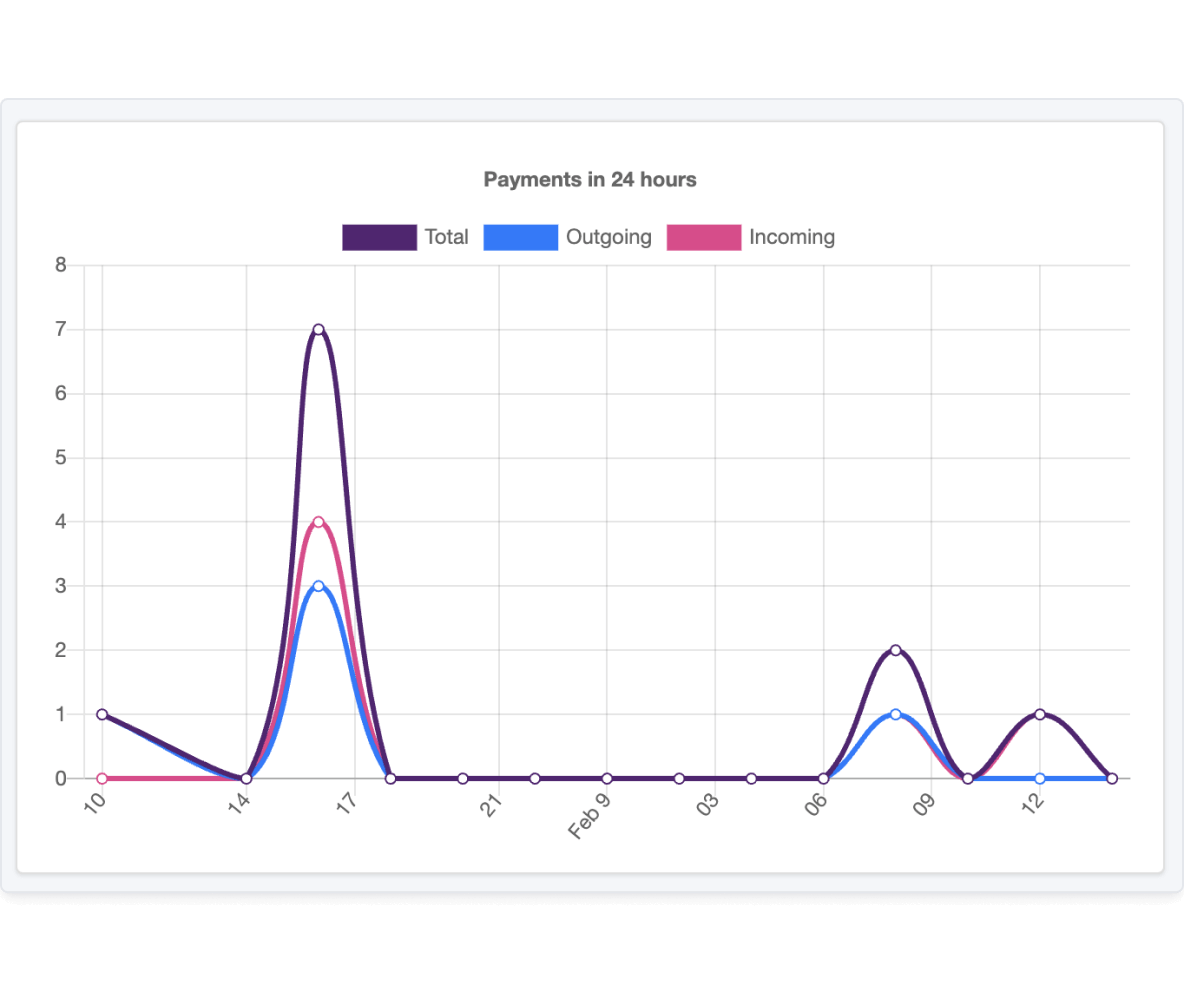

Analytics and monitoring

Gain comprehensive insights with analytics and reporting features, as well as transaction monitoring and fraud prevention tools.

- Detailed analytics and actionable insights: Access comprehensive analytics to gain insights into transaction data, customer behavior, and spending patterns. Make informed business decisions and optimize marketing strategies for growth.

- Performance tracking and scalability: Track key performance metrics such as transaction volumes, user engagement, and revenue streams. Our platform is designed for scalability, ensuring a seamless experience even during peak periods. Regular performance monitoring and optimization guarantee high-quality service.

- Transaction monitoring and compliance: Detect and mitigate suspicious activities to protect your institution and customers from fraud. Stay compliant with industry regulations, including KYC and AML, through our monitoring tools.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.