Consumer lending software

Discover FTM's Consumer lending software - comprehensive and user-friendly platform for managing short-term personal loans.

FTM consumer lending software

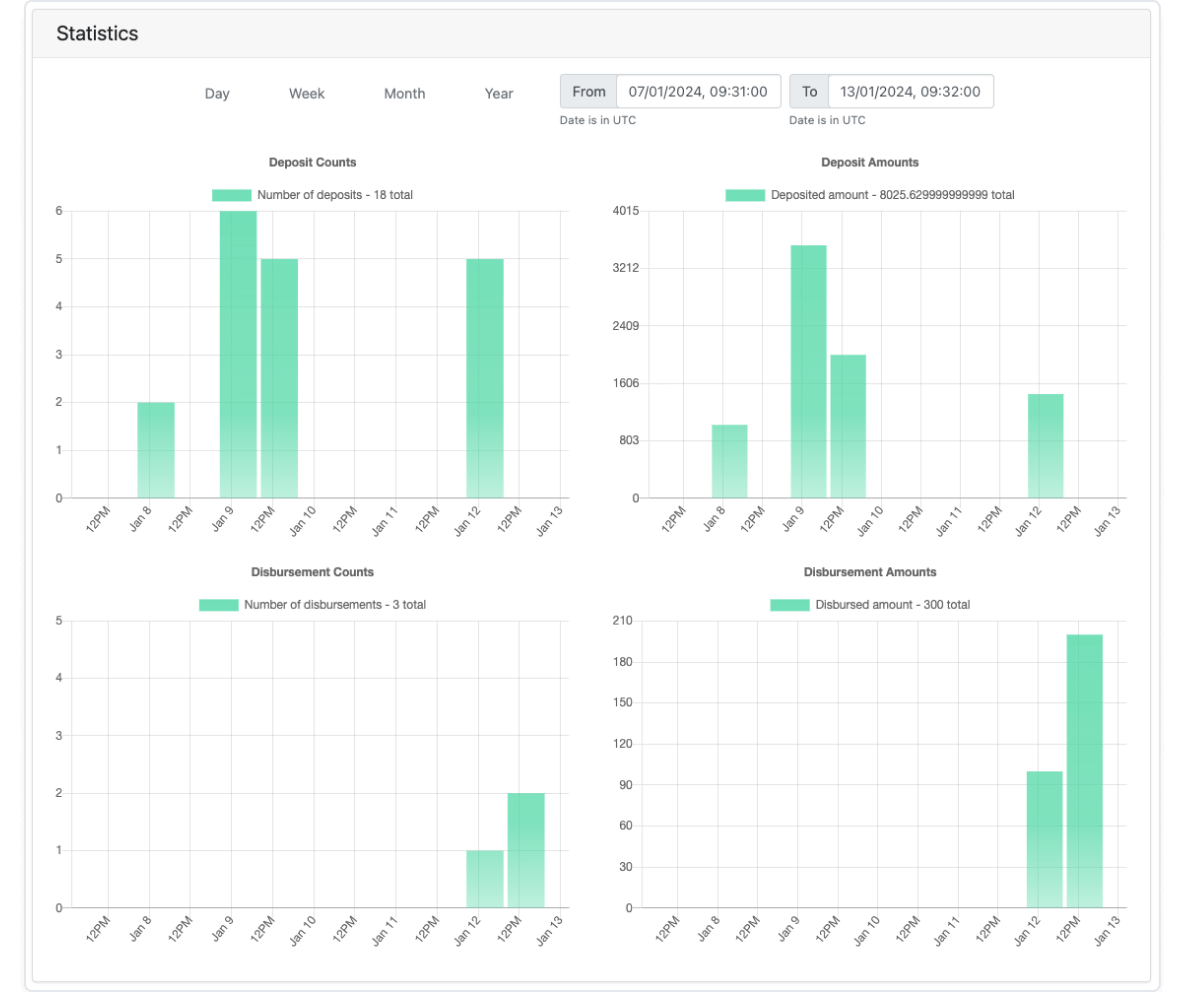

FTM's consumer lending system is designed to help financial institutions and lenders provide small-scale loans and other financial products to individuals and businesses who lack access to traditional banking services. The loan management system includes analytics and reporting tools to help you track the performance of your inclusive finance business.

Customizable product

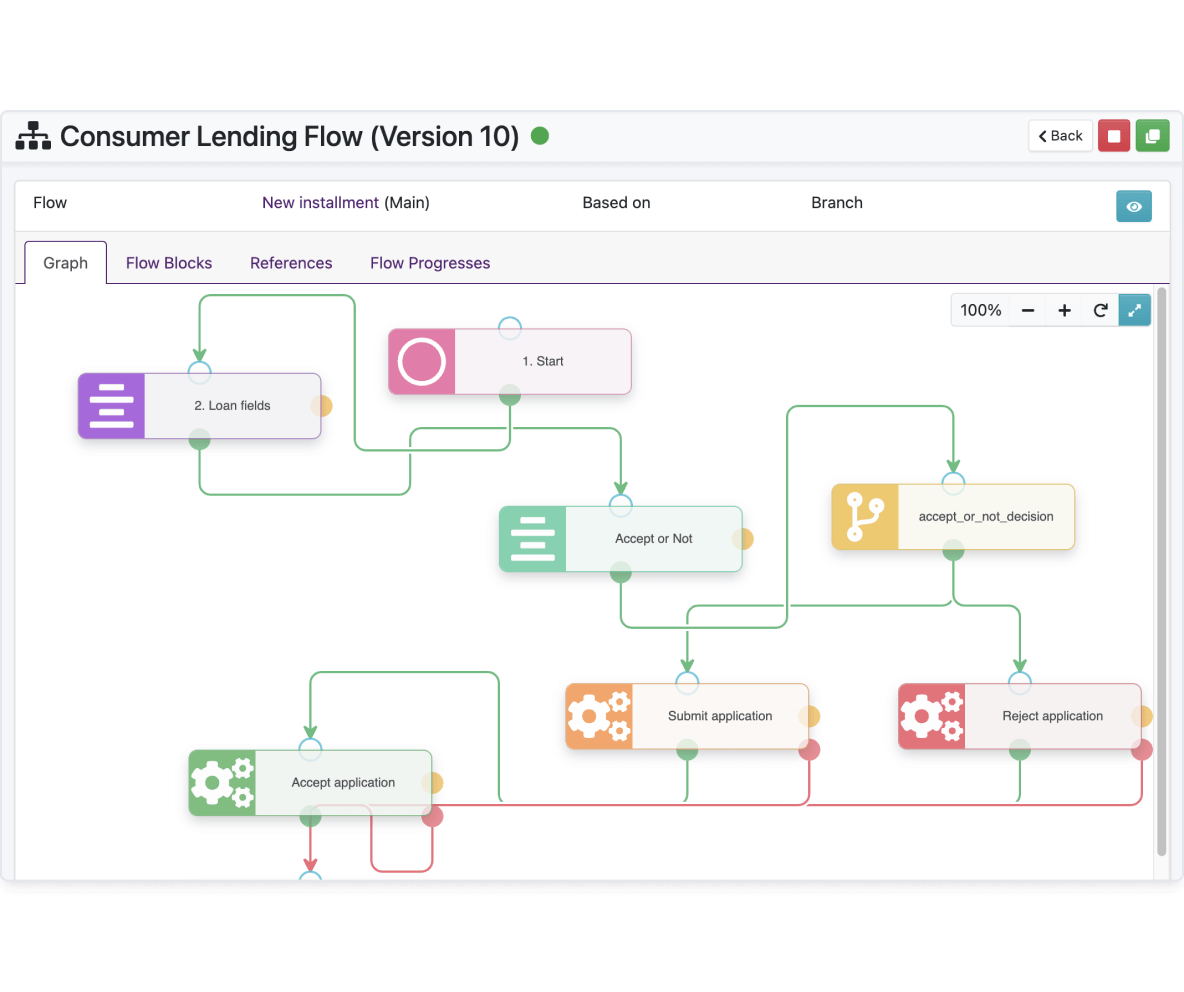

Empower your business by setting up alternative financial products tailored to the needs of underserved customers, promoting financial inclusion, and mitigating high-risk profiles. The platform excels in managing consumer loan products and simplifying the loan origination process.

- Tailored financial solutions: Our loan management platform enables institutions to create customized financial products, catering to specific demographics such as women entrepreneurs, rural communities, or small-scale farmers. This allows you to address their unique financial needs and build processes accordingly. It allows you to manage a diverse range of products, including unsecured and secured loans.

- Adaptive product configurations: Stay competitive in the evolving finance landscape by incorporating new compliance standards and adjusting loan features with our flexible configuration options that include setting ranges to available loan amount, term, and interest rate, and adding collateral.

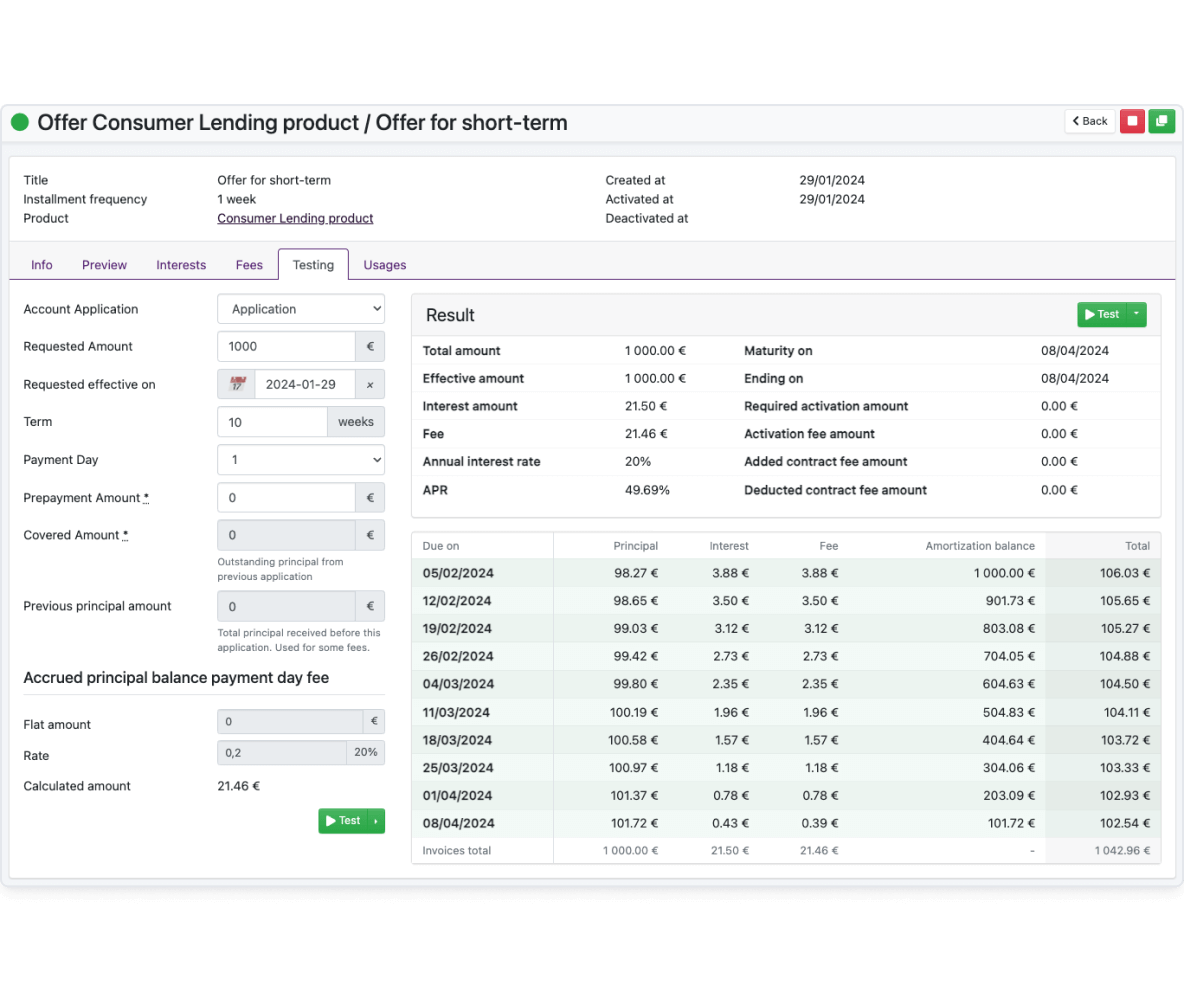

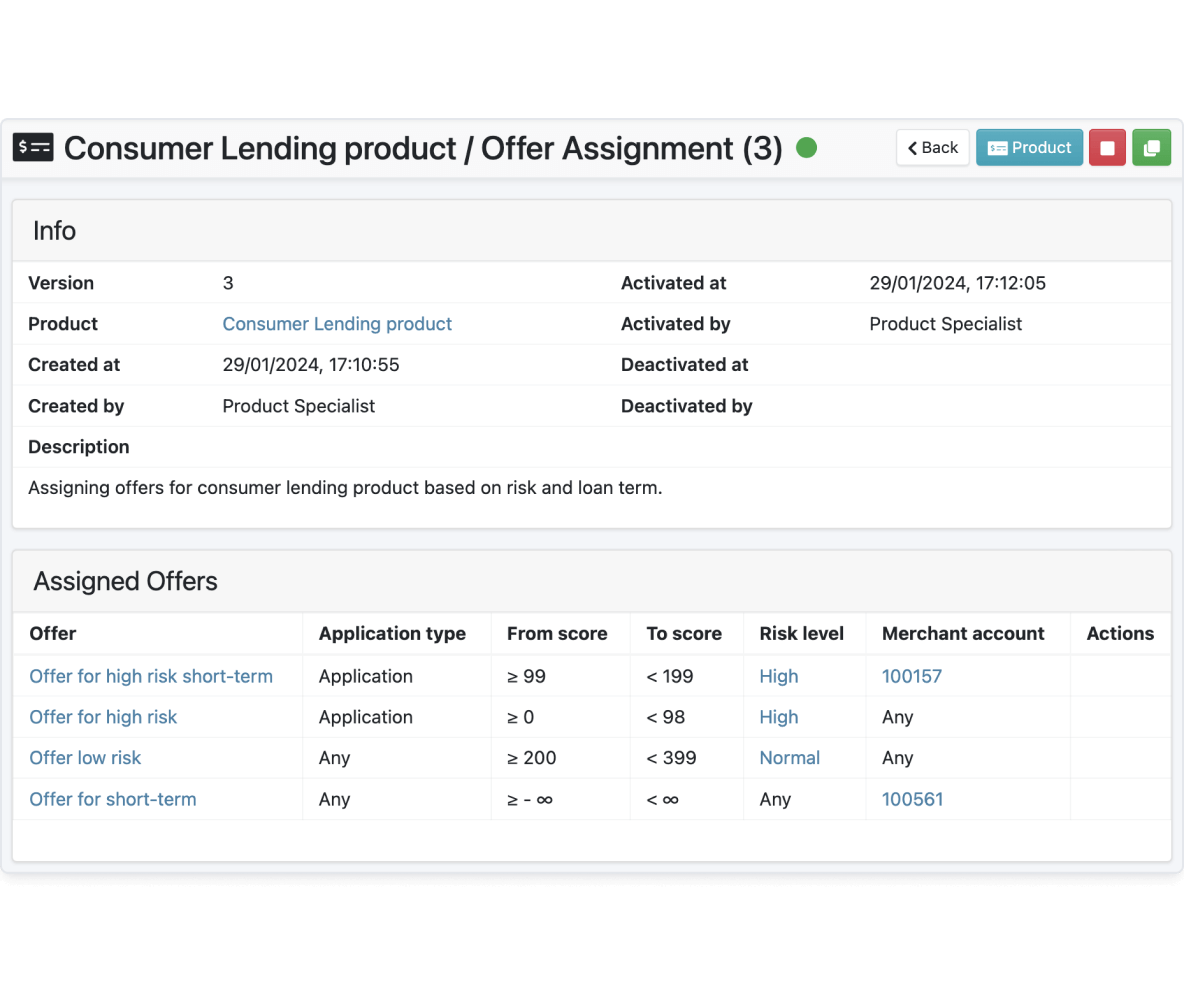

- Personalized product offers: Our FTM loan management system enables to personalize loan terms, such as loan amounts, repayment schedules, interest rates, and grace periods to accommodate the financial situations and needs of borrowers based on individual client profiles and risk assessments. This level of customization enhances client satisfaction and improves the likelihood of successful loan repayment and expedites the customer onboarding process.

Risk evaluation and mitigation

By leveraging our comprehensive risk evaluation and mitigation features, you can optimize risk management practices and ensure the financial stability of your inclusive finance operations.

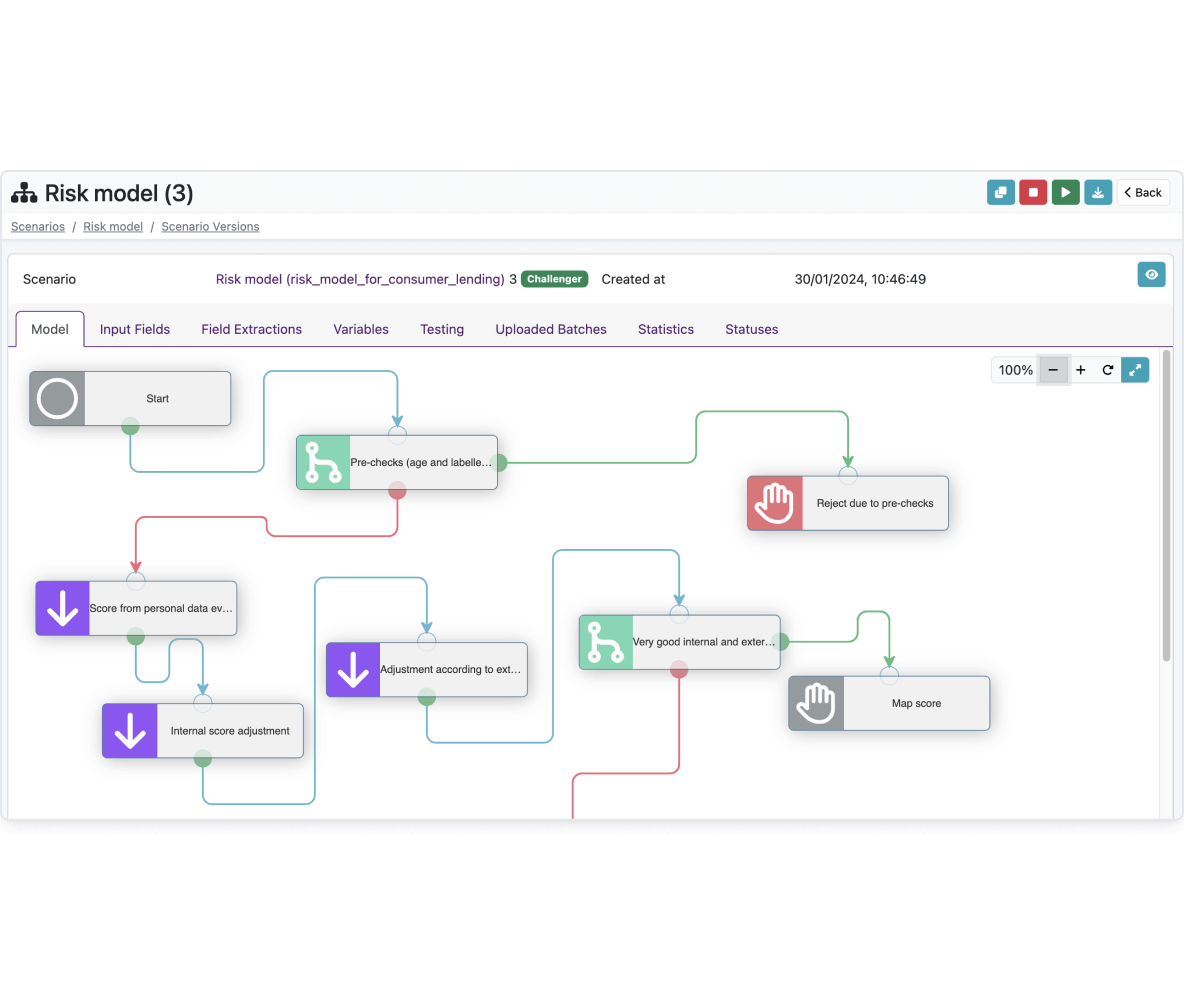

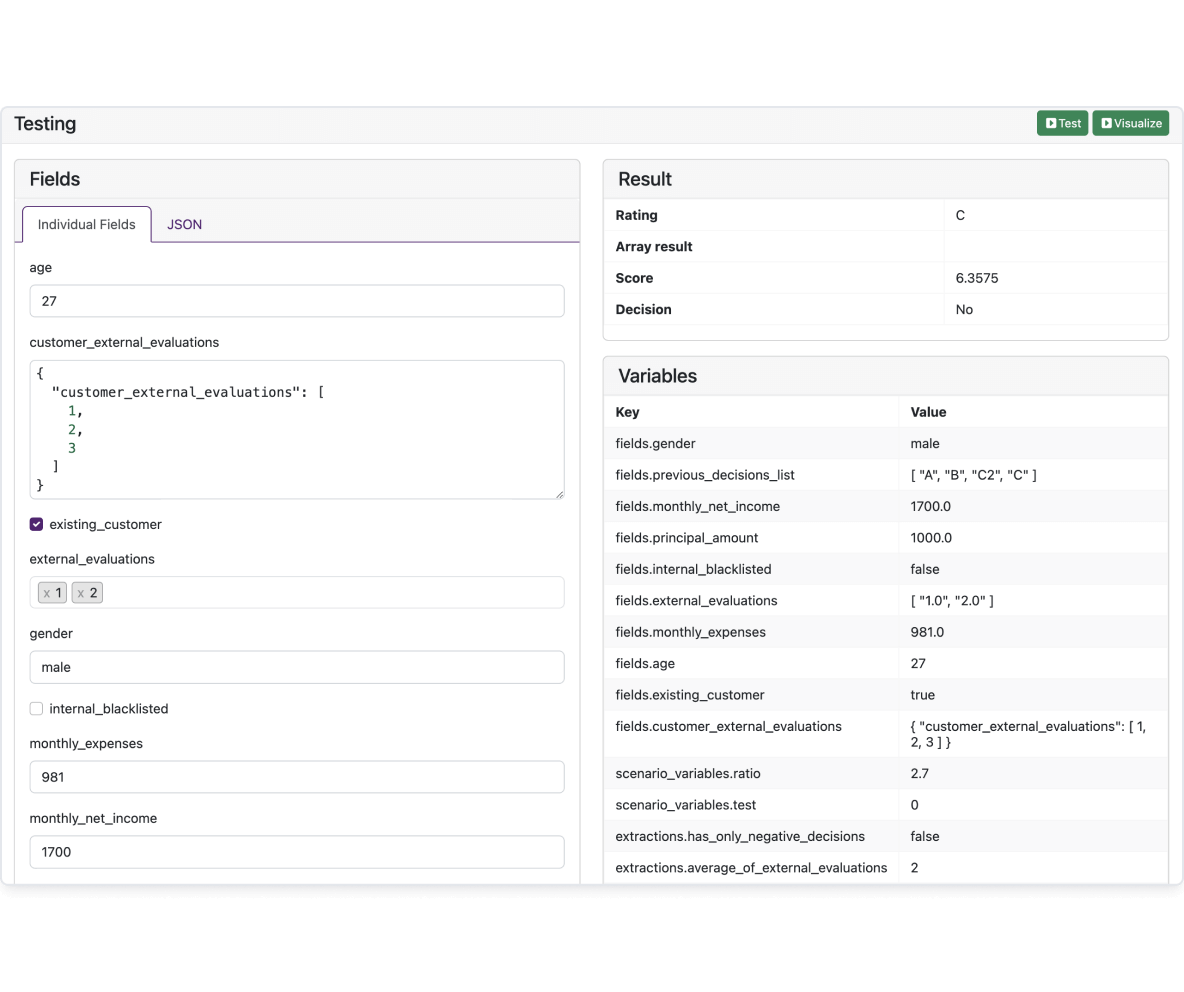

- Comprehensive risk assessment: Our consumer lending platform includes a robust risk evaluation framework, allowing you to assess the creditworthiness of borrowers, estimate repayment capacity, and analyze potential risks associated with each loan. This comprehensive risk assessment process enables you to make informed lending decisions and mitigate the probability of defaults.

- Real-time risk monitoring: With our solution's real-time monitoring capabilities, you can proactively identify and address emerging risks promptly. Customizable risk indicators and alerts such as status updates, labels, and automated reactions triggered by specific events enable you to detect delinquencies, the concentration of risk, or other relevant factors, facilitating timely interventions to manage potential risks effectively.

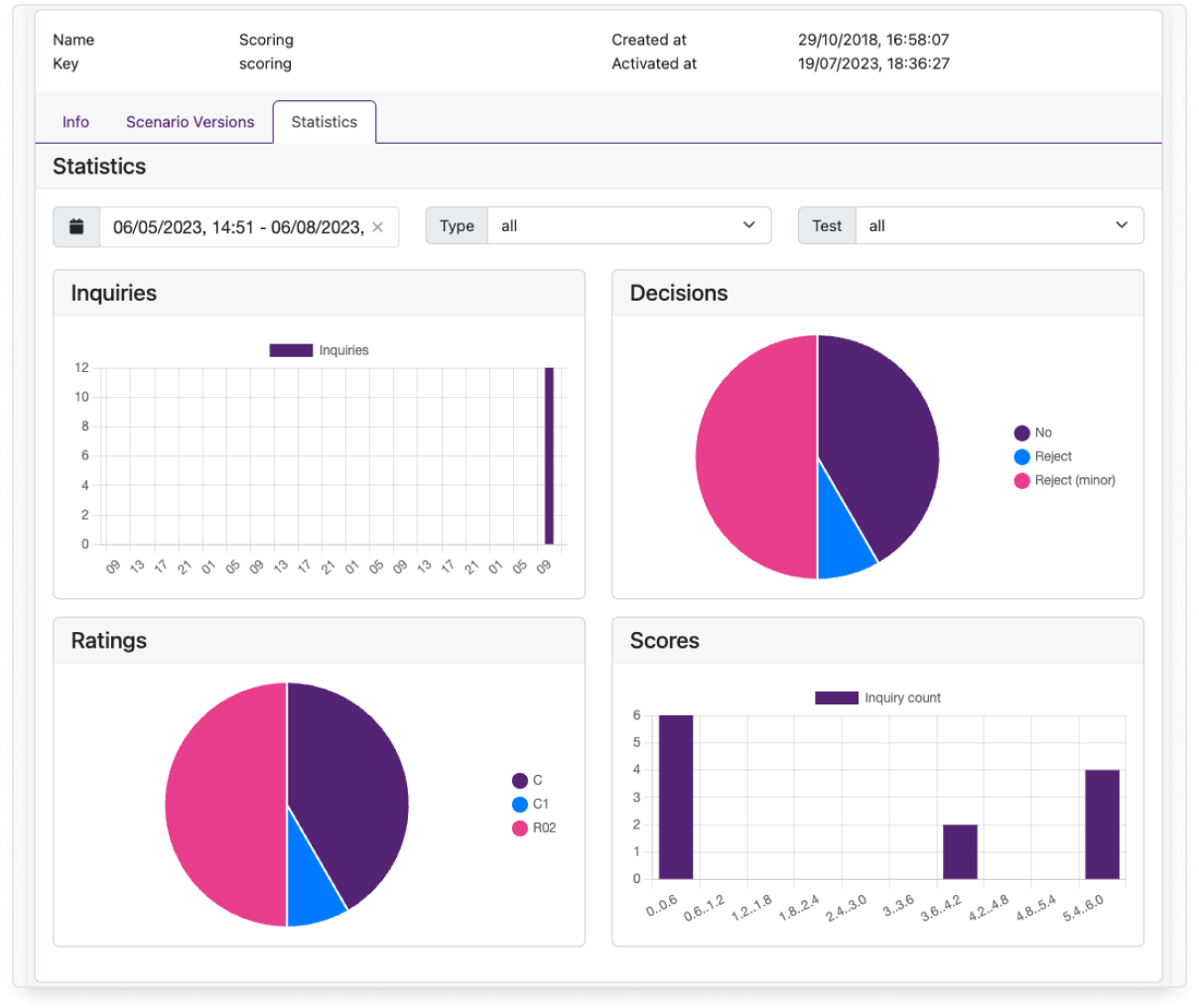

- Proactive risk management: Our Decision Engine software equips you with tools and features to implement a proactive approach to reduce potential risks. This allows you to create decision models that give each customer a score according to your desired business model. By actively managing risks, you can minimize potential losses and optimize portfolio performance.

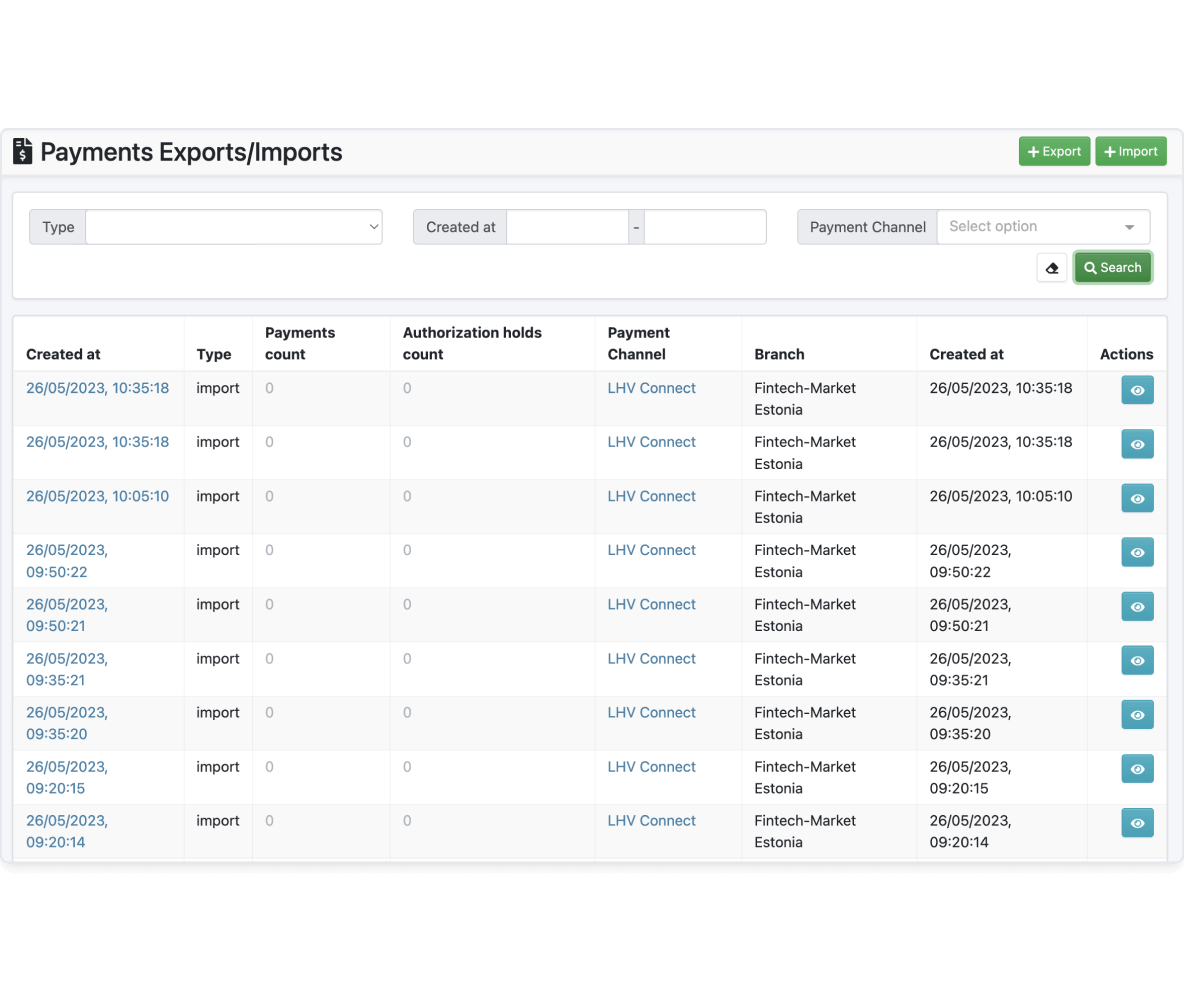

Payments and reminders

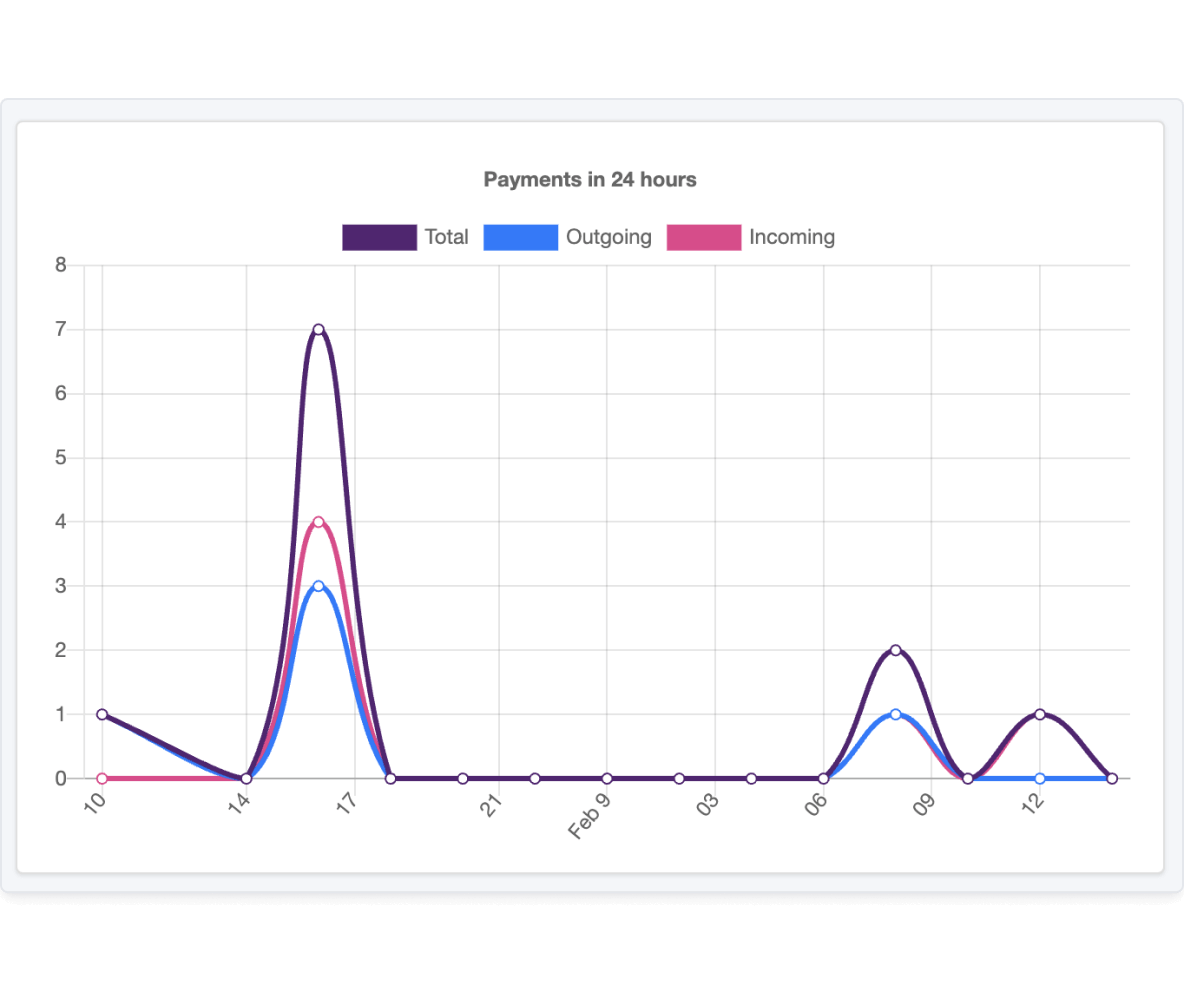

By integrating streamlined digital payments, automated payment reminders, and flexible repayment options, you can enhance the consumer lending journey, improve repayment rates, and support the sustainable growth of your consumer lending institution.

- Streamlined digital payments: Enable borrowers to make seamless digital payments, improving the loan repayment process and enhancing customer experience. By offering secure and convenient payment options such as mobile money transfers or online payment gateways, for the clients, you can streamline the loan repayment process, reducing administrative burden.

- Automated payment reminders: Send automated reminders to borrowers that notify them about upcoming payment due dates. Through SMS, push notifications, or emails, borrowers receive timely reminders, reducing the likelihood of missed payments and enhancing repayment rates. This automated system promotes financial discipline and minimizes collection efforts.

- Flexible repayment options: Offer customized repayment plans to accommodate borrowers' needs, improving repayment capacity and overall loan portfolio performance. This includes offering installment plans, grace periods, or variable payment frequencies. By accommodating borrowers' financial situations and preferences, you can enhance their repayment capacity and improve loan portfolio performance.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.