Core system

Discover Fintech Market’s core loan management system and lending software. Configure products, flows, and integrations while managing payments and debt management.

Powerful features

Our goal is simple - we want to give financial service providers more time to focus on customers, risk, and growth while keeping the costs low.

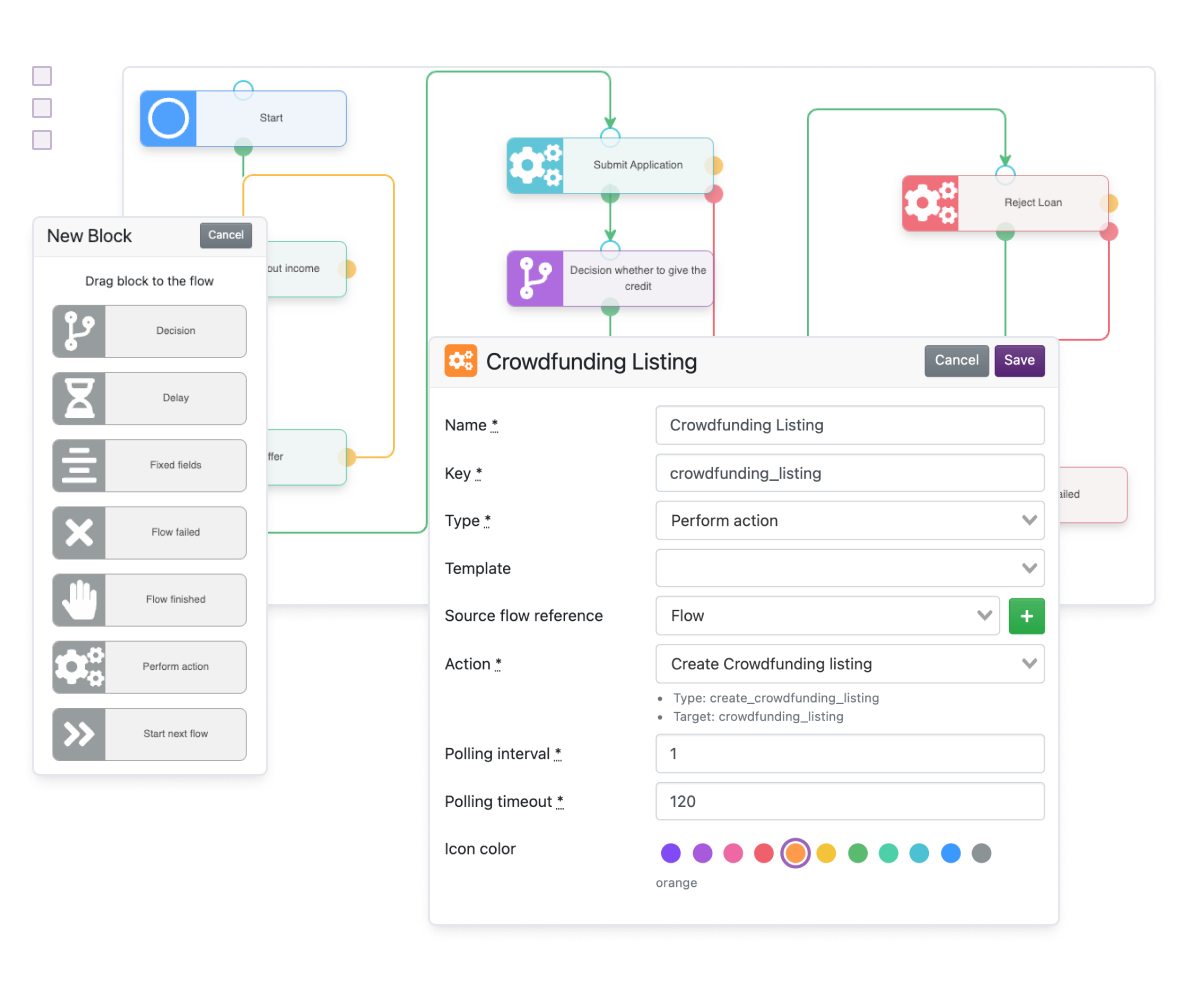

Flows

Create customizable, interdependent workflows, according to business needs, organizational goals, and legal requirements.

- Versatile Lego-like functionality: Users can assemble smaller components to create larger, personalized parts, allowing for a wide range of possibilities limited only by imagination.

- Visual flowchart management: The platform provides intuitive visual flowcharts for easy process management, with the ability to create, connect, and rearrange elements with just a few clicks.

- Automation and user control: Workflows can be initiated automatically or manually, providing flexibility for efficient course execution based on specific requirements and user preferences.

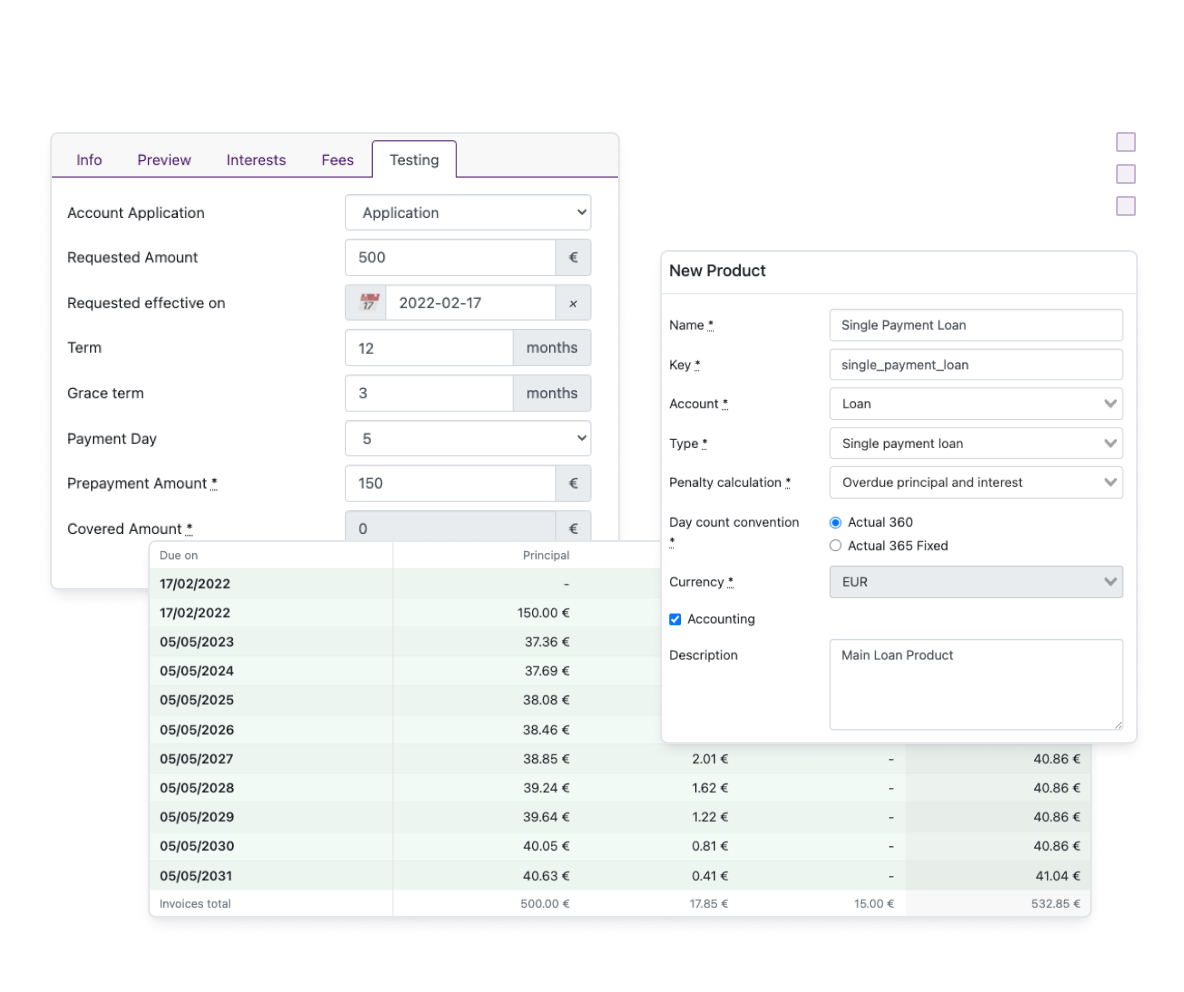

Product configuration, testing, fees

The configuration layer of the system allows for extensive tailoring, catering to regulatory and business requirements.

- Data fields: Users can utilize preset data fields or create personalized ones, defining field values, formats, and defaults.

- Diverse financial products: The system includes a wide range of financial products such as revolving credits, loans with fixed schedules, deposits, current accounts, investments, and merchant solutions.

- Flexible configurations and testing: The system offers several changeable options like schedule types for each product, empowering businesses to customize their offers. Moreover, users have the ability to test and preview the created products before final implementation.

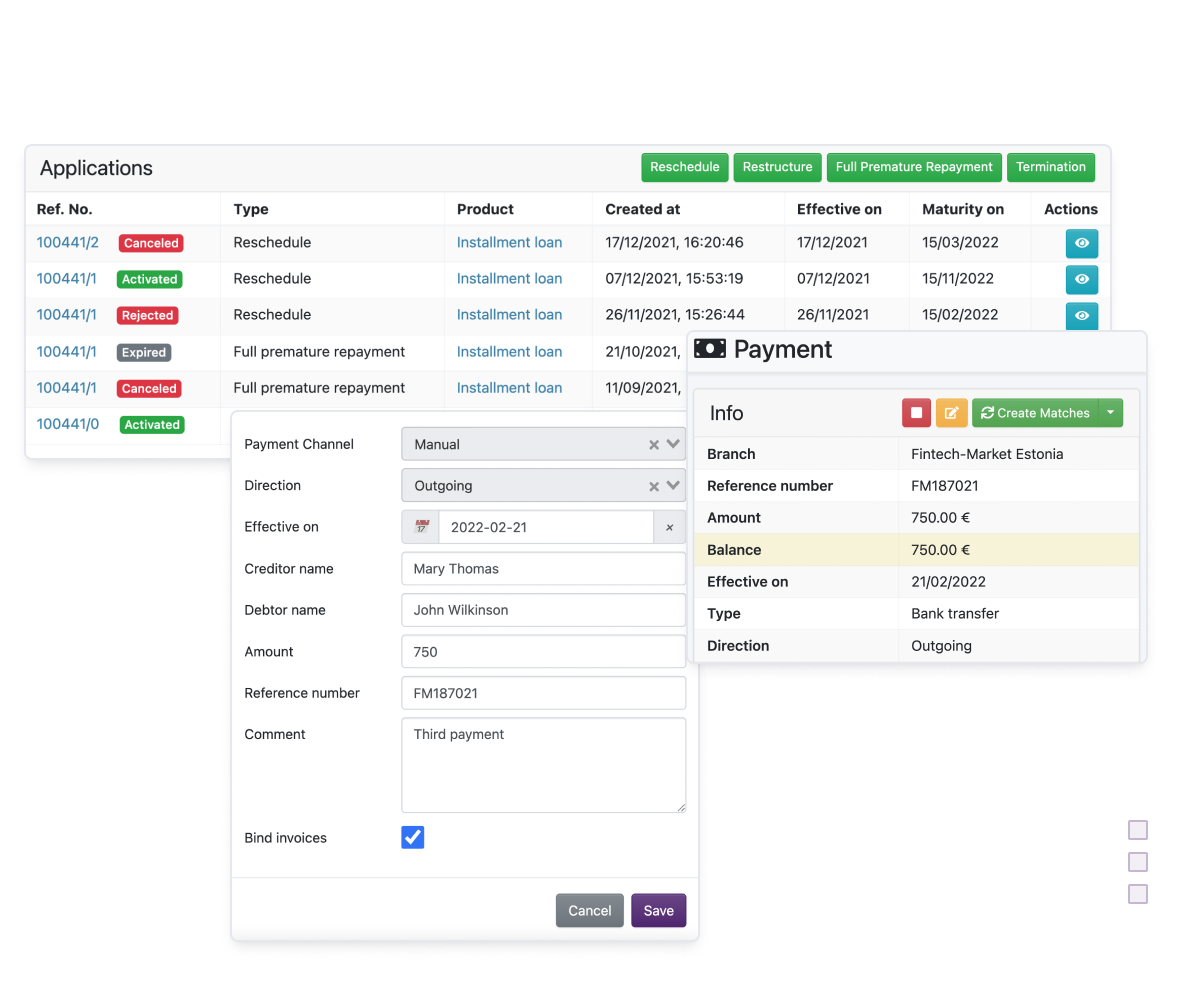

Payments and debt management

The payment solutions offered by the system encompass a wide range of functionalities, facilitating the creation and receipt of bank transfers, direct debits, cash, and card payments.

- Payment allocation: Configuration options are available to determine the order in which loan obligations are covered, ensuring flexible repayment allocation.

- Debt management tools: Notifications, messages, and workflows facilitate effective debt collection. Additionally, users can sell or write off loans, modify repayment schedules, and refinance loans.

- Comprehensive debt collection: The system enables the recording of payment promises, collaboration with external debt collection agencies, and reduction of penalties or customer obligations, delivering wide range of debt management capabilities.

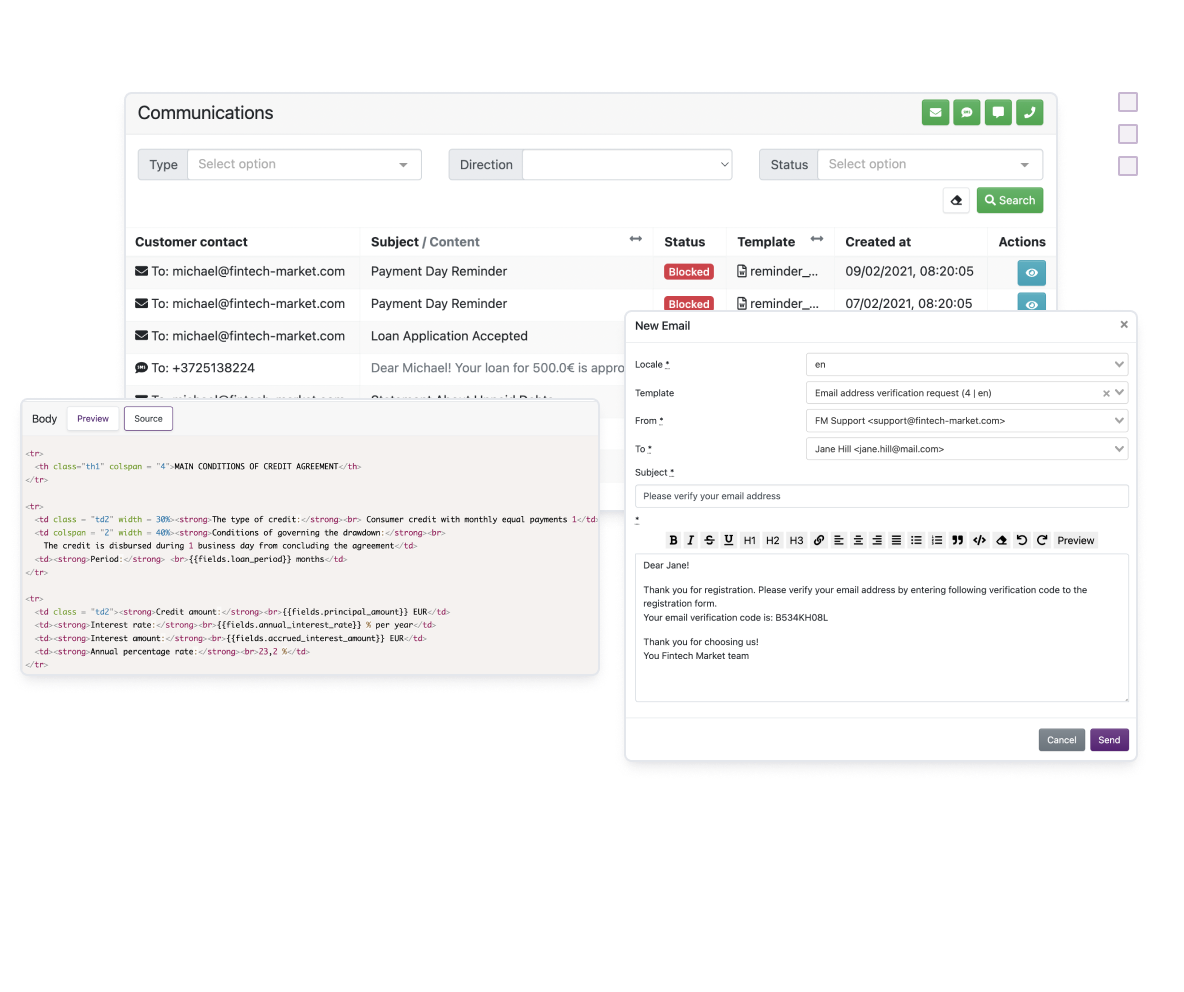

Communication, channels, PDF converting, tasks

The platform offers versatile messaging functionality across multiple communication channels, enabling users to send various types of messages, automate sending rules, and integrate with communication providers.

- Customizable message templates: Users can create templates with attachments, contracts, or other documents for efficient message creation, which can also be used for self-service publishing, eliminating repetitive design work.

- Efficient customer contact and task management: The platform's task functionality allows for direct customer engagement and streamlined configuration of workflows, optimizing client servicing processes.

- Seamless integration and streamlined communication: The platform integrates smoothly with communication providers, enabling automated message sending and enhances overall communication efficiency.

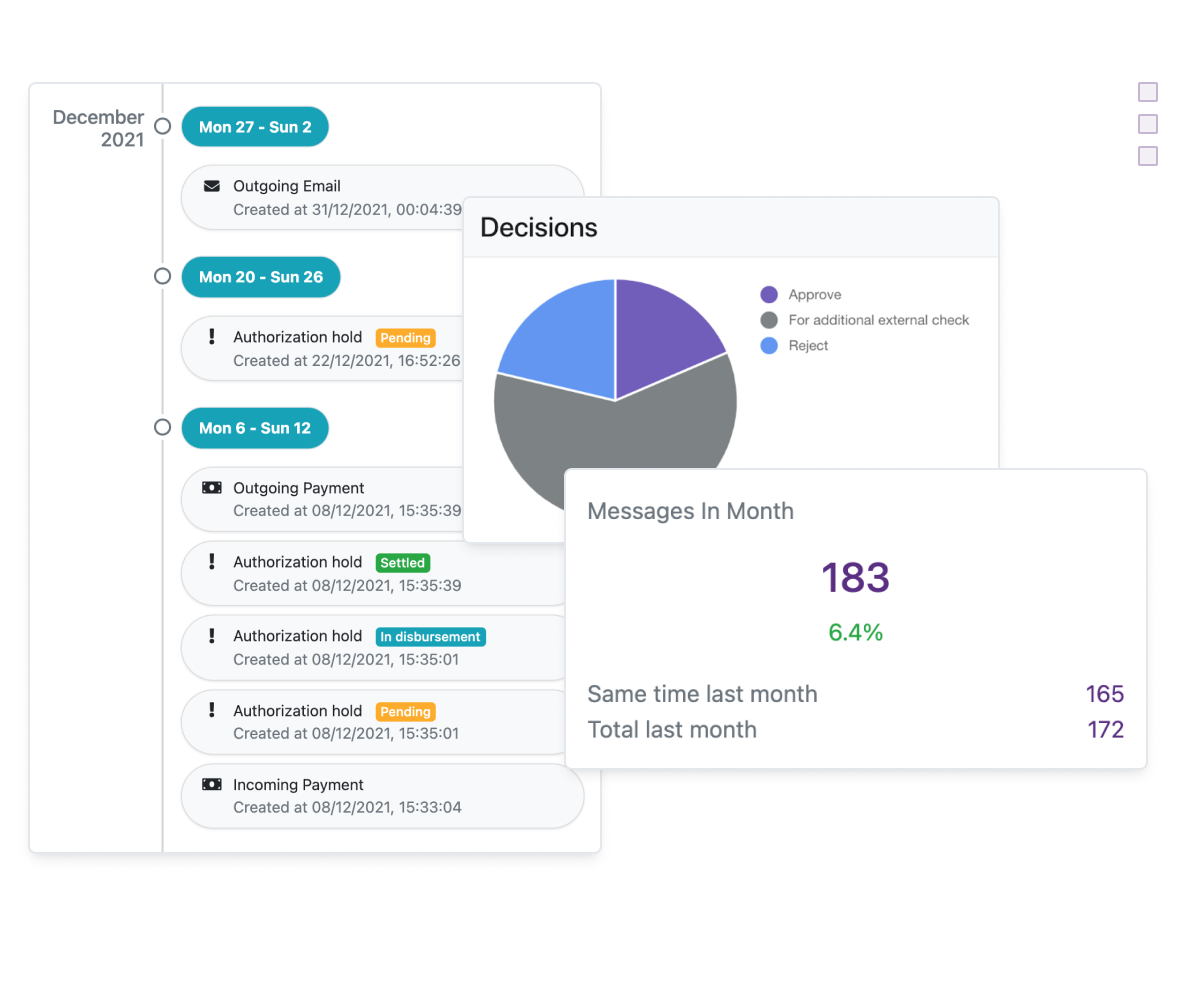

Timeline and statistics UI

The system provides a consolidated view of the timeline, statistics, and historical data, simplifying information access without extensive data management.

- Timeline and statistics: Securely stored and fingerprinted system actions offer visibility into change history. Visual charts provide overviews, timelines, and key statistics, eliminating manual data searching.

- Version control and transparency: Changes to the system require a new version and activation, ensuring transparency and simplifying audits.

- Analytical database integration: Seamless integration with an analytical database enables access to detailed information, enhancing comprehensive reporting and analysis capabilities.

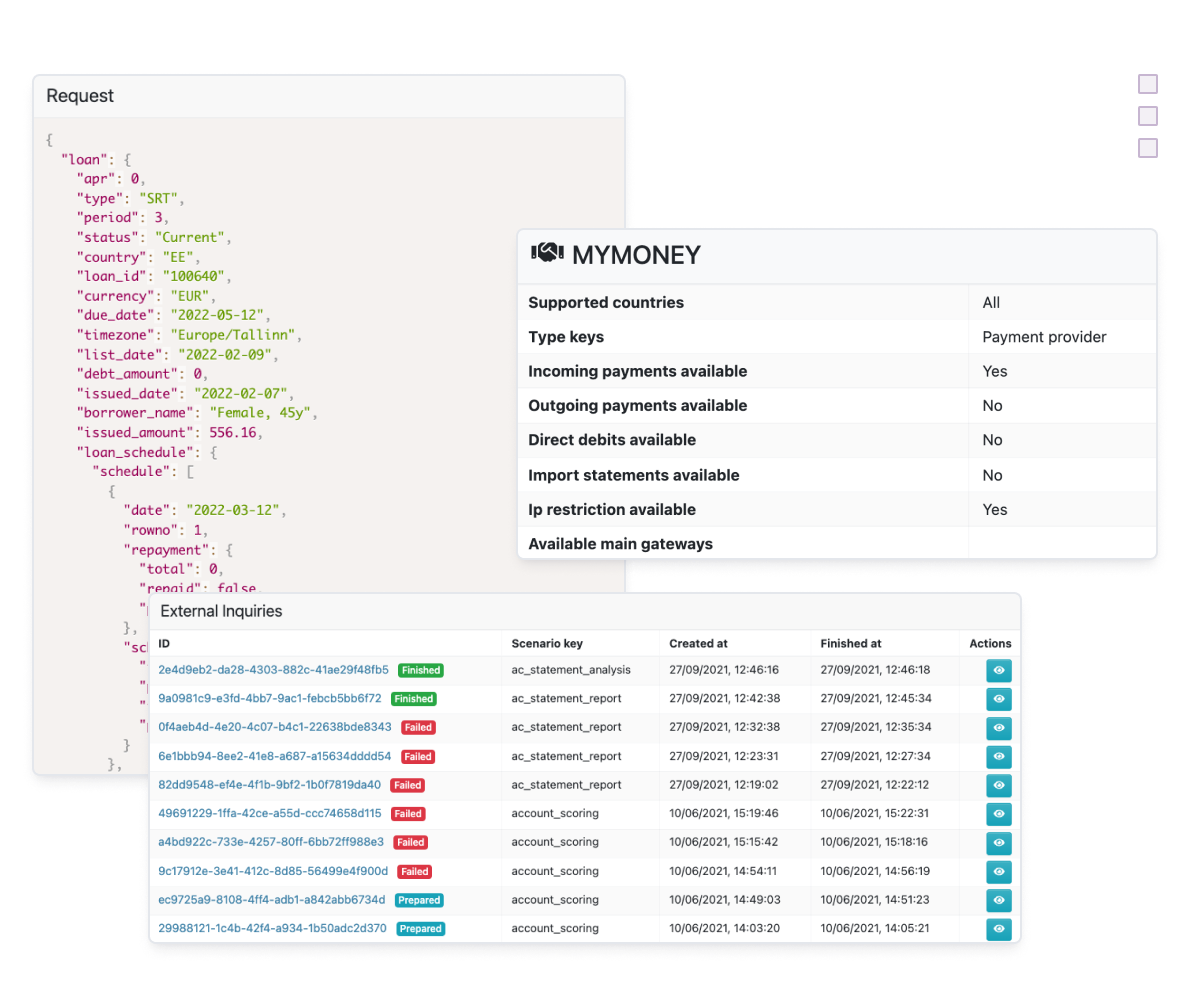

Integrations

Integrations empower businesses with rapid access to vital information, enhancing decision-making agility.

- Extensive global integrations: A diverse selection of global integrations is available, continually expanding to meet various needs. The existing integrations encompass payment gateways, risk management providers, communication gateways, and authentication services, facilitating streamlined operations and enhanced efficiency.

- User-friendly custom integrations: Users can easily add their own integrations, tailoring the platform to their specific requirements.

- Streamlined data consolidation and extraction: The platform simplifies data extraction from multiple providers, eliminating the need for additional development.

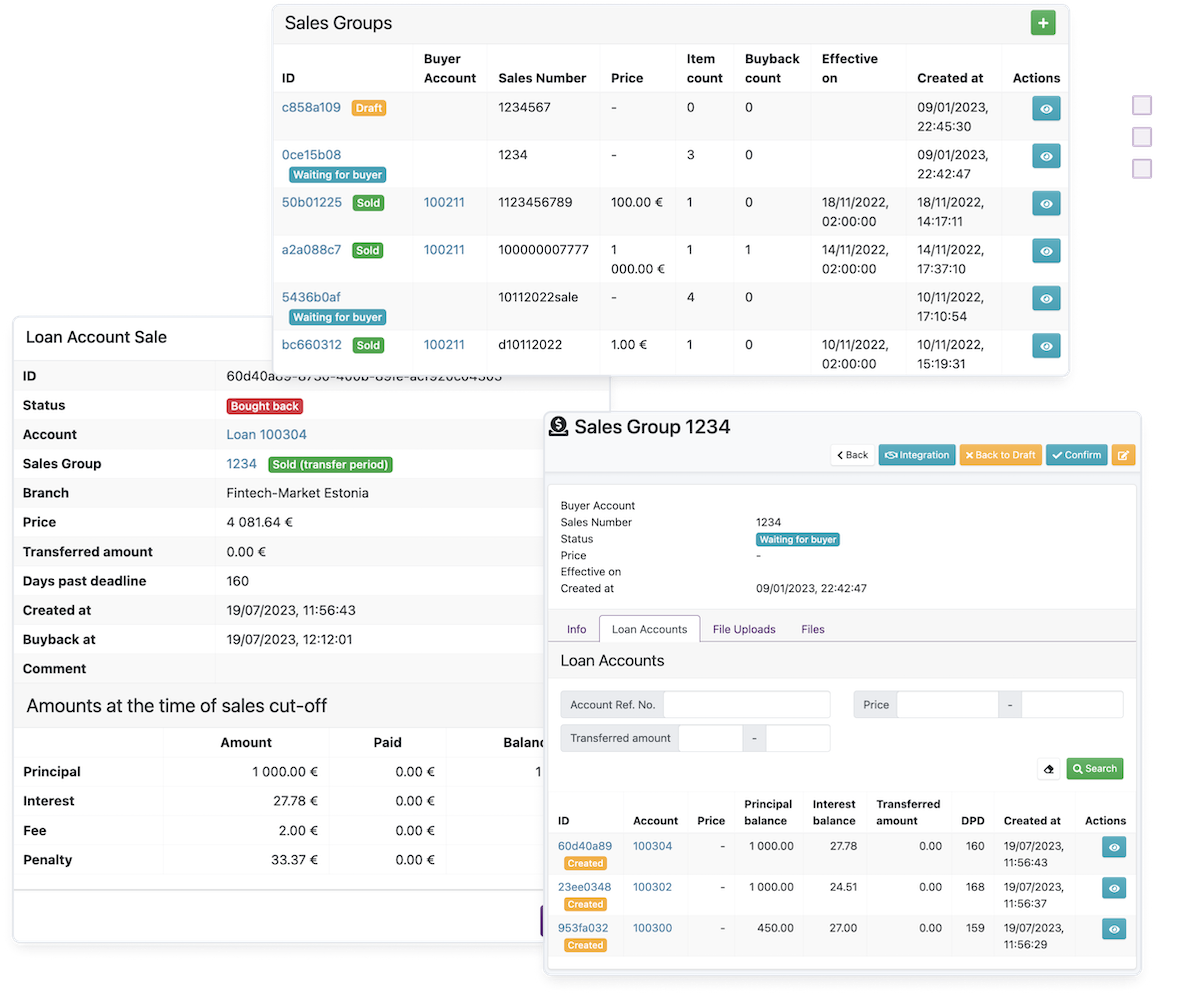

Sales portfolio

Fintech Market loan management platform has an option to sell loan accounts through an integrated provider, or by inserting the provider's data manually.

- Convenient sales integration: Users can easily set up the sales integration on their own by configuring the system to their specific requirements. Utilize an integrated provider or manually insert data to create a sales portfolio.

- Customizable sales process: Add the loan selection criteria based on organizational preferences and business requirements, such as targeting overdue accounts or any loan type. Included are parameters such as accounts that are overdue, specific debt thresholds, customer responsiveness, and other relevant factors. You can add the data either manually or with a CSV file.

- Portfolio management: The platform simplifies portfolio management, with options to add or remove accounts, set price and transaction period, and select the buyer, with the possibility of buyback.

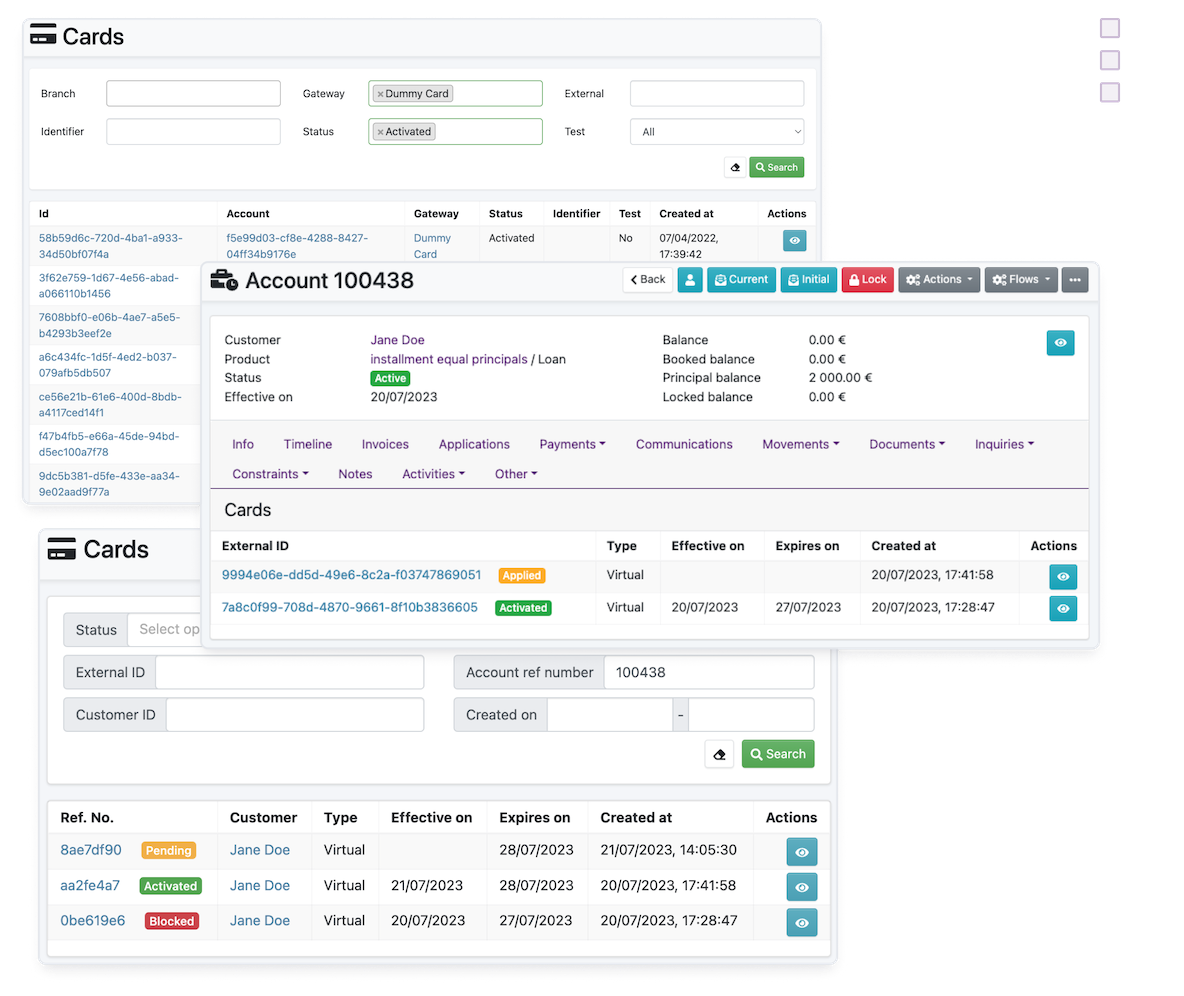

Card management

FTM loan solution system includes virtual and physical cards, where virtual cards serve as digital substitutes for online payments, and physical cards allow transactions with integrated providers.

- Card creation: Users can create virtual cards for the customers, and apply for the physical card issued by a card provider through an integration.

- Card management: Users can configure card expiration time, authorization hold timeout, and other settings. Various actions can be performed on cards, such as creating, applying, activating, blocking, closing, and unblocking cards, along with adding labels and notes to the cards.

- Timeline and settings view: The card management view includes customizable panels, easy tracking of activities, content generation, and provides insights into external requests.

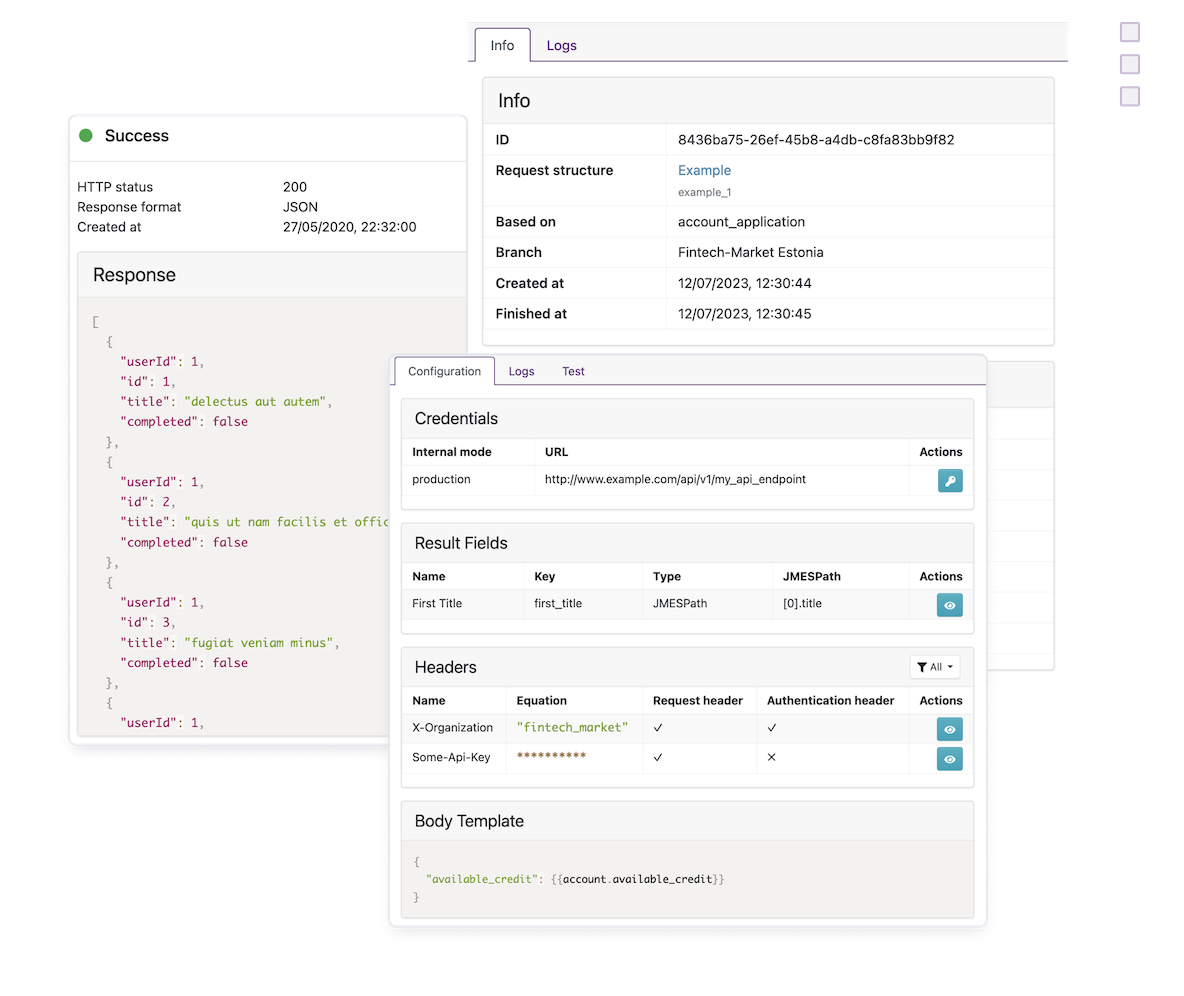

Outgoing requests

The outgoing requests feature is for making web requests to external systems for data retrieval without incoming requests.

- Convenient setup: The outgoing requests feature offers a quick and easy setup with configurable retry attempts, authentication, and result field extraction using JMESPath or JavaScript.

- Example responses: View the example response and data received from outgoing requests by setting up new example responses with HTTP status and response format selections.

- Testing options and logs: Test functionality allows request previewing for testing purposes, ensuring efficient integration and response tracking. In addition, there are logs available that display the list of all made requests and their respective results. These logs offer valuable insights into the request history and outcomes for better tracking and analysis.

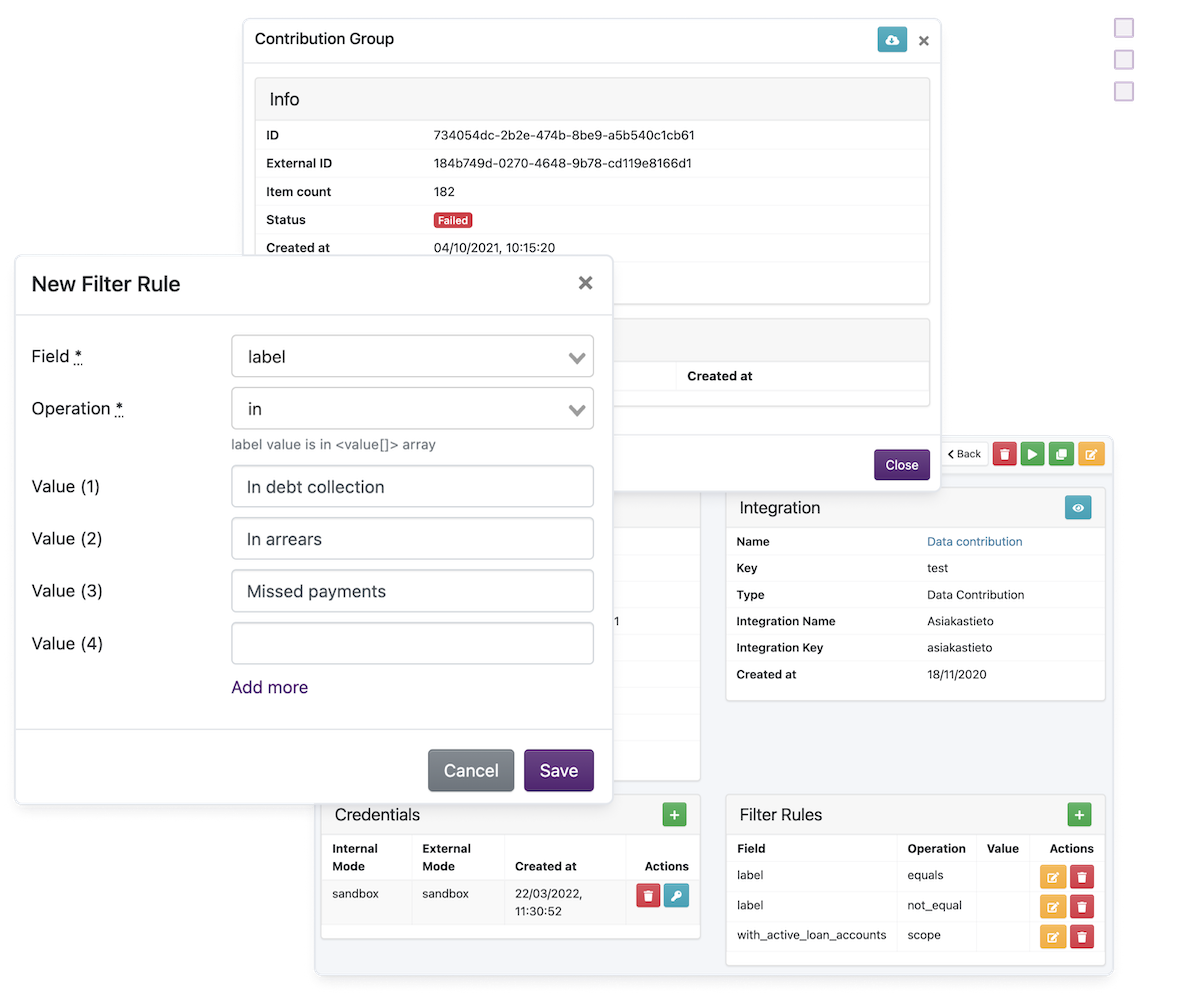

Data contribution

FTM loan management platform's data contribution solution helps grow risk minimization databases by relying on contributions from financial service providers each time a request is added.

- User-friendly integration setup: Integration setup can be configured on our user-friendly interface with only a few steps.

- Customizable reports: Contributions can be either a summarized data about the customer, or be based on account, with the main contribution item being the loan account which also includes customer data.

- Report overview and filters: Filter rules allow for selective customer contribution based on labels or specific scoped fields. The reports can be downloaded in XML format.

Do you want to explore all features?

Our team would be delighted to introduce you to all the functionalities. Schedule a demo to explore how our solution aligns with your business needs.